United Airlines 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

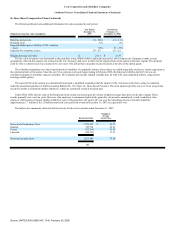

(2) Summary of Significant Accounting Policies (Continued)

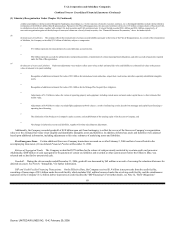

(i) Deferred Gains—Gains on aircraft sale and leaseback transactions are deferred and amortized over the terms of the related leases as a reduction of

aircraft rent expense.

(j) United Express—United has agreements under which independent regional carriers, flying under the United Express name, connect passengers to other

United Express and/or United flights (the latter of which we also refer to as "mainline" operations, to distinguish them from United Express regional operations).

The vast majority of United Express flights are operated under capacity agreements, while a relatively smaller number are operated under prorate agreements.

United Express operating revenues and expenses are classified as "Passenger—Regional Affiliates" and "Regional affiliates," respectively, in the Statements

of Consolidated Operations, the latter includes both allocated and direct costs. Direct costs represent expenses that are specifically and exclusively related to

United Express flying activities, such as capacity agreement payments, commissions, booking fees, fuel expenses and dedicated staffing. The capacity agreement

payments are based on specific rates for various operating expenses of the United Express carriers, such as crew expenses, maintenance and aircraft ownership,

some of which are multiplied by specific operating statistics (e.g., block hours, departures) while others are fixed per month. Allocated costs represent United

Express's portion of shared expenses and include charges for items such as airport operating costs, reservation-related costs, credit card discount fees and facility

rents. For each of these expense categories, the Company estimates United Express's portion of total expense and allocates the applicable portion of expense to

the United Express carrier.

United has the right to exclusively operate and direct the operations of these aircraft, and accordingly the minimum future lease payments for these aircraft

are included in the Company's lease obligations. See Note 10, "Segment Information" and Note 16, "Lease Obligations," for additional information related to

United Express.

The Company recognizes revenue as flown on a net basis for flights on United Express covered by prorate agreements.

United has call options on 152 regional jet aircraft currently being operated by certain United Express carriers. At December 31, 2007, none of the call

options were exercisable because none of the required conditions to make an option exercisable by the Company were met.

(k) Advertising—Advertising costs, which are included in other operating expenses, are expensed as incurred.

(l) Intangibles—Goodwill represents the excess of the reorganization value of the Successor Company over the fair value of net tangible assets and

identifiable intangible assets and liabilities resulting from the application of SOP 90-7. Indefinite-lived intangible assets are not amortized but are reviewed for

impairment annually or more frequently if events or circumstances indicate that the asset may be impaired. The Mileage Plus customer database is amortized on

an accelerated basis utilizing cash flows correlating to the expected attrition rate of the Mileage Plus database. The other customer relationships, which are

included in "Contracts," are amortized in a manner consistent with the timing and amount of revenues that the Company expects to generate from these customer

relationships. All other definite-lived intangible assets are amortized on a straight-line basis over the estimated lives of the related assets.

93

Source: UNITED AIR LINES INC, 10-K, February 29, 2008