United Airlines 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(5) Share-Based Compensation Plans (Continued)

the HR Subcommittee to grant any of a variety of incentive Awards to participants, including the following:

•

stock options, including both tax qualified and non-qualified options,

•

stock appreciation rights, which provide the participant the right to receive the excess (if any) of the fair market value of a specified number

of shares of common stock at the time of exercise over the grant price of the stock appreciation right,

•

stock awards to be granted at no cost to the participant, including grants in the form of (i) an immediate transfer of shares which are subject

to forfeiture and certain transfer restrictions ("Restricted Stock"); and (ii) an immediate transfer of shares which are not subject to forfeiture

or a deferred transfer of shares if and when the conditions specified by the HR Subcommittee are met ("Unrestricted Stock"), and

•

performance-based awards, in which the HR Subcommittee may grant a stock award that will entitle the holder to receive a specified

number of shares of common stock, or the cash value thereof, if certain performance goals are met.

The shares may be issued from authorized and unissued shares of UAL common stock or from UAL's treasury stock. The exercise price for each underlying

share of UAL common stock under all options and stock appreciation rights awarded under the MEIP will not be less than the fair market value of a share of

common stock on the date of grant or as otherwise determined by the HR Subcommittee. Each instrument granted under the MEIP will generally expire 10 years

after its date of grant.

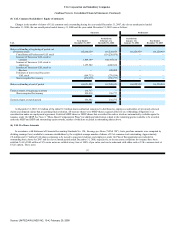

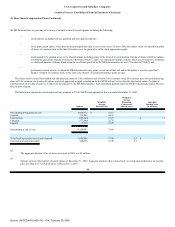

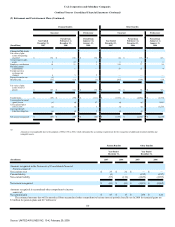

The table below summarizes stock option activity pursuant to UAL's MEIP stock options for the year ended December 31, 2007:

Options

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Life (in years)

Aggregate

Intrinsic Value

(in millions)

Outstanding at beginning of year 5,064,672 $ 35.13

Granted 256,866 44.26

Exercised(a) (989,848) 35.18 $ 11

Canceled (177,646) 35.78

Expired (3,951) 35.25

Outstanding at end of year 4,150,093 35.66

Vested and expected to vest at end of period 3,669,884 37.09 8.2 $ 2

Exercisable at end of period(b) 948,698 35.40 8.1 —

(a)

The aggregate intrinsic value of shares exercised in 2006 was $3 million.

(b)

Options represent the number of vested options at December 31, 2007. Aggregate intrinsic value is based only on vested options that have an exercise

price less than the UAUA stock price at December 31, 2007.

100

Source: UNITED AIR LINES INC, 10-K, February 29, 2008