United Airlines 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

(1) Voluntary Reorganization Under Chapter 11 (Continued)

through settlement or objections ordered by the Bankruptcy Court. The Company will continue to settle claims and file additional objections with the Bankruptcy

Court.

With respect to unsecured claims, once a claim is deemed to be valid, either through the Bankruptcy Court process or through other means, the claimant is

entitled to a distribution of common stock in Successor UAL. Pursuant to the terms of the Plan of Reorganization, 115 million shares of common stock in

Successor UAL have been authorized to be issued to satisfy valid unsecured claims. The Bankruptcy Court confirmed the Plan of Reorganization and established

January 20, 2006 as the record date for purposes of establishing the persons that are claimholders of record to receive distributions. Approximately 112.2 million

common shares have been issued and distributed to holders of valid unsecured claims between February 2, 2006, the first distribution date established in the Plan

of Reorganization, and December 31, 2007. As of December 31, 2007, approximately 46,000 valid unsecured claims aggregating to approximately $29.2 billion

in claim value had received those common shares to satisfy those claims. There are 2,802,797 remaining shares of UAL common stock held in reserve to satisfy

all of the remaining disputed and undisputed unsecured claim values, once the remaining claim disputes are resolved. The final distributions of shares will not

occur until 2008 or later, pending resolution of bankruptcy matters.

The Company's current estimate of the probable range of unsecured claims to be allowed by the Bankruptcy Court is between $29.3 billion and

$29.6 billion. Differences between claim amounts filed and the Company's estimates continue to be investigated and will be resolved in connection with the

claims resolution process. However, there will be no further financial impact to the Company associated with the settlement of such unsecured claims, as the

holders of all allowed unsecured claims will receive under the Plan of Reorganization no more than their pro rata share of the distribution of the 115 million

shares of common stock of Successor UAL, together with the previously-agreed issuance of certain securities.

With respect to valid administrative and priority claims, pursuant to the terms of the Plan of Reorganization these claims will be satisfied with cash. Many

asserted administrative and priority claims still remain unpaid, and the Company will continue to settle claims and file objections with the Bankruptcy Court to

eliminate or reduce such claims. In addition, certain disputes, the most significant of which are discussed in "Significant Matters Remaining to be Resolved in

Chapter 11 Cases," above, still remain with respect to the valuation of certain claims. The Company accrued an obligation for claims it believed were reasonably

estimable and probable at the Effective Date. However, the claims resolution process is uncertain and adjustments to claims estimates could result in material

adjustments to the Successor Company's financial statements in future periods as a result of court rulings, the receipt of new or revised information or the

finalization of these matters.

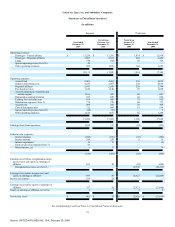

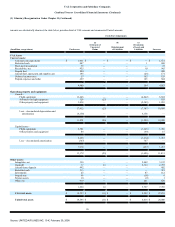

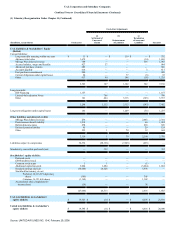

The table below includes activity related to the administrative and priority claims and other bankruptcy-related claim reserves including reserves related to

legal, professional and tax matters, among others, for the Successor Company for the twelve and eleven months ended December 31, 2007 and 2006,

respectively. These reserves are primarily classified in other current liabilities in the Statements of Consolidated Financial Position. Certain of the accrual

adjustments identified below are a direct result of the Company's ongoing efforts to resolve certain bankruptcy pre-confirmation

81

Source: UNITED AIR LINES INC, 10-K, February 29, 2008