United Airlines 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

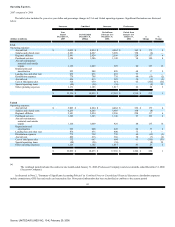

to cash used to increase restricted cash of $80 million and $72 million in 2005 for UAL and United, respectively.

The $39 million of cash provided during 2006 from the disposition of property and equipment included $19 million of cash proceeds from the sale of nine

non-operating B767-200 aircraft. The Company used $362 million in cash for the acquisition of property and equipment in 2006, as compared to approximately

$470 million in 2005.

Cash Flows from Financing Activities.

2007 compared to 2006

Cash used by financing activities for both UAL and United was $2.1 billion in 2007, as compared to $0.8 billion of cash provided by financing activities

during 2006. In 2007, cash of approximately $2.9 billion was used to prepay approximately $1.5 billion of credit facility obligations, refinance certain aircraft as

discussed below and to make other debt and capital lease payments.

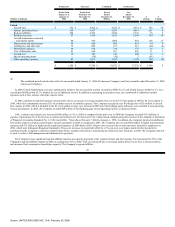

In 2007, the Company completed financing transactions totaling approximately $964 million which included the $694 million EETC secured financing and

the $270 million Denver Airport financing. A portion of the proceeds of the $694 million EETC transaction was used to payoff $590 million of debt obligations

that were secured by ten previously mortgaged, owned aircraft and to finance three previously unencumbered owned aircraft. The proceeds of the Denver Airport

bonds were used to refinance the former $261 million of Denver Series 1992A bonds.

In both February and December 2007, United amended certain terms of its credit facility. The February 2007 amendment resulted in a reduction in the

amount of the Amended Credit Facility from $3.0 billion to $2.055 billion, consisting of a $1.8 billion term loan commitment and a $255 million revolving

commitment. The December 2007 amendment allowed the Company to pay the January 2008 special distribution of $257 million and provides the Company the

ability to undertake an additional $243 million in future shareholder initiatives without any additional prepayment. At December 31, 2007, $153 million was

available for loans or standby letters of credit under the Amended Credit Facility. See Note 12, "Debt Obligations" in Combined Notes to Consolidated Financial

Statements for further information related to the financing transactions discussed above.

In 2007, cash from aircraft lease deposits increased $80 million primarily due to the use of the deposits to purchase the three previously leased assets

described above in "Cash Flows from Investing Activities." This was reported as a financing cash inflow as the prepayment of the initial deposits were recorded

as a financing cash outflow.

During 2006, we generated proceeds of $3.0 billion from United's new credit facility but used approximately $2.1 billion of these proceeds to repay the

$1.2 billion DIP Financing and make other scheduled and revolving payments under long-term debt and capital lease agreements.

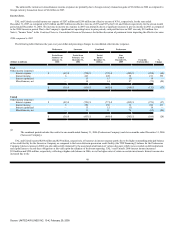

2006 compared to 2005

Cash generated through financing activities was $782 million in 2006 compared to cash used of $110 million in 2005. In 2006, the Company made principal

payments under long-term debt and capital lease obligations totaling $2.1 billion, which included $1.2 billion for the repayment of the DIP Financing.

In 2006, the Company obtained access to up to $3.0 billion in secured exit financing which consisted of a $2.45 billion term loan, a $350 million delayed

draw term loan and a $200 million revolving credit line. On the Effective Date, $2.45 billion of the $2.8 billion term loan and the entire revolving credit line was

drawn and used to repay the DIP Financing and to make other payments required upon exit from bankruptcy, as well as to provide ongoing liquidity to conduct

52

Source: UNITED AIR LINES INC, 10-K, February 29, 2008