United Airlines 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(6) Income Taxes (Continued)

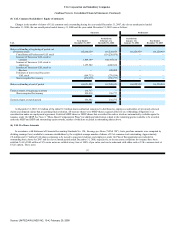

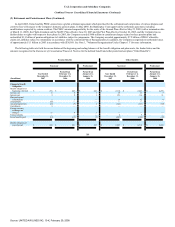

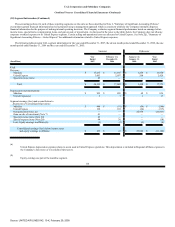

The following is a reconciliation of the beginning and ending amount of unrecognized tax benefits related to uncertain tax positions:

(In millions)

Balance at January 1, 2007 $ 48

Increase in unrecognized tax benefits as a result of tax positions taken during the current period 1

Decrease in unrecognized tax benefits as a result of tax positions taken during a prior period (14)

Decrease in unrecognized tax benefits relating to settlements with taxing authorities —

Reductions to unrecognized tax benefits as a result of a lapse of the statute of limitations —

Balance at December 31, 2007 $ 35

Our income tax returns for tax years after 2002 remain subject to examination by the Internal Revenue Service and state taxing jurisdictions.

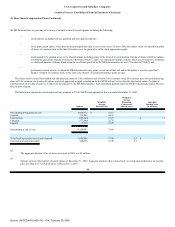

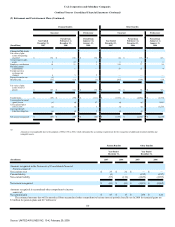

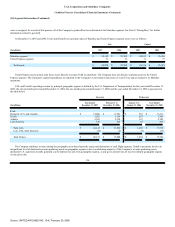

(7) Investments

The Company had investments accounted for using the cost method of accounting of $5 million and $91 million at December 31, 2007 and 2006,

respectively. The Company revalued its investments to their estimated fair values as of the Effective Date in accordance with SOP 90-7. Since that time, there

have been no triggering events that required the Company to evaluate any of these investments for impairment.

In the fourth quarter of 2007, United, along with certain other major air carriers, sold its interests in Aeronautical Radio, Inc. ("ARINC") to Radio

Acquisition Corp., an affiliate of The Carlyle Group. ARINC is a provider of transportation communications and systems engineering. The transaction generated

proceeds of $128 million and resulted in a pre-tax gain of $41 million.

Investments at December 31, 2007 include $91 million of the Company's previously issued EETC debt securities that the Company repurchased in 2007.

These securities remain outstanding and are classified as available-for-sale. An unrealized loss of $5 million to record these securities at fair value has been

recognized in other comprehensive income during 2007. See Note 12, "Debt Obligations," for additional information.

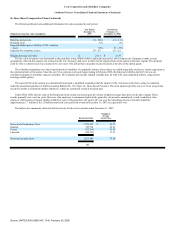

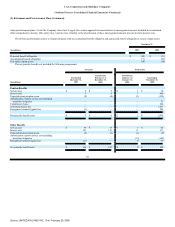

(8) Intangibles

As discussed in Note 10, "Segment Information," in 2006 the Company determined that it has two reporting segments that reflect the management of its

business: Mainline and United Express. See Note 2(l), "Summary of Significant Accounting Policies—Intangibles," for further information related to impairment

testing.

106

Source: UNITED AIR LINES INC, 10-K, February 29, 2008