United Airlines 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•

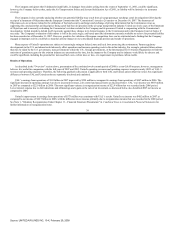

The Company is currently evaluating strategic alternatives to maximize the value of its MRO business. During 2007, the Company met

with various third parties and permitted such third parties to conduct due diligence with respect to a potential transaction involving the

Company's MRO business (excluding the Company's line maintenance activities). The Company has received proposals and is in the

process of evaluating these proposals. As discussed in Item 1A, Risk Factors, there can be no assurance any such transaction will occur, nor

can there be any assurances with respect to the form or timing of any such transaction.

•

The Company is currently evaluating strategic alternatives to maximize the value of its Mileage Plus business. In early 2008, the Company

began the process of preparing Mileage Plus/ULS financial reports and analysis as part of our evaluation process that could eventually

result in a possible disposition of part or all of a company that owns and operates the Mileage Plus program. As discussed in Item 1A, Risk

Factors, there can be no assurance that any such transaction will occur.

•

Effective May 5, 2008, United will charge certain customers a $25 service fee to check a second bag. Customers that have a certain status in

Mileage Plus or Star Alliance will not be charged to check a second bag. United estimates that this and other changes to its baggage policy

will generate more than $100 million annually in cost savings and new revenue.

•

The Company's employees earned approximately $170 million in cash payments related to 2007 business performance, comprised of

approximately $110 million in profit sharing, $40 million in success sharing awards and $20 million as part of the special distribution to

UAL common stockholders. The majority of these payments will be made in the first four months of 2008.

•

The Company has announced a $200 million cost reduction program for fiscal year 2008 following successful completion of its

$400 million cost reduction program in 2007.

•

In 2007, United entered into an agreement to sell its interest in Aeronautical Radio, Inc. ("ARINC"), to Radio Acquisition Corp., an affiliate

of The Carlyle Group. ARINC is a provider of transportation communications and systems engineering. The transaction closed on

October 25, 2007 and generated proceeds of $128 million and a pre-tax net gain of $41 million.

•

In November 2007, the Company showcased the first of 97 international aircraft to be refitted with new first and business class premium

seats, entertainment systems and other product enhancements with an inaugural flight from Washington Dulles to Frankfurt. With this

flight, United earned the distinction of becoming the first U.S. carrier to offer 180-degree, lie-flat beds in business class on overseas flights.

Upgrading of all 97 international aircraft is expected to be completed between late 2007 and early 2010.

•

During 2007, the U.S. government and the European Union ("EU") signed a transatlantic aviation agreement to replace the existing bilateral

arrangements between the U.S. Government and the 27 EU member states. The agreement will become effective at the end of March 2008.

The future effects of this agreement on UAL cannot be predicted with certainty due to the variety of provisions affecting the competitive

position of United and other U.S. and EU carriers subject to its terms; however, we have already taken actions to capitalize on opportunities

under the new agreement. In September 2007, the DOT granted authority to effectuate antitrust immunity between United and bmi, and to

include bmi in the multilateral group of Star Alliance carriers that had already been granted antitrust immunity by the DOT. This immunity

goes into effect at the same time as the Open Skies treaty between the U.S. and the EU in March 2008.

32

Source: UNITED AIR LINES INC, 10-K, February 29, 2008