United Airlines 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

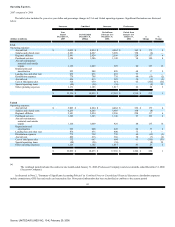

classification of most interest income in 2005 as a component of reorganization expense in accordance with SOP 90-7. In 2005, the Company recorded

$40 million of fuel hedge gains which did not qualify for hedge accounting in non-operating income, while in 2006 the $26 million net realized and unrealized

loss from economic fuel hedges was recognized in aircraft fuel expense.

See Note 1, "Voluntary Reorganization Under Chapter 11—Financial Statement Presentation," in the Combined Notes to Consolidated Financial Statements

for information on Reorganization items, net recognized in January 2006 and during the year ended December 31, 2005.

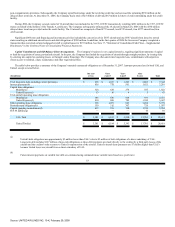

Liquidity and Capital Resources

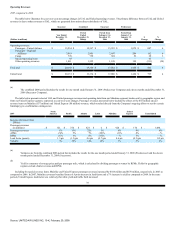

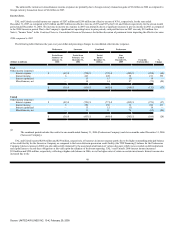

The following table provides a summary of UAL's and United's cash position at December 31, 2007 and 2006, and net cash provided (used) by operating,

financing and investing activities for the year ended December 31, 2007, the eleven month period ended December 31, 2006 and the one month period ended

January 31, 2006.

UAL

United

December 31,

December 31,

(In millions)

2007

2006

2007

2006

Cash, short-term investments & restricted cash $ 4,310 $ 4,991 $ 4,220 $ 4,896

Restricted cash included in total cash 756 847 722 809

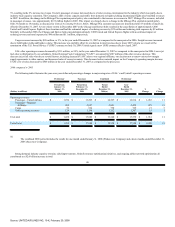

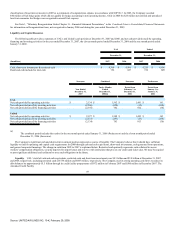

Successor

Combined

Successor

Predecessor

Year Ended

December 31,

2007

Twelve Months

Ended

December 31,

2006(a)

Period from

February 1 to

December 31,

2006

Period from

January 1 to

January 31,

2006

UAL

Net cash provided by operating activities $ 2,134 $ 1,562 $ 1,401 $ 161

Net cash provided (used) by investing activities (2,560) (250) (12) (238)

Net cash provided (used) by financing activities (2,147) 782 812 (30)

United

Net cash provided by operating activities $ 2,127 $ 1,588 $ 1,425 $ 163

Net cash provided (used) by investing activities (2,533) (293) (55) (238)

Net cash provided (used) by financing activities (2,134) 783 813 (30)

(a)

The combined period includes the results for the one month period ended January 31, 2006 (Predecessor) and the eleven month period ended

December 31, 2006 (Successor).

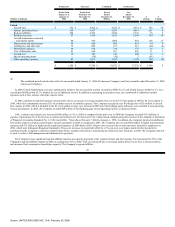

The Company's significant cash and short-term investment position represents a source of liquidity. The Company believes that it should have sufficient

liquidity to fund its operating and capital cash requirements for 2008 through cash and cash equivalents, short-term investments, cash generated from operations,

and general corporate financings. The change in cash from 2005 to 2007 is explained below. Restricted cash primarily represents cash collateral to secure

workers' compensation obligations, security deposits for airport leases and reserves with institutions that process our credit card ticket sales. We may be required

to post significant additional cash collateral to meet such obligations in the future.

Liquidity. UAL 's total of cash and cash equivalents, restricted cash and short-term investments was $4.3 billion and $5.0 billion at December 31, 2007

and 2006, respectively, including restricted cash of $756 million and $847 million, respectively. The Company used its strong operating cash flows to reduce its

debt balances by approximately $1.5 billion through its credit facility prepayments of $972 million in February 2007 and $500 million in December 2007. The

Amended Credit Facility

49

Source: UNITED AIR LINES INC, 10-K, February 29, 2008