United Airlines 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

agreement requires the consortium to make lease payments in amounts sufficient to pay the maturing principal and interest payments on the bonds. As of

December 31, 2007, approximately $890 million principal amount of such bonds were secured by significant fuel facility leases in which United participates, as

to which United and each of the signatory airlines have provided indirect guarantees of the debt. United's exposure is approximately $195 million principal

amount of such bonds based on its recent consortia participation. The Company's exposure could increase if the participation of other carriers decreases. The

guarantees will expire when the tax-exempt bonds are paid in full, which ranges from 2010 to 2028. The Company did not record a liability at the time these

indirect guarantees were made.

Debt Covenants. The Company was in compliance with the Amended Credit Facility covenants as of December 31, 2007. As part of the amendment to the

credit facility completed in February 2007, several covenants were amended to provide the Company more flexibility. The Amended Credit Facility contains

covenants that may limit the ability of United and the Guarantors to, among other things, incur or guarantee additional indebtedness, create liens, pay dividends

on or repurchase stock, make certain types of investments, pay dividends or other payments from United's direct or indirect subsidiaries, enter into transactions

with affiliates, sell assets or merge with other companies, modify corporate documents or change lines of business. The Amended Credit Facility also requires

compliance with certain financial covenants. Failure to comply with the covenants could result in a default under the Amended Credit Facility unless the

Company were to obtain a waiver of, or otherwise mitigate or cure, any such default. Additionally, the Amended Credit Facility contains a cross-default

provision with respect to other credit arrangements that exceed $50 million. A payment default could result in a termination of the Amended Credit Facility and a

requirement to accelerate repayment of all outstanding facility borrowings. For further details about the Amended Credit Facility and the associated covenants,

see Note 12, "Debt Obligations," in the Combined Notes to Consolidated Financial Statements.

Future Financing. Subject to the restrictions of its Amended Credit Facility, the Company could raise additional capital by issuing unsecured debt, equity

or equity-like securities, monetizing or borrowing against certain assets or refinancing existing obligations to generate net cash proceeds. However, the

availability and capacity of these funding sources cannot be assured or predicted. General economic conditions, poor credit market conditions and any adverse

changes in the Company's credit ratings could adversely impact the Company's ability to raise capital, if needed, and could increase the Company's cost of

capital.

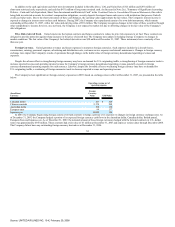

Credit Ratings. As of December 31, 2007, the Company had a corporate credit rating of B (outlook stable) from Standard & Poor's and a corporate family

rating of B2 (outlook stable) from Moody's Investors Services. These ratings are unchanged from the ratings received upon the Company's exit from bankruptcy.

These credit ratings are below investment grade levels. Downgrades from these rating levels could restrict the availability and/or increase the cost of future

financing for the Company.

Other Information

Foreign Operations. The Company's Statements of Consolidated Financial Position reflect material amounts of intangible assets related to the Company's

Pacific and Latin American route authorities, and its operations at London's Heathrow Airport. Because operating authorities in international markets are

governed by bilateral aviation agreements between the U.S. and foreign countries, changes in U.S. or foreign government aviation policies can lead to the

alteration or termination of existing air service agreements that could adversely impact, and significantly impair, the value of our international route authorities.

Significant changes in such policies could also have a material impact on the Company's operating revenues and expenses and results of operations. For further

information, see Note 8, "Intangibles" in the Combined Notes to Consolidated Financial Statements, Item 1, Business—International Regulation and Item 7A,

Quantitative and Qualitative Disclosures above Market

55

Source: UNITED AIR LINES INC, 10-K, February 29, 2008