United Airlines 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

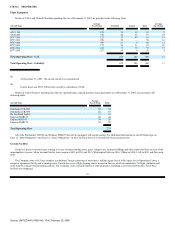

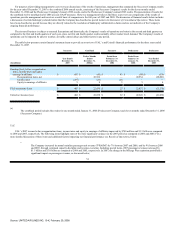

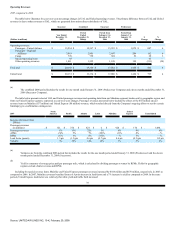

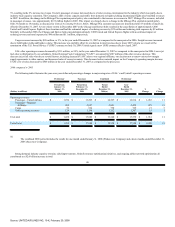

ITEM 6. SELECTED FINANCIAL DATA.

In connection with its emergence from Chapter 11 bankruptcy protection, the Company adopted fresh-start reporting in accordance with SOP 90-7 and in

conformity with accounting principles generally accepted in the United States of America ("GAAP"). As a result of the adoption of fresh-start reporting, the

financial statements prior to February 1, 2006 are not comparable with the financial statements after February 1, 2006. References to "Successor Company" refer

to UAL and United on or after February 1, 2006, after giving effect to the adoption of fresh-start reporting. References to "Predecessor Company" refer to UAL

and United prior to February 1, 2006.

Successor

Predecessor

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended December 31,

Year Ended

December 31,

2007

(In millions, except rates)

2005

2004

2003

Income Statement Data:

UAL

Operating revenues $ 20,143 $ 17,882 $ 1,458 $ 17,379 $ 16,391 $ 14,928

Operating expenses 19,106 17,383 1,510 17,598 17,245 16,288

Fuel expenses—Mainline 5,003 4,462 362 4,032 2,943 2,072

Reorganization (income) expense — — (22,934) 20,601 611 1,173

Net income (loss)(a) 403 25 22,851 (21,176) (1,721) (2,808)

Basic earnings (loss) per share 3.34 0.14 196.61 (182.29) (15.25) (27.36)

Diluted earnings (loss) per share 2.79 0.14 196.61 (182.29) (15.25) (27.36)

Cash distribution declared per common

share(b) 2.15 —

— — — —

United

Operating revenues $ 20,131 $ 17,880 $ 1,454 $ 17,304 $ 16,413 $ 14,933

Operating expenses 19,099 17,369 1,506 17,529 17,217 16,246

Fuel expenses—Mainline 5,003 4,462 362 4,032 2,943 2,072

Reorganization (income) expense — — (22,709) 20,432 611 1,174

Net income (loss)(a) 402 32 22,626 (21,036) (1,679) (2,777)

Balance Sheet Data at period-end:

UAL

Total assets $ 24,220 $ 25,369 $ 19,555 $ 19,342 $ 20,705 $ 21,979

Long-term debt and capital lease obligations,

including current portion 8,449 10,600

1,432 1,433 1,204 852

Liabilities subject to compromise — — 36,336 35,016 16,035 13,964

United

Total assets $ 24,236 $ 25,581 $ 19,595 $ 19,396 $ 20,719 $ 21,959

Long-term debt and capital lease obligations,

including current portion 8,446 10,596

1,432 1,433 1,204 852

Liabilities subject to compromise — — 36,379 35,060 16,161 14,090

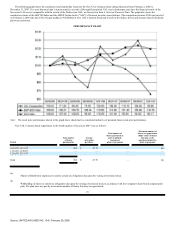

Mainline Operating Statistics(c):

UAL and United

Revenue passengers 68 69 (c) 67 71 66

RPMs 117,399 117,470 (c) 114,272 115,198 104,464

ASMs 141,890 143,095 (c) 140,300 145,361 136,630

Passenger load factor 82.7% 82.1% (c) 81.4% 79.2% 76.5%

Yield(d) 12.99¢ 12.19¢ (c) 11.25¢ 10.83¢ 10.79¢

Passenger revenue per ASM ("PRASM")(e) 10.78¢ 10.04¢ (c) 9.20¢ 8.63¢ 8.32¢

Operating revenue per ASM ("RASM")(f) 12.03¢ 11.49¢ (c) 10.66¢ 9.95¢ 9.81¢

Operating expense per ASM ("CASM")(g) 11.39¢ 11.23¢ (c) 10.59¢ 10.20¢ 10.52¢

Fuel gallons consumed 2,292 2,290 (c) 2,250 2,349 2,202

Average price per gallon of jet fuel, including

tax and hedge impact 218.3¢ 210.7¢

(c) 179.2¢ 125.3¢ 94.1¢

(a)

Net income (loss) was significantly impacted in the Predecessor periods due to the reorganization items related to the bankruptcy restructuring.

(b)

Paid in January 2008.

(c)

Mainline operations exclude the operations of independent regional carriers operating as United Express. Statistics included in the 2006 Successor period were calculated using the

combined results of the Successor period from February 1 to December 31, 2006 and the Predecessor January 2006 period.

(d)

Yield is Mainline passenger revenue excluding industry and employee discounted fares per RPM.

(e)

PRASM is Mainline passenger revenue per ASM.

(f)

RASM is operating revenues excluding United Express passenger revenue per ASM.

(g)

CASM is operating expenses excluding United Express operating expenses per ASM.

30

Source: UNITED AIR LINES INC, 10-K, February 29, 2008