United Airlines 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

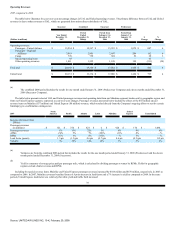

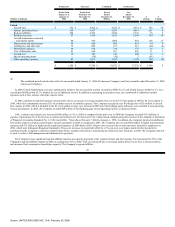

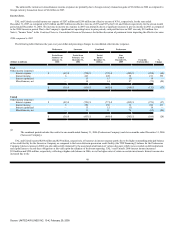

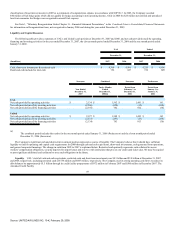

expense increased only 3% despite a 9% increase in capacity due to the benefits of restructured regional carrier capacity agreements in 2006 along with regional

carrier network optimization and the replacement of some 50-seat regional jets with 70-seat regional jets. The 3% increase in regional affiliates expense includes

an 18% increase in fuel costs. See Note 2(j), "Summary of Significant Accounting Policies—United Express," in the Combined Notes to Consolidated Financial

Statements for further discussion of the Regional affiliates expense.

The Company's purchased services increased 18% in 2006, as compared to 2005, primarily due to an increase of approximately $120 million in outsourcing

costs for various non-core work activities; as well as a $31 million increase in certain professional fees, which were classified as reorganization expenses by the

Predecessor Company. The offsetting benefits of higher outsourcing costs are reflected in a 4% reduction in manpower associated with the 6% labor productivity

improvement noted for salaries and related costs.

In 2006, aircraft maintenance materials and outside repairs expense increased $128 million, or 15%, from 2005 primarily due to engine-related maintenance

rate increases as well as increased repair volume.

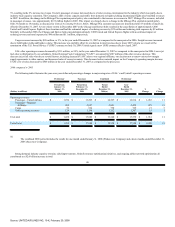

As discussed in Note 1, "Voluntary Reorganization Under Chapter 11—Fresh-Start Reporting," in the Combined Notes to Consolidated Financial

Statements, the Company revalued its assets and liabilities to estimated fair values. In 2006, UAL 's amortization expense increased $162 million due to the

recognition of $453 million of additional definite-lived intangible assets; however, this increase was offset by decreased depreciation expense from fresh-start

reporting adjustments that significantly reduced depreciable tangible asset book values to fair value. The impact of the decrease in tangible asset valuation was

significant as depreciation and amortization only increased $32 million despite the $162 million increase in intangible asset amortization and incremental

depreciation on post-emergence property additions. The fresh-start impacts on United's depreciation and amortization expense were not materially different than

the UAL impacts.

The Company's distribution expenses, which include commissions, GDS fees and credit card fees, increased $23 million, or 3%, year-over-year primarily

due to a $24 million increase in credit card fees due to higher passenger revenues.

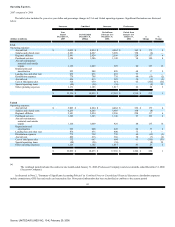

UAL 's and United's other operating expenses decreased $104 million and $96 million in 2006, as compared to 2005, respectively. The adoption of

fresh-start reporting, which included the revaluation of the Company's frequent flyer obligation to estimated fair value and the change in accounting policy to a

deferred revenue model for the Successor Company reduced other expense by an estimated $27 million. For periods on or after February 1, 2006, adjustments to

the frequent flyer obligation are recorded to passenger and other operating revenues, whereas periodic adjustments under the Predecessor Company's incremental

cost basis were recognized in both operating revenues and other operating expense. See "Critical Accounting Policies," below, for further details. Various cost

savings initiatives also reduced the Company's costs in 2006 as compared to 2005.

In 2006, the Company recognized a net benefit of $36 million to operating expense resulting from the resolution of preconfirmation contingencies for the

estimated liability for SFO and LAX municipal bond obligations, and favorable adjustments to preconfirmation contingencies related to the pilots non-qualified

pension plan. In 2005, UAL and United recognized charges of $18 million and $5 million, respectively, for aircraft impairments related to the planned

accelerated retirement of certain aircraft.

46

Source: UNITED AIR LINES INC, 10-K, February 29, 2008