United Airlines 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UAL Corporation and Subsidiary Companies

Combined Notes to Consolidated Financial Statements (Continued)

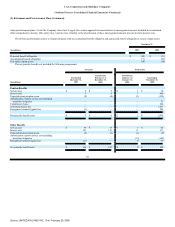

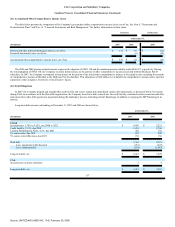

(12) Debt Obligations (Continued)

election not to extend its lease. The outstanding bonds and related guarantee are not recorded in the Company's Statements of Consolidated Financial Position at

December 31, 2006 and 2007. See Note 15, "Commitments, Contingent Liabilities and Uncertainties" for additional information related to these bonds.

EETC Repurchases. In addition, the Company purchased certain of its previously issued and outstanding EETC securities in open market transactions

during 2007. The Company purchased EETC securities, including accrued interest, for $96 million and adjusted these securities to a fair value of $91 million at

December 31, 2007. These EETC securities were issued by third-party pass-through trusts that are not consolidated by the Company. The pass-through trusts'

only investments are equipment notes issued by United. The acquisition of the EETC securities does not legally extinguish the corresponding equipment notes;

therefore, the certificates are classified as a non-current investment.

Interest Rate Swap. In January 2007, the Company terminated the interest rate swap that had been used to hedge the future interest payments under the

original credit facility debt. For further details, see Note 14, "Financial Instruments and Risk Management—Interest Rate Swap."

6% senior notes. In accordance with the provisions of the 6% senior notes issued in 2006 (see discussion below), UAL elected to pay interest in kind for

one semi-annual interest payment in 2007. Accordingly, the notes have increased by $15 million reflecting this in kind interest payment.

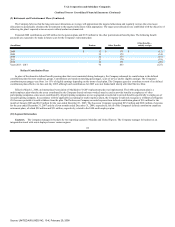

2006 Debt Transactions

Credit Facility. On the Effective Date, United obtained a credit facility that provided for a total commitment of up to $3.0 billion that comprised two

separate tranches: (i) Tranche A consisted of up to $200 million revolving commitment available for Tranche A loans and for standby letters of credit to be

issued in the ordinary course of business of United or one of its subsidiary guarantors; and (ii) Tranche B consisted of a term loan commitment of up to

$2.45 billion available at the time of closing and additional delayed draw term loan commitments of up to $350 million available upon, among other things,

United's acquiring unencumbered title to some or all of the 14 airframes and related engines that were subject to United's 1997-1 EETC financing. The credit

facility would have matured on February 1, 2012 but was amended in February 2007, as explained above.

Borrowings under the credit facility were at a floating interest rate based on either a base rate, or at our option, a LIBOR rate, plus an applicable margin of

2.75% in the case of the base rate loans and 3.75% in the case of the LIBOR loans. The Tranche B term loan required regularly scheduled semi-annual payments

of principal equal to 0.5% of the original principal amount of the Tranche B term loan. Interest was payable on the last day of the applicable interest period but in

no event less than quarterly.

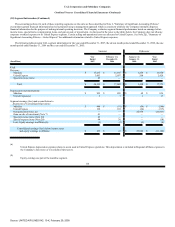

United's obligations under the credit facility were unconditionally guaranteed by UAL and certain of the direct and indirect domestic subsidiaries of the

Company, other than certain immaterial subsidiaries (the "Original Guarantors"), and were secured by a security interest in substantially all of the tangible and

intangible assets of the Original Guarantors. The obligations under the credit facility were also secured by a pledge of the capital stock of United and the direct

and indirect subsidiaries of UAL Corporation and United, except that a pledge of any first-tier foreign subsidiary was limited to

121

Source: UNITED AIR LINES INC, 10-K, February 29, 2008