United Airlines 2007 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

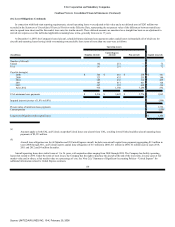

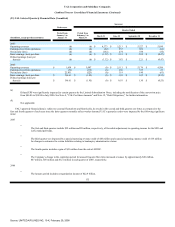

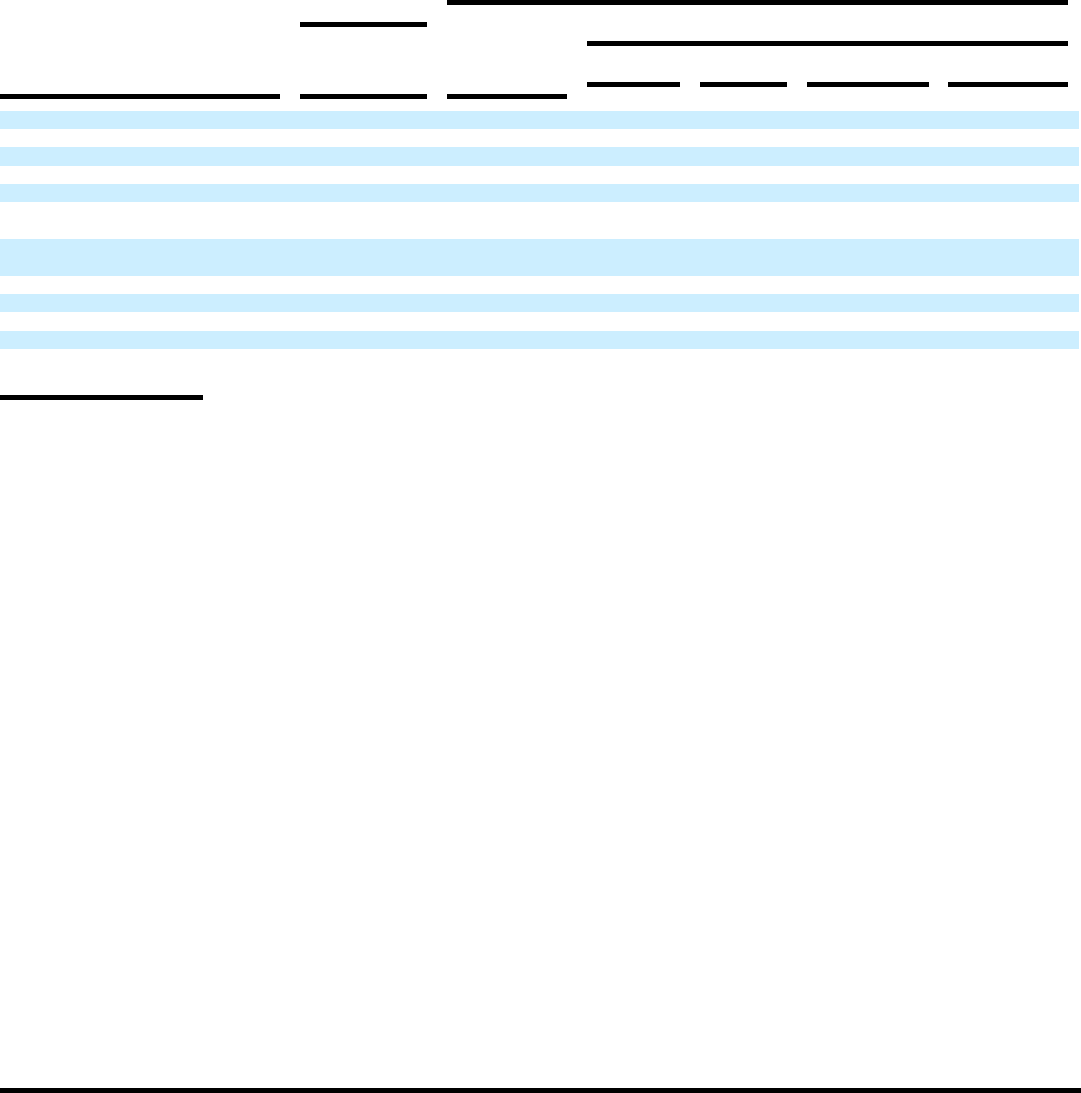

(23) UAL Selected Quarterly Financial Data (Unaudited)

Successor

Predecessor

Quarter Ended

(In millions, except per share amounts)

Period from

January 1 to

January 31

Period from

February 1 to

March 31

March 31

June 30

September 30

December 31

2007:

Operating revenues (b) (b) $ 4,373 $ 5,213 $ 5,527 $ 5,030

Earnings (loss) from operations (b) (b) (92) 537 656 (64)

Net income (loss) (b) (b) (152) 274 334 (53)

Basic earnings (loss) per share (b) (b) $ (1.32) $ 2.31 $ 2.82 $ (0.47)

Diluted earnings (loss) per

share(a) (b) (b) $ (1.32) $ 1.83 $ 2.21 $ (0.47)

2006:

Operating revenues $ 1,458 $ 3,007 (b) $ 5,113 $ 5,176 $ 4,586

Earnings (loss) from operations (52) (119) (b) 260 335 23

Net income (loss) 22,851 (223) (b) 119 190 (61)

Basic earnings (loss) per share $ 196.61 $ (1.95) (b) $ 1.01 $ 1.62 $ (0.55)

Diluted earnings (loss) per

share(a) $ 196.61 $ (1.95) (b) $ 0.93 $ 1.30 $ (0.55)

(a)

Diluted EPS was significantly impacted in certain quarters by the Limited-Subordination Notes, including the modification of the conversion price

from $46.86 to $34.84 in July 2006. See Note 4, "UAL Per Share Amounts" and Note 12, "Debt Obligations," for further information.

(b)

Not applicable.

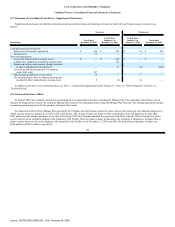

UAL's quarterly financial data is subject to seasonal fluctuations and historically, its results in the second and third quarters are better as compared to the

first and fourth quarters of each year since the latter quarters normally reflect weaker demand. UAL's quarterly results were impacted by the following significant

items:

2007

•

The first and third quarters include $22 million and $8 million, respectively, of favorable adjustments to operating income for the SFO and

LAX municipal bonds.

•

The third quarter was impacted by a special operating revenue credit of $45 million and a special operating expense credit of $14 million

for changes in estimates for certain liabilities relating to bankruptcy administrative claims.

•

The fourth quarter includes a gain of $41 million from the sale of ARINC.

•

The Company's change in the expiration period for unused frequent flier miles increased revenues by approximately $28 million,

$47 million, $50 million and $121 million in each quarter of 2007, respectively.

2006

•

The January period includes reorganization income of $22.9 billion.

135

Source: UNITED AIR LINES INC, 10-K, February 29, 2008