United Airlines 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$11 million to its defined contribution plans and non-U.S. pension plans, respectively, in the eleven months ended December 31, 2006.

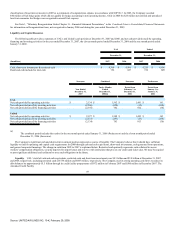

Cash Flows from Investing Activities.

2007 compared to 2006

UAL 's and United's cash released from restricted funds was $91 million and $87 million, respectively, in 2007 as compared to $310 million and

$319 million that was provided by a decrease in the segregated and restricted funds for UAL and United, respectively, in 2006. The significant cash generated

from restricted accounts in 2006 was due to our improved financial position upon our emergence from bankruptcy. Net purchases of short-term investments used

cash of $2.0 billion for both UAL and United in 2007 as compared to cash used for net purchases of short-term investments of $0.2 billion in 2006. This change

was due to investing additional excess cash in longer-term commercial paper in 2007 to increase investment yields. Investing activities in 2007 also includes the

Company's use of $96 million of cash to acquire certain of the Company's previously issued and outstanding debt instruments. The debt instruments repurchased

by the Company remain outstanding. See Note 12, "Debt Obligations," in Combined Notes to Consolidated Financial Statements for further information related

to the $96 million of purchased debt securities.

The Company's capital expenditures were $658 million and $362 million in 2007 and 2006, respectively, including the purchase of six aircraft during 2007.

In the third quarter of 2007, the Company purchased three 747-400 aircraft that had previously been financed by United through operating leases which were

terminated at closing. The total purchase price for these aircraft was largely financed with certain proceeds from the secured EETC financing described below.

These transactions did not result in any change in the Company's fleet count of 460 mainline aircraft, or in the amount of aircraft encumbered by debt or lease

agreements.

During the fourth quarter of 2007, the Company used existing cash to acquire three aircraft that were previously financed under operating lease agreements.

The total purchase price of these three aircraft and the three aircraft acquired in the third quarter of 2007 was approximately $200 million. This purchase did not

result in any change in the Company's fleet count of 460 mainline aircraft, but did unencumber three aircraft.

In addition, in the fourth quarter of 2007, the Company utilized existing aircraft deposits pursuant to the terms of the original capital lease to make the final

lease payments on three aircraft, resulting in the reclassification of the aircraft from capital leased assets to owned assets. However, the purchase of these three

aircraft did not result in a net change in cash because the Company had previously provided cash deposits equal to the purchase price of the aircraft to third party

financial institutions for the benefit of the lessor. These transactions resulted in three additional aircraft becoming unencumbered for a total increase of six

unencumbered aircraft during the year.

During 2007, the Company sold its interest in ARINC, generating proceeds of $128 million. In 2006, UAL received $43 million more in cash proceeds from

investing activities as compared to United primarily due to $56 million of proceeds from the sale of MyPoints, a former direct subsidiary of UAL.

2006 compared to 2005

Cash released from segregated funds after exit from bankruptcy in 2006 provided $200 million in cash proceeds. UAL 's sale of the subsidiary

MyPoints.com, Inc. generated an additional $56 million in cash proceeds in 2006 as compared to 2005. UAL 's and United's cash used for increases in short-term

investments in 2006 was $235 million and $231 million, respectively, as compared to no material purchases or sales of short-term investments in 2005. A

reduction in restricted cash balances provided $110 million and $119 million of cash proceeds in 2006 for UAL and United, respectively, as compared

51

Source: UNITED AIR LINES INC, 10-K, February 29, 2008