United Airlines 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

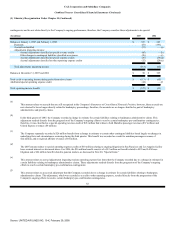

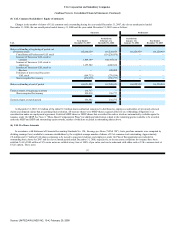

(2) Summary of Significant Accounting Policies (Continued)

that have been reclassified to "Distribution expenses" in the Company's 2007 Annual Report on Form 10-K are shown below:

Successor

Predecessor

(In millions)

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

2005

UAL and United

Commissions (historical) $ 291 $ 24 $ 305

Purchased services (historical) 447 36 470

Distribution expenses (new) $ 738 $ 60 $ 775

UAL

Purchased services (historical) $ 1,595 $ 134 $ 1,524

Reclassed to distribution expense (447) (36) (470)

Purchased services (new) $ 1,148 $ 98 $ 1,054

United

Purchased services (historical) $ 1,593 $ 133 $ 1,519

Reclassed to distribution expense (447) (36) (470)

Purchased services (new) $ 1,146 $ 97 $ 1,049

(c) Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

("GAAP") requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual

results could differ from those estimates.

Under fresh-start reporting, the Company's asset values were remeasured using fair value, which was allocated using the purchase method of accounting in

conformity with SFAS 141. In addition, fresh-start reporting also requires that all liabilities, other than deferred taxes, should be stated at fair value, or at the

present values of the amounts to be paid using appropriate market interest rates. Deferred taxes are determined in conformity with SFAS 109.

Estimates of the fair value of assets and liabilities were determined based on the Company's best estimates as discussed in Note 1, "Voluntary

Reorganization Under Chapter 11—Fresh-Start Reporting," above. The Company also estimates fair value of its financial instruments and its reporting units and

indefinite-lived intangible assets for testing impairment of indefinite-lived intangible assets, including goodwill. These estimates and assumptions are inherently

subject to significant uncertainties and contingencies beyond the control of the Company. Accordingly, the Company cannot provide assurance that the estimates,

assumptions, and values reflected in the valuations will be realized, and actual results could vary materially.

(d) Airline Revenues—The value of unused passenger tickets and miscellaneous charge orders ("MCO's") are included in current liabilities as advance

ticket sales. United records passenger ticket sales and tickets sold by other airlines for use on United as operating revenues when the transportation is provided or

when the ticket expires. Tickets sold by other airlines are recorded at the estimated values to be billed to the other airlines. Non-refundable tickets generally

expire on the date of the

90

Source: UNITED AIR LINES INC, 10-K, February 29, 2008