United Airlines 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

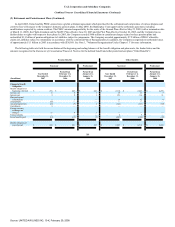

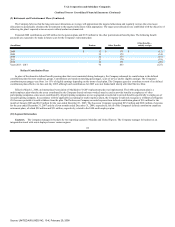

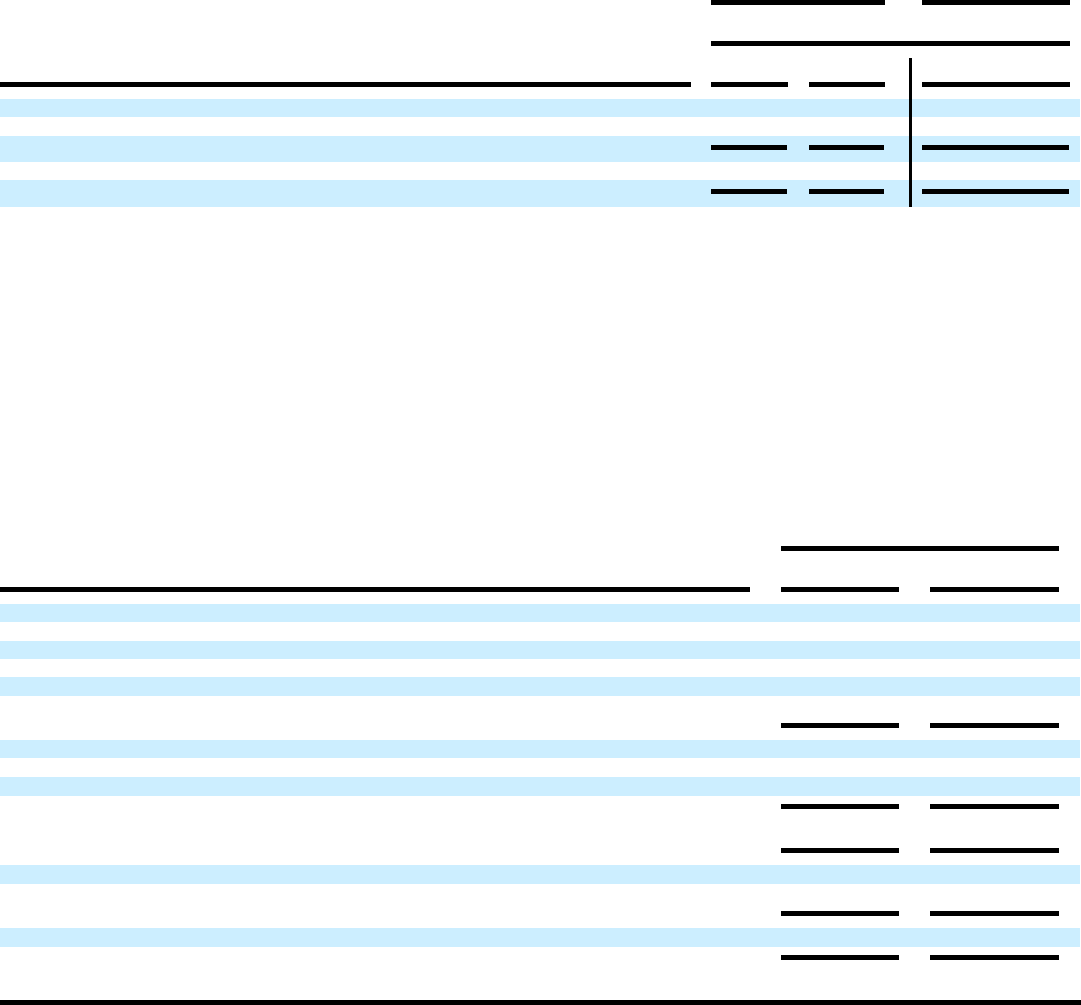

(11) Accumulated Other Comprehensive Income (Loss)

The table below presents the components of the Company's accumulated other comprehensive income (loss), net of tax. See Note 9, "Retirement and

Postretirement Plans" and Note 14, "Financial Instruments and Risk Management," for further information on these items.

Successor

Predecessor

At December 31,

(In millions)

2007

2006

2005

Pension and other postretirement gains (losses), net of tax $ 141 $ 87 $ (12)

Financial instrument losses, net of tax — (5) (24)

Accumulated other comprehensive income (loss), net of tax $ 141 $ 82 $ (36)

The 2006 and 2005 pension-related amounts represent the adoption of SFAS 158 and the minimum pension liability under SFAS 87, respectively. During

the initial adoption of SFAS 158, the Company recorded deferred taxes on the portion of other comprehensive income associated with the Medicare Part D

subsidiary. In 2007, the Company recomputed deferred taxes on the portion of the initial other comprehensive balance at the adoption date excluding the amount

of comprehensive income attributable to the Medicare Part D subsidiary. This adjustment of $40 million is excluded from comprehensive income and is reported

separately in the Company's Statements of Stockholders' Equity.

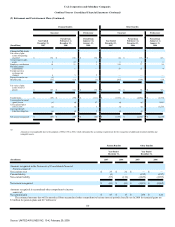

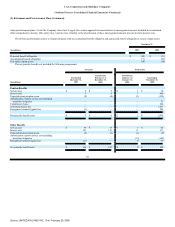

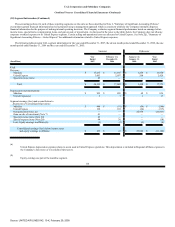

(12) Debt Obligations

In 2007, the Company prepaid and amended the credit facility and issued, repaid and repurchased various debt instruments, as discussed below. Previously

during 2006, in accordance with the Plan of Reorganization, the Company issued new debt, entered into the credit facility, reinstated certain secured aircraft debt

and entered into other debt agreements negotiated during the bankruptcy process (including aircraft financings) in addition to repaying the DIP Financing in its

entirety.

Long-term debt amounts outstanding at December 31, 2007 and 2006 are shown below:

At December 31,

(In millions)

2007

2006

United

Secured notes, 5.38% to 9.52%, due 2008 to 2022 $ 4,659 $ 5,221

Credit Facility, 7.13%, due 2014 1,291 2,786

Limited-Subordination Notes, 4.5%, due 2021 726 726

6% senior notes, due 2031 515 500

5% senior convertible notes, due 2021 150 150

Total debt 7,341 9,383

Less: unamortized debt discount (251) (247)

Less: current portion (678) (1,687)

Long-term debt, net $ 6,412 $ 7,449

UAL

Secured notes of direct subsidiary 3 4

Long-term debt, net $ 6,415 $ 7,453

117

Source: UNITED AIR LINES INC, 10-K, February 29, 2008