United Airlines 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

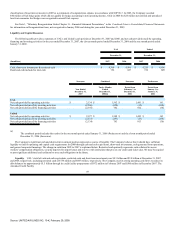

post-reorganization operations. Subsequently, the Company repaid borrowings under the revolving credit line and accessed the remaining $350 million on the

delayed draw term loan. At December 31, 2006, the Company had a total of $2.8 billion of debt and $63 million in letters of credit outstanding under this credit

facility.

During 2006, the Company secured control of 14 aircraft that were included in the 1997-1 EETC transaction by remitting $281 million to the 1997-1 EETC

trustee on behalf of the holders of the Tranche A certificates. The Company subsequently refinanced the 14 aircraft on March 28, 2006 with the $350 million

delayed draw term loan provided under the credit facility. The 14 aircraft are comprised of four B737 aircraft, two B747 aircraft, four B777 aircraft and four

A320 aircraft.

Significant 2006 non-cash financing and investment activities included the conversion of six B757 aircraft and one B747 aircraft from leased to owned

status resulting in additional aircraft assets and debt obligations of $242 million. In addition, in the first quarter of 2006 the Successor Company completed a

transaction that converted certain mortgaged aircraft to capital leases for $155 million. See Note 17, "Statement of Consolidated Cash Flows—Supplemental

Disclosures," in the Combined Notes to Consolidated Financial Statements.

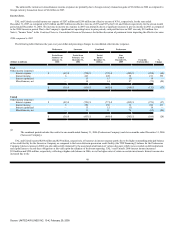

Capital Commitments and Off-Balance Sheet Arrangements. The Company's business is very capital intensive, requiring significant amounts of capital

to fund the acquisition of assets, particularly aircraft. In the past, the Company has funded the acquisition of aircraft through outright purchase, by issuing debt,

by entering into capital or operating leases, or through vendor financings. The Company also often enters into long-term lease commitments with airports to

ensure access to terminal, cargo, maintenance and other required facilities.

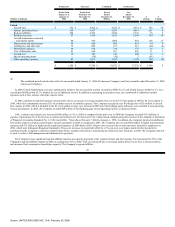

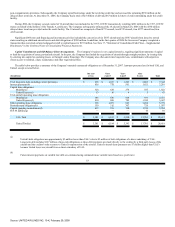

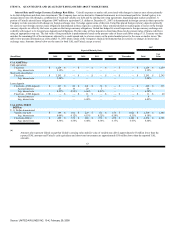

The table below provides a summary of the Company's material contractual obligations as of December 31, 2007. Amounts presented are for both UAL and

United, except as noted below.

(In millions)

One year

or less

Years

2 and 3

Years

4 and 5

After

5 years

Total

UAL long-term debt, including current portion(a) $ 678 $ 1,655 $ 1,209 $ 3,802 $ 7,344

Interest payments(b) 456 778 561 1,421 3,216

Capital lease obligations

Mainline(c) 328 629 278 587 1,822

United Express(c) 13 16 9 5 43

UAL aircraft operating lease obligations

Mainline(a) 346 630 604 936 2,516

United Express(d) 410 868 789 1,380 3,447

Other operating lease obligations 558 1,051 883 3,284 5,776

Postretirement obligations(e) 159 315 307 726 1,507

Capital spending commitments(f) 433 251 700 1,550 2,934

FIN 48 liability(g) — — — 10 10

UAL Total $ 3,381 $ 6,193 $ 5,340 $ 13,701 $ 28,615

United Total(a) $ 3,381 $ 6,194 $ 5,343 $ 13,701 $ 28,619

(a)

United's debt obligations are approximately $3 million lower than UAL 's due to $3 million of debt obligations of a direct subsidiary of UAL.

Long-term debt includes $127 million of non-cash obligations as these debt payments are made directly to the creditor by a third party lessee of the

aircraft and the creditor's only recourse to United is repossession of the aircraft. United's aircraft lease payments are $7 million higher than UAL's

because United leases one aircraft from a direct subsidiary of UAL.

(b)

Future interest payments on variable rate debt are estimated using estimated future variable rates based on a yield curve.

53

Source: UNITED AIR LINES INC, 10-K, February 29, 2008