United Airlines 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

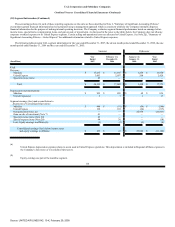

(6) Income Taxes (Continued)

in 2022, $0.4 billion expire in 2023, $0.5 billion expire in 2024 and $0.4 billion expire in 2025. In addition, the state tax benefit of $156 million, if not utilized,

expires over a five to twenty year period.

At this time, the Company does not believe that the limitations imposed by the Internal Revenue Code on the usage of the NOL carry forward and other tax

attributes following an ownership change will have an effect on the Company. Therefore, the Company does not believe its exit from bankruptcy has had any

material impact on the utilization of its remaining NOL carry forward and other tax attributes.

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income (including the reversals of deferred tax liabilities)

during the periods in which those temporary differences will become deductible. The Company's management assesses the realizability of its deferred tax assets,

and records a valuation allowance for the deferred tax assets when it is more likely than not that a portion, or all of the deferred tax assets, will not be realized. As

a result, the Company has a valuation allowance against its deferred tax assets as of December 31, 2007 and 2006, to reflect management's assessment regarding

the realizability of those assets. The Company expects to continue to maintain a valuation allowance on deferred tax assets until other positive evidence is

sufficient. The current valuation allowance of $1,815 million and $1,757 million for UAL and United, respectively, if reversed in 2008 will be allocated to reduce

goodwill and then other intangible assets; if reversed in 2009 or later, it will be allocated to reduce income tax expense as discussed in Note 2(p), "Summary of

Significant Accounting Policies—New Accounting Pronouncements."

In addition to the deferred tax assets listed above, the Company has an $801 million unrecorded tax benefit at December 31, 2007 attributable to the

difference between the amount of the financial statement expense and the allowable tax deduction for UAL common stock issued to certain unsecured creditors

and employees pursuant to the Plan of Reorganization. The Company is accounting for this unrecorded tax benefit by analogy to SFAS 123R which requires

recognition of the tax benefit to be deferred until it is realized as a reduction of taxes payable.

Effective January 1, 2007, we adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes ("FIN 48"). Our adoption

of FIN 48 resulted in a $24 million increase in the liability for unrecognized tax benefits ("UTB") which was accounted for as a $6 million decrease in goodwill,

a $2 million increase in additional capital invested, and a $32 million increase to deferred tax assets.

At December 31, 2007, our liability for uncertain tax positions was $35 million. UTB of $19 million would affect our effective tax rate if recognized.

Excluding amounts related to tax positions for which the ultimate deductibility is highly certain, there were no significant changes in the components of the

liability in the twelve months ending December 31, 2007. Any change in the amount of unrecognized tax benefits within the next twelve months is not expected

to result in a significant impact on the results of operations or the financial position of the Company.

Included in the balance at December 31, 2007 is $16 million of tax positions for which the ultimate deductibility is highly certain but for which there is

uncertainty about the timing of such deductibility. Because of the impact of deferred tax accounting, other than interest and penalties, the disallowance of the

shorter deductibility period would not affect the effective tax rate but would cause a reduction to the net operating losses available for utilization.

We record penalties and interest relating to uncertain tax positions in the other operating expense and interest expense line items, respectively, within our

consolidated statement of income.

105

Source: UNITED AIR LINES INC, 10-K, February 29, 2008