United Airlines 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

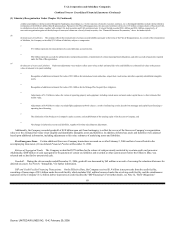

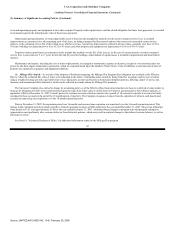

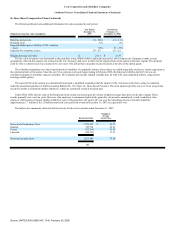

(2) Summary of Significant Accounting Policies (Continued)

to owned operating property and equipment at cost when acquired. Property under capital leases, and the related obligation for future lease payments, is recorded

at an amount equal to the initial present value of those lease payments.

Depreciation and amortization of owned depreciable assets is based on the straight-line method over the assets' estimated service lives. Leasehold

improvements are amortized over the remaining term of the lease, including estimated facility renewal options when renewal is reasonably assured at key

airports, or the estimated service life of the related asset, whichever is less. Aircraft are depreciated to estimated salvage values, generally over lives of 27 to

30 years; buildings are depreciated over lives of 25 to 45 years; and other property and equipment are depreciated over lives of 4 to 15 years.

Properties under capital leases are amortized on the straight-line method over the life of the lease or, in the case of certain aircraft, over their estimated

service lives. Lease terms are 5 to 17 years for aircraft and 40 years for buildings. Amortization of capital leases is included in depreciation and amortization

expense.

Maintenance and repairs, including the cost of minor replacements, are charged to maintenance expense as incurred, except for costs incurred under our

power-by-the-hour engine maintenance agreements, which are expensed based upon the number of hours flown. Costs of additions to and renewals of units of

property are capitalized as property and equipment additions.

(h) Mileage Plus Awards—As a result of the adoption of fresh-start reporting, the Mileage Plus frequent flyer obligation was revalued at the Effective

Date to reflect the estimated fair value of miles to be redeemed in the future. Outstanding miles earned by flying United or its partner carriers were revalued

using a weighted-average per-mile equivalent ticket value, taking into account such factors as historical redemption patterns, differing classes of service and

domestic and international ticket itineraries, which can be reflected in awards chosen by Mileage Plus members.

The Successor Company also elected to change its accounting policy as of the Effective Date from an incremental cost basis to a deferred revenue model, to

measure its obligation for miles to be redeemed based upon the equivalent ticket value of similar fares on United or amounts paid to Star Alliance partners, as

applicable. Effective December 31, 2007, United's policy for customer accounts which are inactive for a period of 18 consecutive months is to cancel all miles

contained in those accounts at the end of the 18 month period of inactivity. The Company recognizes revenue from the expiration of miles in such deactivated

accounts by amortizing such expiration over the 18 month expiration period.

Prior to December 31, 2007, the expiration period was 36 months and revenue from expiration was amortized over the 36 month expiration period. This

change in the expiration period provided a benefit to United's operating revenues of $246 million for the year ended December 31, 2007. The pre-tax diluted per

share benefit to UAL was approximately $1.60 for the year ended December 31, 2007. Additional future changes to program rules and program redemption

opportunities can significantly alter customer behavior from historical patterns, which may result in material changes to the deferred revenue balance, as well as

passenger revenues.

See Note 18, "Advanced Purchase of Miles," for additional information related to the Mileage Plus program.

92

Source: UNITED AIR LINES INC, 10-K, February 29, 2008