United Airlines 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•

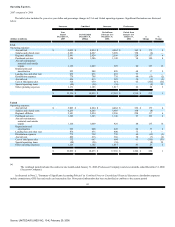

The Company recognized non-cash depreciation and amortization charges of $74 million on assets that were recorded at fair value as part

of fresh-start reporting, including definite-lived intangible assets that were recognized under fresh-start accounting. UAL did not recognize

similar asset values or related amortization expense in the preceding annual periods.

•

The adjustment of the Company's postretirement plan liabilities to fair value at fresh-start resulted in the elimination of unrecognized prior

service credits and actuarial losses for its non-pension postretirement plan. The elimination of these unrecognized items negatively

impacted the Company's 2006 expenses by approximately $51 million.

•

Aircraft rent was negatively impacted by approximately $101 million. This included an unfavorable impact of $66 million related to

deferred gains on pre-emergence sale-leaseback transactions that were eliminated as part of fresh-start reporting. Before fresh-start

reporting, these deferred gains were being amortized into earnings over the lease terms as a reduction of the related aircraft rent expense.

Also due to the restructuring of aircraft financings in bankruptcy, the Company's operating leases were at average rates below market value;

therefore, a deferred charge was recorded to adjust these leases to fair value. Amortization of this deferred charge resulted in additional rent

expense of approximately $35 million in 2006.

•

The Company recognized additional non-cash interest expense of approximately $51 million for the amortization of debt and capital lease

obligation discounts that were recorded upon its emergence from bankruptcy to adjust its debt and capital lease obligations to fair value.

•

The January 2006 reorganization income of approximately $22.9 billion and $22.7 billion for UAL and United, respectively, primarily

relates to the discharge of liabilities and other fresh-start adjustments recorded in connection with the Company's emergence from

bankruptcy. In 2005, reorganization charges of approximately $20.6 billion and $20.4 billion for UAL and United, respectively, were

primarily for pension, employee-related, and aircraft claim charges of $8.9 billion, $6.5 billion and $3.0 billion, respectively. For additional

information, see Note 1, "Voluntary Reorganization Under Chapter 11—Financial Statement Presentation," in the Combined Notes to

Consolidated Financial Statements.

•

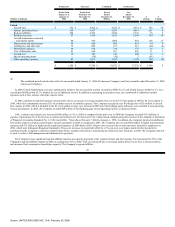

At the Company's emergence from bankruptcy, there were certain unresolved matters which are considered to be preconfirmation

contingencies. The Company initially recorded on the Effective Date an obligation for its best estimate of the amounts it expected to pay to

resolve these matters. Adjustments to these initial estimates are recorded in current results of operations. See Note 1, "Voluntary

Reorganization Under Chapter 11—Claims Resolution Process," in the Combined Notes to Consolidated Financial Statements for

additional information related to these adjustments.

United

From 2006 to 2007, the improvement in United's results was largely consistent with that of UAL with United's 2007 net income improving to $402 million

as compared to UAL 's 2007 net income of $403 million. The primary difference between United's and UAL 's net income for the combined twelve months of

2006 was a $225 million variance in reorganization income that was primarily due to $239 million of additional UAL income from the discharge of certain

bankruptcy claims and liabilities that existed at UAL, but not at United. In 2005, UAL 's net loss was approximately $140 million greater than United's loss due

to a $131 million larger bankruptcy-related impairment charge on lease certificates.

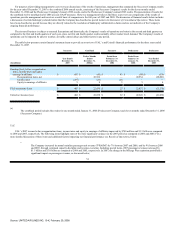

Liquidity. As of December 31, 2007, UAL had total cash, including restricted cash and short-term investments, of $4.3 billion. The Company's strong cash

position resulted from its recapitalization upon emergence from bankruptcy, together with strong operating cash flows of $2.1 billion in 2007, as

36

Source: UNITED AIR LINES INC, 10-K, February 29, 2008