United Airlines 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•

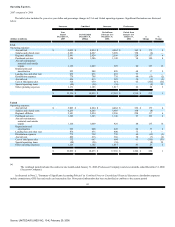

United Express contributed $122 million to operating income in 2007, as compared to $77 million in 2006 and $317 million of operating

losses in 2005. This improvement is due to an improved regional operations cost structure resulting from the bankruptcy reorganization,

network optimization similar to that achieved for the mainline operation, and the replacement of some 50-seat regional jets with larger

regional jets that are equipped with explus and offer both first class and Economy Plus service, among other factors.

•

Mainline fuel costs have significantly increased since 2005, increasing by $179 million from 2006 to 2007, in addition to the $792 million

increase from 2005 to 2006. These increases are primarily due to significant increases in market prices for jet fuel. The Company's average

cost per gallon for jet fuel, including taxes and hedge impacts, increased from approximately $1.79 in 2005 to $2.11 in 2006 and $2.18 in

2007. Similar increases were experienced in United Express' average cost per gallon of jet fuel, which is classified as Regional affiliates

expense in the Statements of Consolidated Operations.

•

In 2007 and 2006, the Company recorded approximately $119 million and $9 million, respectively, of employee profit sharing, including

related employee taxes, based on annual pre-tax earnings. The rate of profit sharing was increased from 7.5% to 15% between periods, and

pre-tax income was significantly higher in 2007. A $110 million decrease in share-based compensation expense offset the increase in the

Company's profit sharing plan expense.

•

Aircraft maintenance materials and outside repairs expense increased $157 million, or 16%, in 2007 as compared to 2006, and by

$128 million, or 15%, in 2006 as compared to 2005. As further discussed in the "Results of Operations" section below, these increases are

due to several factors, including higher volumes of heavy maintenance visits, increased rates under certain long-term maintenance contracts

and a higher cost of parts.

•

Interest expense decreased $109 million in 2007 as compared to 2006 primarily due to $2.2 billion of decreased balance sheet debt

outstanding and a credit facility amendment in February 2007 that significantly lowered our interest rate under the credit facility. Interest

expense increased $288 million in 2006 as compared to 2005 primarily due to increased debt outstanding of approximately $1.4 billion as a

result of the Company's new capital structure resulting from its emergence from bankruptcy on February 1, 2006.

•

In 2007 and 2006, UAL recognized income tax expense of $297 million and $21 million, respectively. Income taxes were not recorded in

the 2005 period.

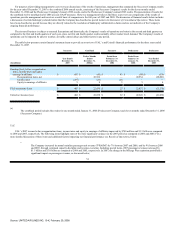

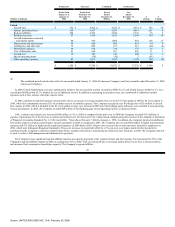

The following items describe the significant and largely non-cash fresh-start reporting impacts effective February 1, 2006 that affect the comparison of 2006

to 2005.

•

As part of fresh-start reporting the Company changed its accounting for Mileage Plus from the incremental cost model to the deferred

revenue model. This change in accounting negatively impacted the Company's operating revenues by approximately $158 million in 2006

as compared to 2005. The negative revenue impact was partially offset by a reduction in operating expense of approximately $27 million

which the Company estimates would have been recorded if the incremental cost method had been continued. Mileage Plus accounting is

discussed further in "Critical Accounting Policies," below.

•

The Company recorded non-cash share-based compensation expense of $159 million in 2006 in association with its share-based

compensation plans. This expense was not recognized in 2005, because prior to 2006 the Company accounted for its share-based

compensation plans under the intrinsic method prescribed by Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to

Employees."

35

Source: UNITED AIR LINES INC, 10-K, February 29, 2008