United Airlines 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

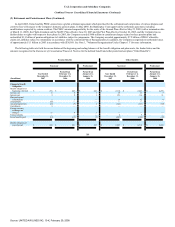

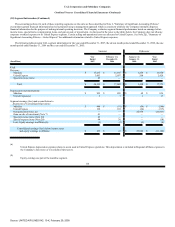

(10) Segment Information (Continued)

The following table presents United segment information for the year ended December 31, 2007, the eleven month period ended December 31, 2006, the

one month period ended January 31, 2006 and the year ended December 31, 2005:

Successor

Predecessor

(In millions)

Year

Ended

2007

February 1 to

December 31,

2006

January 1 to

January 31,

2006

Year

Ended

2005

United

Revenue:

Mainline $ 17,023 $ 15,183 $ 1,250 $ 14,875

United Express 3,063 2,697 204 2,429

Special revenue items 45 — — —

Total $ 20,131 $ 17,880 $ 1,454 $ 17,304

Depreciation and amortization:

Mainline $ 925 $ 820 $ 68 $ 854

United Express(a) 9 7 1 17

Segment earnings (loss) and reconciliation to

Statements of Consolidated Operations:

Mainline $ 446 $ (76) $ (59) $ (282)

United Express 122 101 (24) (317)

Reorganization items, net — — 22,709 (20,432)

Gain on sale of investments (Note 7) 41 — — —

Special revenue items (Note 20) 45 — — —

Special expense items (Note 20) 44 36 — (5)

Less: Equity earnings in affiliates(b) (5) (3) (5) (4)

Consolidated earnings (loss) before income taxes

and equity earnings in affiliates $ 693 $ 58 $ 22,621 $ (21,040)

(a)

United Express depreciation expense relates to assets used in United Express operations. This depreciation is included in Regional affiliates expense in

the Company's Statements of Consolidated Operations.

(b)

Equity earnings are part of the mainline segment.

The Company does not allocate interest income or interest expense to the United Express segment in reports used to evaluate segment performance.

Therefore, all amounts classified as interest income and interest expense in the Statements of Consolidated Operations relate to the mainline segment.

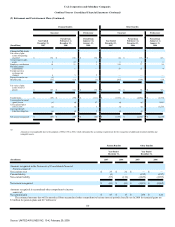

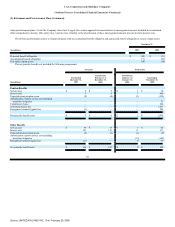

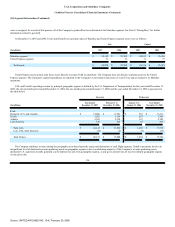

In accordance with SFAS 142, on the Effective Date the Company allocated goodwill upon adoption of fresh-start reporting in a manner similar to how the

amount of goodwill recognized in a business combination is determined. This required the determination of the fair value of each reporting unit to calculate an

estimated purchase price for such reporting unit. This purchase price was then allocated to the individual assets and liabilities assumed to be related to that

reporting unit. Any excess purchase price is the amount of goodwill assigned to that reporting unit. To the extent that individual assets and liabilities could be

assigned directly to specific reporting units, those assets and liabilities

115

Source: UNITED AIR LINES INC, 10-K, February 29, 2008