United Airlines 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

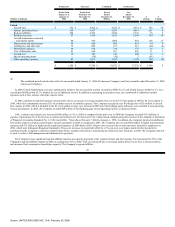

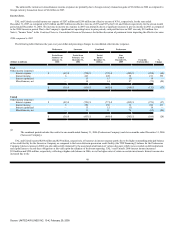

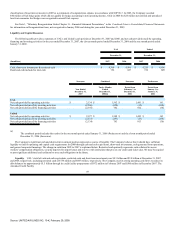

consists of an initial $1.8 billion term loan in February 2007, which was paid down to $1.3 billion at December 31, 2007, and a $255 million revolving

commitment of which $153 million was available at December 31, 2007.

Certain terms of the credit facility were amended in February 2007 thereby creating the Amended Credit Facility. A further amendment in December 2007

authorizes certain shareholder initiatives. This enabled UAL to pay a $2.15 per common share special distribution of approximately $257 million on January 23,

2008. At the Company's option, interest payments on the Amended Credit Facility are based on either a base rate, as defined in the Amended Credit Facility, or at

LIBOR plus 2%. This applicable margin on LIBOR rate loans is a significant reduction of 1.75% from the terms of the credit facility. The February 2007

amendment released a significant amount of assets that had been pledged as collateral under the credit facility. See the "Capital Commitments and Off-Balance

Sheet Arrangements" section, below, for information related to scheduled maturities on the credit facility.

In January 2007, the Company decided to terminate the interest rate swap that had been used to hedge the future interest payments under the original credit

facility term loan of $2.45 billion.

Restricted cash primarily represents cash collateral to secure workers' compensation obligations, security deposits for airport leases and reserves with

institutions that process United's credit card ticket sales. Certain of the credit card processing arrangements are based on the aggregate then-outstanding bank

card air traffic liability, the Company's credit rating and its compliance with certain debt covenants. Credit rating downgrades or debt covenant noncompliance

could materially increase the Company's reserve requirements.

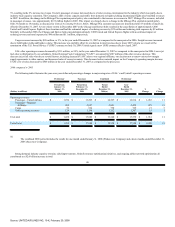

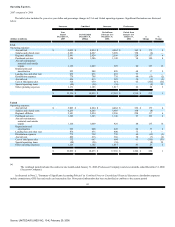

Cash Flows from Operating Activities.

2007 compared to 2006

The Company's cash from operations improved by more than $500 million year-over-year. The Company's improvement in net income excluding

reorganization items, which are primarily non-cash, was a significant factor contributing to the increase in operating cash flows. Operating cash flows for 2007

also include the favorable impact of an increase in non-cash income tax expense of nearly $300 million as compared to 2006. Cash from operations improved due

to the Company's improved performance in 2007, as discussed above in the "Results of Operations" section, above. In addition, cash from operations improved

due to a reduction of $124 million in cash interest payments in 2007 as compared to 2006 as a result of the financing activities completed in 2007 to reduce debt

and interest rates. The improvement in cash generated from operations that was due to better operating performance was further enhanced by a decrease in

operating cash used for working capital. In 2007, the Company contributed approximately $236 million and $14 million to its defined contribution plans and

non-U.S. pension plans, respectively, as compared to contributions of $270 million in 2006 for these plans.

2006 compared to 2005

The Company generated cash from operations of $1.6 billion in 2006 compared to $1.1 billion in 2005. The higher operating cash flow generated in 2006

was due to improved results of operations as discussed above in the "Results of Operation" section, together with differences in the timing and amount of

working capital items, and other smaller changes. As discussed in the "Results of Operations" section, above, the Company's 2006 net income includes

significant non-cash items.

The Company does not have any significant defined benefit pension plan contribution requirements as most of the Company-sponsored plans were replaced

with defined contribution plans upon its emergence from bankruptcy. The Company contributed approximately $259 million and

50

Source: UNITED AIR LINES INC, 10-K, February 29, 2008