United Airlines 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Overview

As discussed further in Item 1, Business, the Company derives virtually all of its revenues from airline related activities. The most significant source of

airline revenues is passenger revenues; however, Mileage Plus, United Cargo, and United Services are also significant sources of operating revenues. The airline

industry is highly competitive, and is characterized by intense price competition. Fare discounting by United's competitors has historically had a negative effect

on the Company's financial results because United has generally been required to match competitors' fares to maintain passenger traffic. Future competitive fare

adjustments may negatively impact the Company's future financial results. The Company's most significant operating expense is jet fuel. Jet fuel prices are

extremely volatile and are largely uncontrollable by the Company. UAL 's historical and future earnings have been and will continue to be significantly impacted

by jet fuel prices. The impact of recent jet fuel price increases is discussed below.

Bankruptcy Matters. On December 9, 2002, UAL, United and 26 direct and indirect wholly-owned subsidiaries filed voluntary petitions to reorganize its

business under Chapter 11 of the Bankruptcy Code. The Company emerged from bankruptcy on February 1, 2006, under a Plan of Reorganization that was

approved by the Bankruptcy Court. In connection with its emergence from Chapter 11 bankruptcy protection, the Company adopted fresh-start reporting, which

resulted in significant changes in post-emergence financial statements, as compared to the Company's historical financial statements. See the "Financial Results"

section below for further discussion. See Note 1, "Voluntary Reorganization Under Chapter 11," in the Combined Notes to Consolidated Financial Statements

for further information regarding bankruptcy matters.

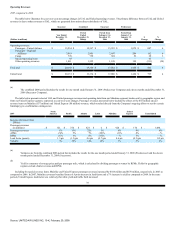

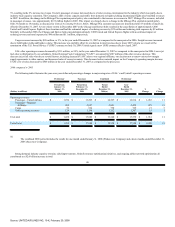

Recent Developments. The Company believes its restructuring has made the Company competitive with other U.S. carriers. The Company's financial

performance has continued to improve despite significant increases in fuel prices, as noted below. Average Mainline price per gallon has increased 22% from

2005 to 2007, which has negatively impacted the Company's unit costs and operating margins. However, between 2005 and 2007 the Company has been able to

mitigate the negative impact of rising fuel costs through its restructuring accomplishments, improved revenues and other means, which have all contributed to

UAL operating income of $1.0 billion in 2007, as compared to operating income (losses) of $447 million and $(219) million in 2006 and 2005, respectively. In

addition, the Company's operating cash flow improved significantly to $2.1 billion, or 37%, in 2007 as compared to 2006.

United seeks to continuously improve the delivery of its products and services to its customers, reduce unit costs, and increase unit revenues. Some of the

Company's more significant recent developments include the following:

•

In 2007, UAL 's management and its Board of Directors completed a strategic planning session to discuss the future of United. The

Company has developed a five-year plan, the ambition of which is to position United as the airline of choice for premium customers,

employees and investors, while maintaining our fundamental commitment to safety and balancing the needs of all of our stakeholders. The

Company's main focus continues to be strengthening our core business, and the plan includes a detailed roadmap of more than 250

initiatives and significant capital investment over the next five years. These investments are targeted to support improvements for customers

and employees, and drive revenue growth and efficiency improvements. In addition to strengthening the performance of the airline, our plan

also contemplates unlocking the value of business units such as United Services and Mileage Plus. Our goal is to generate returns to

stockholders that are competitive with the U.S. industry in general.

31

Source: UNITED AIR LINES INC, 10-K, February 29, 2008