United Airlines 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

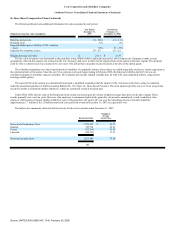

(2) Summary of Significant Accounting Policies (Continued)

(o) Ticket Taxes—Certain governmental taxes are imposed on United's ticket sales through a fee included in ticket prices. United collects these fees and

remits them to the appropriate government agency. These fees are recorded on a net basis (excluded from operating revenues).

(p) New Accounting Pronouncements—In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, Fair Value

Measurements ("SFAS 157"), which defines fair value, establishes a framework for measuring fair value, and expands disclosure about fair value measurements.

SFAS 157 does not require any new fair value measurements; rather it specifies valuation methods and disclosures to be applied when fair value measurements

are required under existing or future accounting pronouncements. As originally issued, SFAS 157 is effective for fiscal years beginning January 1, 2008. The

Company does not expect the adoption of SFAS 157 with respect to its financial assets and financial liabilities to have a material impact on its results of

operations or financial position.

In February 2008, the FASB issued FASB Staff Position ("FSP") No. FAS 157-b. This FSP delayed the effective date of SFAS 157 for all nonfinancial

assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis, until periods

beginning January 1, 2009. The Company is currently evaluating the impact of SFAS 157 on the reporting and disclosure of its nonfinancial assets and

nonfinancial liabilities.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities Including an amendment of FASB Statement No. 115 ("SFAS 159"). This statement permits entities to choose to measure many financial instruments

and certain other items at fair value that are not currently required to be measured at fair value. The objective of SFAS 159 is to improve financial reporting by

providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to

apply complex hedge accounting provisions. SFAS 159 also establishes presentation and disclosure requirements designed to facilitate comparisons between

entities that choose different measurement attributes for similar types of assets and liabilities. This statement does not affect any existing accounting literature

that requires certain assets and liabilities to be carried at fair value. This statement is effective for the Company as of January 1, 2008. The Company did not elect

to apply the provisions of SFAS 159 to any of its existing financial assets or financial liabilities at January 1, 2008.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007), Business Combinations ("SFAS 141R"). This

statement replaces Statement of Financial Accounting Standards No. 141, Business Combinations. SFAS 141R retains the fundamental requirements in

Statement No. 141 that the acquisition method of accounting be used for all business combinations and for an acquirer to be identified for each business

combination. In addition, SFAS 141R provides new guidance intended to improve reporting by creating greater consistency in the accounting and financial

reporting of business combinations, resulting in more complete, comparable, and relevant information for investors and other users of financial statements.

SFAS 141R is effective for the Company for any business combinations with an acquisition date on or after January 1, 2009. The Company will apply the

provisions of SFAS 141R to any business combinations within the scope of SFAS 141R after its effective date. In accordance with the provisions of SFAS 141R

that amended SFAS 109, beginning January 1, 2009, the Company will be required to recognize any changes in the valuation allowance for deferred tax assets,

which was established as part of fresh-start reporting, to be recognized as an adjustment to income tax expense. This reflects a change from current practice

which

95

Source: UNITED AIR LINES INC, 10-K, February 29, 2008