United Airlines 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

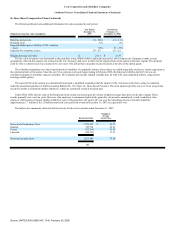

(5) Share-Based Compensation Plans (Continued)

The fair value of restricted shares vested in 2007 was $28 million. The weighted-average grant date price of shares granted in 2006 was $36.78.

Director Equity Incentive Plan ("DEIP"). The Nominating/Governance Committee of the UAL Board of Directors (the "Governance Committee") is

authorized to grant equity-based awards to non-employee directors of the Company under the plan. The DEIP authorizes the Governance Committee to grant any

of a variety of incentive awards to participants, including the following:

•

non-qualified stock options,

•

stock appreciation rights, which provide the participant the right to receive the excess (if any) of the fair market value of a specified number

of shares of common stock at the time of exercise over the grant price of the stock appreciation right,

•

stock awards to be granted at no cost to the participant, including grants in the form of Restricted Stock and Unrestricted Stock,

•

annual compensation in the form of credits to a participant's share account established under the DEIP, and

•

UAL common stock in lieu of receipt of all or any portion of cash amounts payable by UAL to a participant including retainer fees, board

attendance fees and committee fees (but excluding expense reimbursements and similar items).

The shares may be issued from authorized and unissued shares of UAL common stock or from UAL's treasury stock. The exercise price for each underlying

share of UAL common stock under all options and stock appreciation rights awarded under the DEIP will not be less than the fair market value of a share of

common stock on the date of grant. Each instrument granted under the DEIP will generally expire 10 years after its date of grant. The 100,000 unrestricted shares

issued under the DEIP in the eleven month period ended December 31, 2006 immediately vested on their respective grant dates.

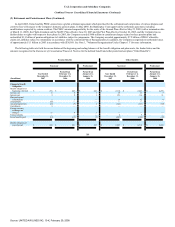

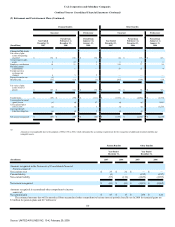

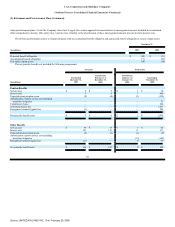

(6) Income Taxes

United and its domestic consolidated subsidiaries, file a consolidated federal income tax return with UAL. Under an intercompany tax allocation policy,

United and its subsidiaries compute, record and pay UAL for their own tax liability as if they were separate companies filing separate returns. In determining

their own tax liabilities, United and each of its subsidiaries take into account all tax credits or benefits generated and utilized as separate companies, and they are

compensated for the aforementioned tax benefits only if they would be able to use those benefits on a separate company basis.

In 2007, the Company's current regular taxable income was completely absorbed by utilization of its net operating loss ("NOL") carry forward; however, it

did incur an alternative minimum tax ("AMT") liability of $6 million, as indicated in the table below. In 2006 and 2005, the Company incurred both a regular tax

loss and an AMT loss.

102

Source: UNITED AIR LINES INC, 10-K, February 29, 2008