United Airlines 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

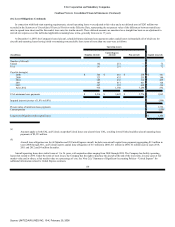

(12) Debt Obligations (Continued)

be sold only to qualified institutional buyers, as defined by Rule 144A under the Securities Act of 1933, as amended, for so long as they are outstanding. Pursuant

to the Note Purchase Agreement, the Trustee for each pass through trust agreed to purchase Equipment Notes issued under a Trust Indenture and Mortgage (each,

an "Indenture" and, collectively, the "Indentures") with respect to each aircraft financing entered into by United and Wilmington Trust Company, as Mortgagee.

Each Indenture contemplated the issuance of Equipment Notes in three series: Series A, bearing interest at the rate of 6.636% per annum, Series B, bearing

interest at the rate of 7.336% per annum, and Series C, bearing interest at the rate of six-month LIBOR plus 2.25% per annum, in the aggregate principal amount

of approximately $694 million divided between the three series as follows: $485 million in the case of Series A Equipment Notes, $107 million in the case of

Series B Equipment Notes, and $102 million in the case of Series C Equipment Notes. The Equipment Notes were purchased by the Trustee for each pass

through trust using the proceeds from the sale of Pass Through Certificates, Series 2007-1A, Pass Through Certificates, Series 2007-1B, and Pass Through

Certificates, Series 2007-1C (collectively, the "Certificates").

Interest on the Equipment Notes is payable semiannually on each January 2 and July 2, beginning on January 2, 2008. Principal payments are scheduled on

January 2 and July 2 in scheduled years, beginning on January 2, 2008. The final payments will be due on July 2, 2022, in the case of the Series A Equipment

Notes, July 2, 2019, in the case of the Series B Equipment Notes, and July 2, 2014, in the case of the Series C Equipment Notes. Maturity of the Equipment

Notes may be accelerated upon the occurrence of certain events of default, including failure by United to make payments under the applicable Indenture when

due or to comply with certain covenants, as well as certain bankruptcy events involving United. The Equipment Notes issued with respect to each of the 13

aircraft are secured by a lien on each such aircraft and are cross-collateralized by the rest of the 13 aircraft financed pursuant to the Note Purchase Agreement.

Distributions on the Certificates are subject to certain subordination provisions whereby Morgan Stanley Senior Funding, Inc. provided a liquidity facility

for each of the Class A and Class B certificates. The liquidity facilities are expected to provide an amount sufficient to pay up to three semiannual interest

payments on the certificates of the related pass through trust. The Class C certificates do not have the benefit of a liquidity facility.

Denver Special Facilities Airport Revenue Refunding Bonds, Series 2007A. On June 28, 2007, the City and County of Denver issued approximately

$270 million of Denver International Airport ("DEN") refunding bonds ("Series 2007A Bonds"). The Series 2007A Bonds are unconditionally guaranteed by

United. The Series 2007 A Bonds were issued in two tranches—approximately $170 million aggregate principal amount of 5.25% discount bonds and

$100 million aggregate principal amount of 5.75% premium bonds. The weighted average yield to the 2032 maturity is approximately 5.47%.

The Series 2007A Bonds were issued to refinance United's guaranteed principal of $261 million, plus accrued interest and new issuance costs relating to the

City and County of Denver, Colorado Special Facilities Airport Revenue Bonds (United Air Lines Project) Series 1992A (the "1992 Bonds") that were issued in

1992 to finance certain facilities at the Denver International Airport. The 1992 Bonds were due in 2032 unless United elected not to extend its airport facility

lease, in which case they were due in 2023. The Series 2007A Bonds similarly are due in 2032 unless United makes a similar

120

Source: UNITED AIR LINES INC, 10-K, February 29, 2008