United Airlines 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

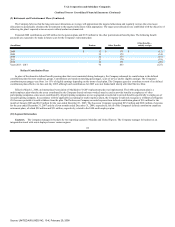

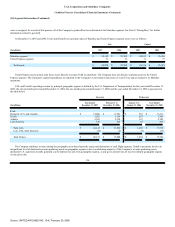

(8) Intangibles (Continued)

United States and London Heathrow, thereby potentially adding new competition to United's Heathrow operation, although Heathrow is currently subject to both

slot and facility constraints which may practically limit the extent of new competition in the near term. This agreement does not provide for a reallocation of

existing slots among carriers.

At December 31, 2007 and 2006, United recorded an indefinite-lived intangible asset of $255 million for its London Heathrow slots, based upon its

estimation of the fair value for those slots as of the adoption of fresh-start reporting on February 1, 2006. United, however, determined at fresh-start that its rights

relating to its actual route authorities to Heathrow had a fair value of zero. The EU/U.S. open skies agreement is expected to directly impact the future value and

expected lives of route authorities to Heathrow; however, there is no direct impact from the open skies agreement on airport slot rights, including those at

Heathrow. The open skies agreement is also expected to provide United an opportunity to secure antitrust immunity for certain of its Star Alliance carrier

relationships, and to provide United and other carriers with access to new markets in EU countries. In September 2007, the DOT granted United and bmi antitrust

immunity. The immunity goes into effect at the same time as the open skies agreement between the U.S. and the EU in March of 2008. Because of the diverse

nature of these potential impacts on United's business, the overall future impact of the EU agreement on United's business in the EU region cannot be predicted

with certainty. United has concluded that, in certain circumstances, the open skies agreement could indirectly and adversely affect the fair value of its slot rights

at Heathrow, and therefore has further concluded that the signing of the open skies agreement on April 30, 2007, constituted an indicator of impairment with

respect to United's Heathrow slots intangible asset.

United performed annual impairment reviews of goodwill and indefinite lived intangible assets as of October 1, 2007 and 2006 and determined that no

impairment was indicated. In addition, a 2007 interim impairment review was performed for the Heathrow slots intangible asset, and the Company concluded

that no impairment was then indicated and that no change was then required to the fresh-start assignment of an indefinite life to the Heathrow slots.

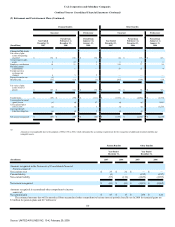

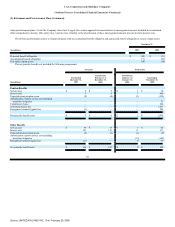

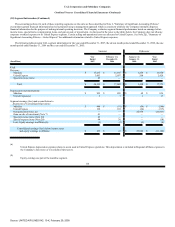

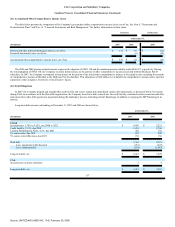

(9) Retirement and Postretirement Plans

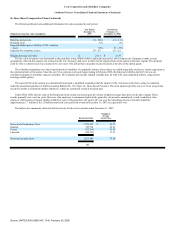

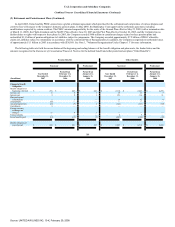

The Company maintains various retirement plans, both defined benefit (qualified and non-qualified) and defined contribution, which cover substantially all

employees. As discussed below, most of the Company's defined benefit plans were terminated and replaced with defined contribution plans as part of the

bankruptcy reorganization. The Company also provides certain health care benefits, primarily in the U.S., to retirees and eligible dependents, as well as certain

life insurance benefits to certain retirees reflected as "Other Benefits" in the tables below. The Company has reserved the right, subject to collective bargaining

agreements, to modify or terminate the health care and life insurance benefits for both current and future retirees.

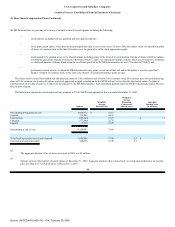

Upon emergence from bankruptcy on February 1, 2006, the Company completed a revaluation of the postretirement liabilities resulting in a reduction of the

net accumulated benefit obligation of approximately $28 million. In accordance with SOP 90-7 upon emergence, the Company also accelerated the recognition of

net unrecognized actuarial gains and losses, prior service costs and transition obligation pertaining to its foreign pension plans and postretirement plans, and

recorded a reorganization expense thereon. The unrecognized costs as of January 31, 2006 that were recognized as part of fresh-start reporting are reported in the

table below.

108

Source: UNITED AIR LINES INC, 10-K, February 29, 2008