United Airlines 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

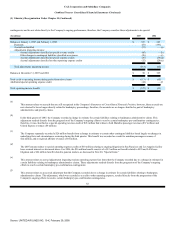

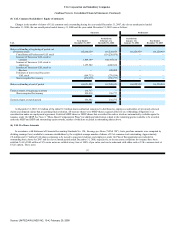

(1) Voluntary Reorganization Under Chapter 11 (Continued)

creditor and employee claims incurred through the bankruptcy proceedings (i.e., by the rejection of aircraft, executory contracts, etc.), discharged liabilities include claims related to

termination of the Debtors' defined benefit pension plans. Pursuant to the Plan of Reorganization, the unsecured creditors will receive 115 million common shares of Successor UAL

in satisfaction of such claims, together with certain UAL debt securities and UAL preferred stock. UAL and United recorded $24.6 billion and $24.4 billion, respectively, of

non-cash reorganization gains on the discharge of unsecured claims net of newly-issued securities. See "Financial Statement Presentation," above for further details.

(b)

Reinstatement of Liabilities. This column reflects the reinstatement of certain secured liabilities pursuant to the terms of the Plan of Reorganization. As a result of the reinstatement

of liabilities, the Company reclassified $7.5 billion of liabilities subject to compromise.

•

$7.1 billion represents the reinstatement of secured debt plus accrued interest.

•

$0.4 billion represents accruals for administrative and priority payments, reinstatement of certain municipal bond obligations, and other accruals of payments required

under the Plan of Reorganization.

(c)

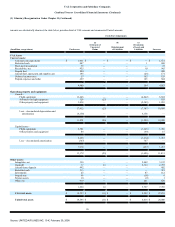

Revaluation of Assets and Liabilities. Fresh-start adjustments were made to reflect asset values at their estimated fair value and liabilities at estimated fair value or the present

value of amounts to be paid, including:

•

Recognition of additional estimated fair value of $2.8 billion for international route authorities, airport slots, trade names and other separately-identifiable intangible

assets,

•

Recognition of additional estimated fair value of $2.4 billion for the Mileage Plus frequent flyer obligation,

•

Adjustments of $1.3 billion to reduce the values of operating property and equipment, including owned assets and assets under capital leases, to their estimated fair

market value,

•

Adjustments of $0.4 billion to reduce recorded flight equipment net book value as a result of refinancing certain aircraft from mortgage and capital lease financing to

operating lease financing,

•

The elimination of the Predecessor Company's equity accounts, and establishment of the opening equity of the Successor Company, and

•

Net changes in deferred tax assets and liabilities, together with other miscellaneous adjustments.

Additionally, the Company recorded goodwill of $2.8 billion upon exit from bankruptcy to reflect the excess of the Successor Company's reorganization

value over the estimated fair value of net tangible and identifiable intangible assets and liabilities. In addition, deferred tax assets and liabilities were adjusted

based upon additional information, including adjustments to fair value estimates of underlying assets and liabilities.

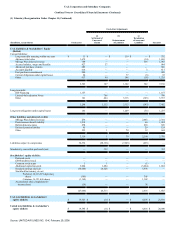

Post-Emergence Items. Certain additional Successor Company transactions occurred on or after February 2, 2006 and have been reflected in the

accompanying Statements of Consolidated Financial Position at December 31, 2006.

Release of Segregated Funds. The Company reclassified $271 million for the release of cash previously restricted by a certain credit card processor.

Additionally, $200 million of cash segregated for the payment of certain tax liabilities and recorded as other current assets before the Effective Date, was

released and reclassified to unrestricted cash.

Goodwill. During the eleven months ended December 31, 2006, goodwill was decreased by $62 million as a result of reversing the valuation allowance for

deferred tax assets. See Note 8, "Intangibles," for further information.

DIP and Credit Facility Financing Transactions. On the Effective Date, the Company received $1.4 billion in net proceeds from the credit facility,

consisting of borrowings of $2.6 billion under the credit facility which includes $161 million borrowed under the revolving credit facility, and the simultaneous

repayment of the Company's $1.2 billion debtor-in-possession credit facility (the "DIP Financing"). For further details, see Note 12, "Debt Obligations."

88

Source: UNITED AIR LINES INC, 10-K, February 29, 2008