United Airlines 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

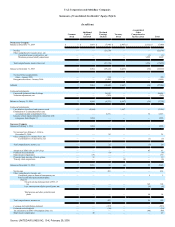

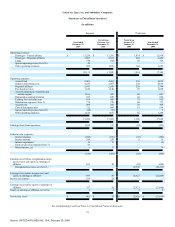

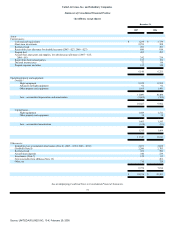

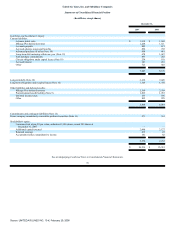

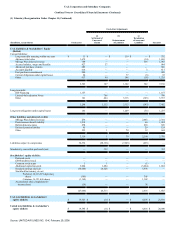

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements

The Company

UAL Corporation (together with its consolidated subsidiaries, "UAL") is a holding company whose principal, wholly-owned subsidiary is United Air

Lines, Inc. (together with its consolidated subsidiaries, "United"). We sometimes use the words "we," "our," "us" and the "Company" in this Annual Report on

Form 10-K for disclosures that relate to both UAL and United.

This Annual Report on Form 10-K is a combined report of UAL and United. Therefore, these Combined Notes to Consolidated Financial Statements apply

to both UAL and United, unless otherwise noted. As UAL consolidates United for financial statement purposes, disclosures that relate to activities of United also

apply to UAL.

As a result of the adoption of fresh-start reporting in accordance with American Institute of Certified Public Accountants' Statement of Position 90-7,

Financial Reporting by Entities in Reorganization under the Bankruptcy Code ("SOP 90-7"), the financial statements before February 1, 2006 are not comparable

with the financial statements for periods on or after February 1, 2006. References to "Successor Company" refer to UAL and United on or after February 1, 2006,

after giving effect to the adoption of fresh-start reporting. References to "Predecessor Company" refer to UAL and United before February 1, 2006. See Note 1,

"Voluntary Reorganization Under Chapter 11—Fresh-Start Reporting," for further details.

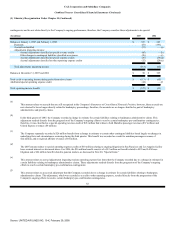

(1) Voluntary Reorganization Under Chapter 11

Bankruptcy Considerations. The following discussion provides general background information regarding the Company's Chapter 11 cases, and is not

intended to be an exhaustive summary. Detailed information pertaining to the bankruptcy filings may be obtained at www.pd-ual.com.

On December 9, 2002 (the "Petition Date"), UAL, United and 26 direct and indirect wholly-owned subsidiaries (collectively, the "Debtors") filed voluntary

petitions to reorganize their businesses under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Northern District of

Illinois, Eastern Division (the "Bankruptcy Court"). On January 20, 2006, the Bankruptcy Court confirmed the Debtors' Second Amended Joint Plan of

Reorganization Pursuant to Chapter 11 of the United States Bankruptcy Code (the "Plan of Reorganization"). The Plan of Reorganization became effective and

the Debtors emerged from bankruptcy protection on February 1, 2006 (the "Effective Date"). On the Effective Date, the Company implemented fresh-start

reporting.

The Plan of Reorganization generally provided for the full payment or reinstatement of allowed administrative claims, priority claims and secured claims,

and the distribution of new equity and debt securities to the Debtors' creditors and employees in satisfaction of allowed unsecured and deemed claims. The Plan

of Reorganization contemplated UAL issuing up to 125 million shares of common stock (out of the one billion shares of new common stock authorized under its

certificate of incorporation), including approximately 115 million shares of common stock to unsecured creditors and employees, up to 9.825 million shares of

common stock (or options or other rights to acquire shares) under the management equity incentive plan approved by the Bankruptcy Court; and up to 175,000

shares of common stock (or options or other rights to acquire shares) under the director equity incentive plan approved by the Bankruptcy Court. The new

common stock was listed on the NASDAQ National Market and began trading under the symbol "UAUA" on February 2, 2006.

Pursuant to the Plan of Reorganization, UAL issued 5 million shares of 2% mandatorily convertible preferred stock to the Pension Benefit Guaranty

Corporation ("PBGC"), approximately $150 million in aggregate principal amount of 5% senior convertible notes issued to holders of certain

79

Source: UNITED AIR LINES INC, 10-K, February 29, 2008