United Airlines 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

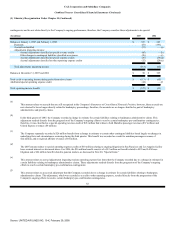

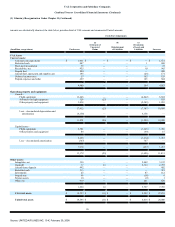

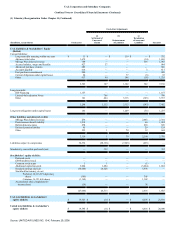

(1) Voluntary Reorganization Under Chapter 11 (Continued)

contingencies and do not relate directly to the Company's ongoing performance; therefore, the Company considers these adjustments to be special.

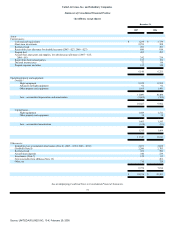

(In millions)

2007

2006

Balance at January 1, 2007 and February 1, 2006 $ 325 $ 583

Payments (83) (193)

Accruals reclassified (31) — (a)

Adjustments impacting income:

Accrual adjustments classified as special revenue credits (45) — (b)

Other changes in contingent liabilities classified as revenues (26) — (c)

Accrual adjustments classified as special expense credits (30) (36)(d)

Accrual adjustments classified as other operating expense credits (12) (29)(e)

Total adjustments impacting income (113) (65)

Balance at December 31, 2007 and 2006 $ 98 $ 325

Total credit to operating income during period from above items $ (113) $ (65)

Additional special operating expense credit (14) — (f)

Total operating income benefit $ (127) $ (65)

(a)

This amount relates to accruals that are still recognized in the Company's Statements of Consolidated Financial Position; however, these accruals are

now deemed to be no longer directly related to bankruptcy proceedings; therefore, the accruals are no longer classified as part of bankruptcy

administrative and priority claims.

(b)

In the third quarter of 2007, the Company recorded a change in estimate for certain liabilities relating to bankruptcy administrative claims. This

adjustment resulted directly from the progression of the Company's ongoing efforts to resolve certain bankruptcy pre-confirmation contingencies;

therefore, it was classified as a special operating revenue credit of $45 million that relates to both Mainline passenger revenues ($37 million) and

United Express revenues ($8 million).

(c)

The Company separately recorded a $26 million benefit from a change in estimate to certain other contingent liabilities based largely on changes in

underlying facts and circumstances occurring during the third quarter. This benefit was recorded as a credit to mainline passenger revenues of

$22 million, and to regional affiliate revenues of $4 million.

(d)

The 2007 amount relates to special operating expense credits of $30 million relating to ongoing litigation for San Francisco and Los Angeles facility

lease secured interests as discussed above. For 2006, the $36 million benefit consists of a $12 million net benefit related to SFO and LAX lease

litigation and a $24 million benefit related to pension matters, as discussed in Note 20, "Special Items."

(e)

This amount relates to accrual adjustments impacting various operating expense line items that the Company recorded due to a change in estimate for

certain liabilities relating to bankruptcy administrative claims. These adjustments resulted directly from the progression of the Company's ongoing

efforts to resolve certain bankruptcy pre-confirmation contingencies.

(f)

This amount relates to an accrual adjustment that the Company recorded due to a change in estimate for certain liabilities relating to bankruptcy

administrative claims. This adjustment, which was recorded as a credit to other operating expense, resulted directly from the progression of the

Company's ongoing efforts to resolve certain bankruptcy pre-confirmation contingencies.

82

Source: UNITED AIR LINES INC, 10-K, February 29, 2008