United Airlines 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

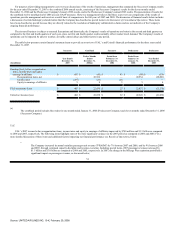

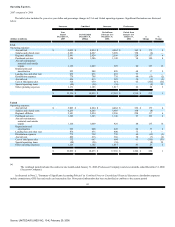

compared to $1.6 billion in 2006 and $1.1 billion in 2005. UAL used cash of approximately $257 million to pay a $2.15 per common share special distribution in

January 2008.

In addition, the Company reduced its balance sheet debt during 2007 by approximately $2.2 billion. Most of the debt reduction related to the Company's

credit facility, which was reduced by $1.5 billion in 2007. The Company amended its credit facility twice during 2007 and prepaid debt following its

February 2007 and December 2007 amendments. Total debt consisting of on-balance sheet debt, the Denver municipal bonds, estimated off-balance sheet debt

related to operating leases and open market debt repurchases decreased by $2.3 billion.

The Company has significant noncancelable contractual cash payment obligations associated with debt and aircraft and facility leases, among others. In

addition, the Company has aircraft purchase commitments; however, the commitments are generally cancelable. However, the cancellations could result in

forfeiture of the Company's deposits. See the "Liquidity and Capital Resources" section, below, for further information related to the credit facility amendments

and the Company's contractual obligations.

Contingencies. During the course of its Chapter 11 proceedings, the Company successfully reached settlements with most of its creditors and resolved

most pending claims against the Debtors. The following discussion provides a summary of the material matters yet to be resolved in the Bankruptcy Court, as

well as other contingencies. For further information on these matters, see Note 1, "Voluntary Reorganization Under Chapter 11—Significant Matters Remaining

to be Resolved in Chapter 11 Cases" and Note 15, "Commitments, Contingent Liabilities and Uncertainties," in the Combined Notes to Consolidated Financial

Statements.

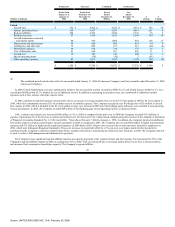

Municipal Bond Obligation & Off-Balance Sheet Financing. We are a party to numerous long-term agreements to lease certain airport and maintenance

facilities that are financed through tax-exempt municipal bonds issued by various local municipalities to build or improve airport and maintenance facilities.

United had been advised during its restructuring that these municipal bonds may have been unsecured (or in certain instances, partially secured) pre-petition debt.

In 2006, certain of United's municipal bond obligations relating to LAX and SFO were conclusively adjudicated through the Bankruptcy Court as financings and

not true leases; however, there remains pending litigation to determine the value of the security interests, if any, that the bondholders at LAX and SFO have in

our underlying leaseholds.

United has guaranteed $270 million of the City and County of Denver, Colorado Special Facilities Airport Revenue Bonds (United Air Lines Project)

Series 2007A (the "Denver Bonds"). This guarantee replaces our prior guarantee of $261 million of bonds issued by the City and County of Denver, Colorado in

1992. These bonds are callable by United. The outstanding bonds and related guarantee are not recorded in the Company's Statements of Consolidated Financial

Position. However, the related lease agreement is accounted for on a straight-line basis resulting in a ratable accrual of the final $270 million payment over the

lease term.

Legal and Environmental. The Company has certain contingencies resulting from litigation and claims incident to the ordinary course of business.

Management believes, after considering a number of factors, including (but not limited to) the information currently available, the views of legal counsel, the

nature of contingencies to which the Company is subject and prior experience, that the ultimate disposition of the litigation and claims will not materially affect

the Company's consolidated financial position or results of operations. When appropriate, the Company accrues for these matters based on its assessments of the

likely outcomes of their eventual disposition. The amounts of these liabilities could increase or decrease in the near term, based on revisions to estimates relating

to the various claims.

37

Source: UNITED AIR LINES INC, 10-K, February 29, 2008