United Airlines 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

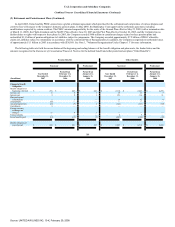

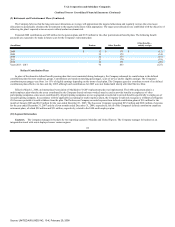

(6) Income Taxes (Continued)

Successor

Predecessor

(In millions)

Year Ended

December 31,

2007

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

Year Ended

December 31,

2005

United

Income tax provision at statutory rate $ 243 $ 20 $ 7,917 $ (7,363)

State income taxes, net of federal income tax

benefit 13 1 419 (413)

Nondeductible employee meals 10 9 1 11

Nondeductible interest expense 21 — — —

Medicare Part D Subsidy (2) (12) (2) (17)

Valuation allowance — — (8,397) 7,779

Share-based compensation 2 5 — —

Other, net 9 6 62 3

$ 296 $ 29 $ — $ —

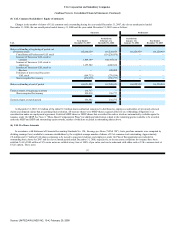

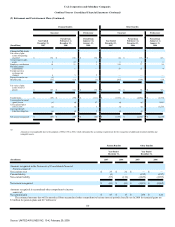

Temporary differences and carry forwards that give rise to a significant portion of deferred tax assets and liabilities at December 31, 2007 and 2006 were as

follows:

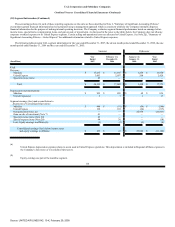

UAL

United

December 31,

December 31,

(In millions)

2007

2006

2007

2006

Deferred income tax asset (liability):

Employee benefits, including postretirement, medical and ESOP $ 1,292 $ 1,416 $ 1,322 $ 1,445

Federal and state net operating loss carry forwards 2,458 2,709 2,473 2,722

Mileage Plus deferred revenue 1,216 1,242 1,220 1,245

AMT credit carry forwards 297 291 297 291

Restructuring charges 170 223 165 218

Other asset 290 1,802 282 1,199

Less: Valuation allowance (1,815) (2,248) (1,757) (2,190)

Total deferred tax assets $ 3,908 $ 5,435 $ 4,002 $ 4,930

Depreciation, capitalized interest and other $ (3,165) $ (3,139) $ (3,161) $ (3,168)

Gains on sale and leasebacks (12) (9) (3) —

Aircraft rent (31) (46) (25) (40)

Intangibles (913) (964) (959) (1,010)

Other liability (347) (1,843) (337) (1,194)

Total deferred tax liabilities $ (4,468) $ (6,001) $ (4,485) $ (5,412)

Net deferred tax liability $ (560) $ (566) $ (483) $ (482)

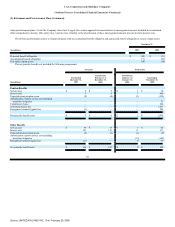

The federal and state NOL carry forwards relate to prior years' NOLs which may be carried forward to reduce the tax liabilities of future years. This tax

benefit is mostly attributable to federal pre-tax NOL carry forwards of $6.6 billion. If not utilized, the federal tax benefits of $1.0 billion expire

104

Source: UNITED AIR LINES INC, 10-K, February 29, 2008