United Airlines 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

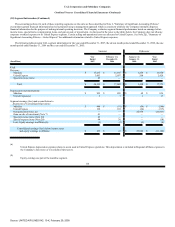

(12) Debt Obligations (Continued)

slots, certain gate interests in domestic airport terminals and certain supporting route facilities, (iii) certain spare engines, (iv) certain quick engine change kits,

(v) certain owned real property and related fixtures, and (vi) certain flight simulators (the "Collateral"). After the closing date, and subject to certain conditions,

United and the Guarantors may grant a security interest in the following assets, in substitution for certain Collateral (which may be released from the lien in

support of the Amended Credit Facility upon the satisfaction of certain conditions): (a) certain aircraft, (b) certain spare parts, (c) certain ground handling

equipment, and (d) accounts receivable. In addition, United has the right to remove collateral pledged to the Amended Credit Facility as long as the minimum

collateral ratio described in item (iii) below is achieved.

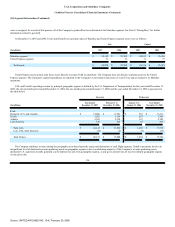

The Amended Credit Facility contains covenants that in certain circumstances may limit the ability of United and the Guarantors to, among other things,

incur or guarantee additional indebtedness, create liens, pay dividends on or repurchase stock, make certain types of investments, enter into transactions with

affiliates, sell assets or merge with other companies, modify corporate documents or change lines of business. The Amended Credit Facility also requires

compliance with the following financial covenants: (i) a minimum ratio of EBITDAR to the sum of cash interest expense, aircraft rent and scheduled debt

payments, (ii) a minimum unrestricted cash balance of $750 million, and (iii) a minimum ratio of market value of collateral to the sum of (a) the aggregate

outstanding amount of the loans plus (b) the undrawn amount of outstanding letters of credit, plus (c) the unreimbursed amount of drawings under such letters of

credit and (d) the termination value of certain interest rate protection and hedging agreements with the Amended Credit Facility lenders and their affiliates, of

150% at any time, or 200% at any time following the release of Primary Routes having an appraised value in excess of $1 billion (unless the Primary Routes are

the only collateral then pledged). Failure to comply with the Amended Credit Facility covenants could result in a default under the Amended Credit Facility

unless the Company were to obtain a waiver of, or otherwise mitigate or cure, the default. Additionally, the Amended Credit Facility contains a cross-default

provision with respect to other credit arrangements that exceed $50 million. A default could result in a termination of the Amended Credit Facility and a

requirement to accelerate repayment of all outstanding facility borrowings. The Company was in compliance with the Amended Credit Facility covenants at

December 31, 2007.

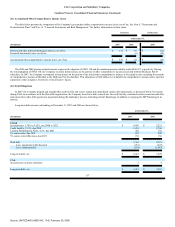

EETC Pass Through Certificates, Series 2007-1. On June 26, 2007, United and Wilmington Trust Company, as subordination agent and pass through

trustee under three pass through trusts newly formed by United (the "Trustee") entered into a note purchase agreement, dated as of June 26, 2007 (the "Note

Purchase Agreement"). The Note Purchase Agreement provides for the issuance by United of equipment notes (the "Equipment Notes") in the aggregate

principal amount of approximately $694 million to finance 13 aircraft owned by United. Ten of these owned aircraft had been financed by pre-existing aircraft

mortgages which United repaid in full (approximately $590 million principal amount) with most of the proceeds of the Equipment Notes. The mortgages related

to these ten aircraft had been adjusted to fair market value at the adoption of fresh-start reporting on February 1, 2006. The extinguishment of the aircraft

mortgages resulted in the recognition of a $22 million gain for the unamortized premium, which was accounted for as a reduction in interest expense in the

second quarter of 2007. The remaining three owned aircraft were unencumbered prior to the closing of the Enhanced Equipment Trust Certificates ("EETC")

transaction.

The payment obligations of United under the Equipment Notes are fully and unconditionally guaranteed by UAL. The Class B and Class C certificates are

subject to transfer restrictions. They may

119

Source: UNITED AIR LINES INC, 10-K, February 29, 2008