United Airlines 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(2) Summary of Significant Accounting Policies (Continued)

requires changes in the valuation allowance to first reduce goodwill to zero and then to reduce intangible assets to zero.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160, Noncontrolling Interests in Consolidated Financial

Statements—an amendment of ARB No. 51 ("SFAS 160"). This statement amends Accounting Research Bulletin 51, "Consolidated Financial Statements," to

establish accounting and reporting standards for the noncontrolling interest (also known as minority interest) in a subsidiary and for the deconsolidation of a

subsidiary. SFAS 160 is effective for the Company for periods beginning January 1, 2009. The Company is currently evaluating the impact of SFAS 160 on its

consolidated financial statements.

In 2006, the Company adopted FASB Statement of Financial Accounting Standards No. 158, Employers' Accounting for Defined Benefit Pension and Other

Postretirement Plans—an amendment of FASB Statements No. 87, 88, 106 and 132R ("SFAS 158").

(q) Income Tax Contingencies—UAL and United have recorded reserves for taxes and associated interest that may become payable in future years as a

result of audits by tax authorities. Certain of these reserves are for uncertain income tax positions taken on income tax returns which are accounted for in

accordance with FIN 48, effective January 1, 2007. Although management believes that the positions taken on previously filed tax returns are reasonable, UAL

and United nevertheless have established tax and interest reserves in recognition that various taxing authorities may challenge certain of the positions taken by

the Company, potentially resulting in additional liabilities for taxes and interest. The Company's tax contingency reserves are reviewed periodically and are

adjusted as events occur that affect its estimates, such as the availability of new information, the lapsing of applicable statutes of limitations, the conclusion of tax

audits, the measurement of additional estimated liability based on current calculations, the identification of new tax contingencies, the release of administrative

tax guidance affecting its estimates of tax liabilities, or the rendering of relevant court decisions. See Note 6, "Income Taxes," for further information related to

uncertain income tax positions and the adoption of FIN 48.

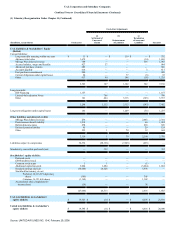

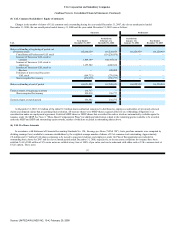

(3) UAL Common Stockholders' Equity

As a result of the Plan of Reorganization becoming effective on February 1, 2006, the then-outstanding equity securities as well as the shares held in

treasury of Predecessor UAL were canceled. New UAL common stock began trading on the NASDAQ market on February 2, 2006 under the symbol "UAUA."

In accordance with the Plan of Reorganization, Successor UAL established the equity structure in the table below upon emergence and, on February 2, 2006,

began distributing portions of the shares of new common stock to certain general unsecured creditors and employees and certain management employees and

non-employee directors.

Party of Interest

Shares of

Successor UAL

Common Stock

General unsecured creditors and employees 115,000,000

Management equity incentive plan ("MEIP") 9,825,000

Director equity incentive plan ("DEIP") 175,000

125,000,000

96

Source: UNITED AIR LINES INC, 10-K, February 29, 2008