United Airlines 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(8) Intangibles (Continued)

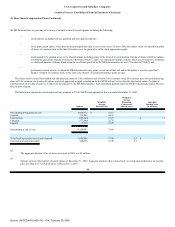

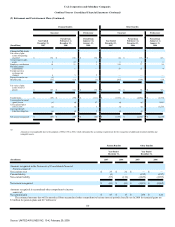

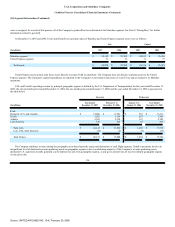

The following table presents information about the intangible assets of the Successor and Predecessor Companies, including goodwill, at December 31,

2007 and 2006, respectively:

Weighted

Average Life of

Assets

(in years)

Gross Carrying

Amount

Accumulated

Amortization

Gross Carrying

Amount

Accumulated

Amortization

(Dollars in millions)

2007

2006

Amortized intangible assets

Airport slots and gates 9 $ 72 $ 22 $ 72 $ 14

Hubs 20 145 14 145 7

Patents 3 70 45 70 21

Mileage Plus database 7 521 137 521 77

Contracts 13 216 101 216 48

Other 7 18 5 18 2

10 $ 1,042 $ 324 $ 1,042 $ 169

Unamortized intangible assets

Goodwill $ 2,280 $ 2,703

Airport slots and gates 255 255

Route authorities 1,146 1,146

Trade-name 752 754

$ 4,433 $ 4,858

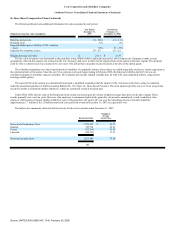

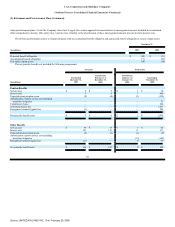

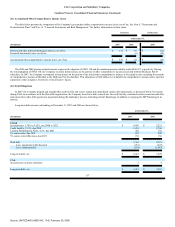

The Company initially recorded goodwill of $2,756 million upon its exit from bankruptcy. During the year ended December 31, 2007, goodwill decreased

by $423 million due to a $414 million reduction of the valuation allowance for the deferred tax assets established at fresh-start, $6 million due to the adoption of

FIN 48 and $3 million due to a change in estimate of tax accruals existing at the Effective Date. During the eleven month period ended December 31, 2006,

goodwill was decreased by $62 million due to Successor Company tax activity that impacted the deferred tax asset valuation allowance, and increased by

$9 million due to net adjustments to the fair values of certain assets and liabilities. Total amortization expense recognized was $155 million for the year ended

December 31, 2007, $1 million for the one month period ended January 31, 2006 and $169 million for the eleven month period ended December 31, 2006. The

Company expects to record amortization expense of $92 million, $70 million, $64 million, $59 million and $56 million for 2008, 2009, 2010, 2011 and 2012,

respectively.

Open Skies. On April 30, 2007, the U.S. government and the European Union ("EU") signed a transatlantic aviation agreement to replace the existing

bilateral arrangements between the U.S. Government and the 27 EU member states. The agreement is expected to become effective at the end of March 2008.

The agreement is based on the U.S. open skies model and authorizes U.S. airlines to operate between the United States and any point in the EU and beyond,

free from government restrictions on capacity, frequencies and scheduling and provides EU carriers with reciprocal rights in these U.S./EU markets. The

agreement also authorizes all U.S. and EU carriers to operate services between the

107

Source: UNITED AIR LINES INC, 10-K, February 29, 2008