United Airlines 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

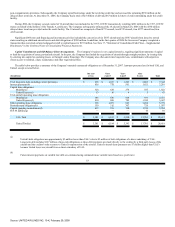

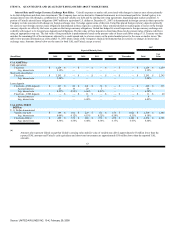

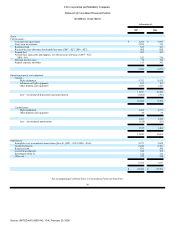

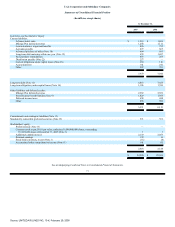

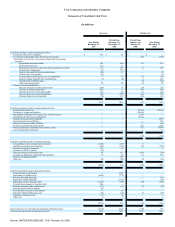

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate and Foreign Currency Exchange Rate Risks. United's exposure to market risk associated with changes in interest rates relates primarily

to its debt obligations and short-term investments. The Company does not use derivative financial instruments in its investment portfolio. United's policy is to

manage interest rate risk through a combination of fixed and variable rate debt and by entering into swap agreements, depending upon market conditions. A

portion of United's aircraft lease obligations ($497 million in equivalent U.S. dollars at December 31, 2007) is denominated in foreign currencies that expose the

Company to risks associated with changes in foreign exchange rates. To hedge against some of this risk, United has placed foreign currency deposits (primarily

for euros) to meet foreign currency lease obligations denominated in those respective currencies. Since unrealized mark-to-market gains or losses on the foreign

currency deposits are offset by the losses or gains on the foreign currency obligations, United has hedged its overall exposure to foreign currency exchange rate

volatility with respect to its foreign lease deposits and obligations. The fair value of these deposits is determined based on the present value of future cash flows

using an appropriate swap rate. The fair value of long-term debt is predominantly based on the present value of future cash flows using a U.S. Treasury rate that

matches the remaining life of the instrument, adjusted by a credit spread and, to a lesser extent, on the quoted market prices for the same or similar issues. The

table below presents information as of December 31, 2007 about certain of the Company's financial instruments that are sensitive to changes in interest and

exchange rates. Amounts shown below are the same for both UAL and United, except as noted.

2007

Expected Maturity Dates

(In millions)

Fair

Value

2008

2009

2010

2011

2012

Thereafter

Total

UAL ASSETS(a)

Cash equivalents

Fixed rate $ 1,259 $ — $ — $ — $ — $ — $ 1,259 $ 1,259

Avg. interest rate 5.12% — — — — — 5.12%

Short term investments

Fixed rate $ 2,295 $ — $ — $ — $ — $ — $ 2,295 $ 2,295

Avg. interest rate 5.04% — — — — — 5.04%

Lease deposits

Fixed rate—EUR deposits $ 147 $ 24 $ 241 $ 16 $ — $ — $ 428 $ 511

Accrued interest 23 10 29 7 — — 69

Avg. interest rate 4.93% 4.34% 6.66% 4.41% — — 6.54%

Fixed rate—USD deposits $ — $ — $ 11 $ — $ — $ — $ 11 $ 20

Accrued interest — — 8 — — — 8

Avg. interest rate — — 6.49% — — — 6.49%

UAL LONG-TERM

DEBT(a)

U. S. Dollar denominated

Variable rate debt $ 189 $ 162 $ 229 $ 152 $ 156 $ 1,622 $ 2,510 $ 2,405

Avg. interest rate 6.09% 6.12% 6.15% 6.22% 6.26% 6.31% 6.18%

Fixed rate debt(a) $ 489 $ 576 $ 689 $ 672 $ 228 $ 2,180 $ 4,834 $ 4,391

Avg. interest rate 6.54% 6.56% 6.44% 6.34% 6.17% 6.07% 6.40%

(a)

Amounts also represent United except that United's carrying value and fair value of variable rate debt is approximately $3 million lower than the

reported UAL amounts and United's cash equivalents and short-term investments are approximately $56 million lower than the reported UAL

amounts.

63

Source: UNITED AIR LINES INC, 10-K, February 29, 2008