United Airlines 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

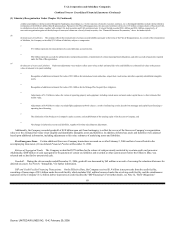

(2) Summary of Significant Accounting Policies (Continued)

In accordance with Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets ("SFAS 142"), the Company applies a fair

value-based impairment test to the net book value of goodwill and indefinite-lived intangible assets on an annual basis as of October 1, or on an interim basis

whenever a triggering event occurs. SFAS 142 requires that a two-step impairment test be performed on goodwill. In the first step, the Company compares the

fair value of each reporting unit to its carrying value. If the fair value of a reporting unit exceeds the carrying value of the net assets of the reporting unit,

goodwill is not impaired and the Company is not required to perform further testing. If the carrying value of the net assets of a reporting unit exceeds the fair

value of the reporting unit, then the Company must perform the second step to determine the implied fair value of the goodwill and compare it to the carrying

value of the goodwill. If the carrying value of goodwill exceeds its implied fair value, then the Company must record an impairment charge equal to such

difference.

The Company assesses the fair value of its reporting units considering both the market and income approaches. Under the market approach, fair value is

based on a comparison of similar publicly traded companies. Under the income approach, fair value is based on the present value of estimated future cash flows.

The income approach is dependent on a number of assumptions including estimates of future capacity, passenger yield, traffic, operating costs including jet fuel

prices, appropriate discount rates and other relevant assumptions.

No impairments of goodwill or indefinite-lived assets have been identified since the Effective Date. See Note 8, "Intangibles" for additional information.

(m) Measurement of Impairments—In accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal

of Long-Lived Assets and SFAS 142, the Company evaluates the carrying value of long-lived assets and intangible assets subject to amortization whenever events

or changes in circumstances indicate that an impairment may exist. An impairment charge is recognized when the asset's carrying value exceeds its net

undiscounted future cash flows and its fair market value. The amount of the charge is the difference between the asset's carrying value and fair market value.

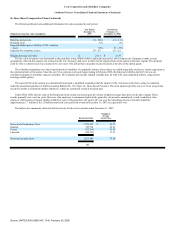

(n) Share-Based Compensation—The Company adopted Statement of Financial Accounting Standards No. 123 (Revised 2004), Share-Based Payment

("SFAS 123R") effective January 1, 2006. This pronouncement requires companies to measure the cost of employee services received in exchange for an award

of equity instruments based on the grant-date fair value of the award. The resulting cost is recognized over the period during which an employee is required to

provide service in exchange for the award, usually the vesting period.

Before the adoption of SFAS 123R, the Company accounted for these plans under Accounting Principles Board Opinion No. 25, Accounting for Stock

Issued to Employees, ("APB 25") and disclosed the pro forma compensation expense as required under Statement of Financial Accounting Standards No. 123,

Accounting for Stock Based Compensation, ("SFAS 123"). No stock-based employee compensation cost for stock options is reflected in the Company's financial

statements for 2005, as all options granted had an exercise price equal to the market value of the underlying common stock on the date of grant. If compensation

cost for stock-based employee compensation plans had been determined using the fair value recognition provisions of SFAS 123, the Company's 2005 net loss

and loss per share would have increased by $4 million and four cents, respectively. See Note 5, "Share-Based Compensation Plans," for additional information.

94

Source: UNITED AIR LINES INC, 10-K, February 29, 2008