United Airlines 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company anticipates that if ultimately found liable, its damages from claims arising from the events of September 11, 2001, could be significant;

however, the Company believes that, under the Air Transportation Safety and System Stabilization Act of 2001, its liability will be limited to its insurance

coverage.

The Company is also currently analyzing whether any potential liability may result from air cargo/passenger surcharge cartel investigations following the

receipt of a Statement of Objections that the European Commission (the "Commission") issued to 26 carriers on December 18, 2007. The Statement of

Objections sets out evidence related to the utilization of fuel and security surcharges and exchange of pricing information that the Commission views as

supporting the conclusion that an illegal price-fixing cartel had been in operation in the air cargo transportation industry. United received a copy of the Statement

of Objections and is currently evaluating the Commission's evidence related to the Company and its personnel. United is cooperating with the Commission's

investigation. United intends to defend itself vigorously against these charges in its formal response to the Commission and in the European Court of Justice if

necessary. The Company's evaluation of this matter is still in the early stages, and based upon the information currently available no reserve for potential liability

has been recorded as of December 31, 2007. However, penalties for violation of European competition laws can be substantial and a finding that the Company

engaged in improper activity could have a material adverse impact on our consolidated financial position and results of operations.

Many aspects of United's operations are subject to increasingly stringent federal, state and local laws protecting the environment. Future regulatory

developments in the U.S. and abroad could adversely affect operations and increase operating costs in the airline industry. For example, potential future actions

that may be taken by the U.S. government, state governments within the U.S., foreign governments, or the International Civil Aviation Organization to limit the

emission of greenhouse gases by the aviation industry are uncertain at this time, but the impact to the Company and its industry would likely be adverse and

could be significant, including the potential for increased fuel costs, carbon taxes or fees, or a requirement to purchase carbon credits.

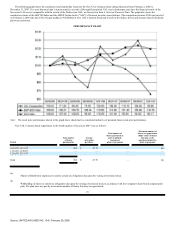

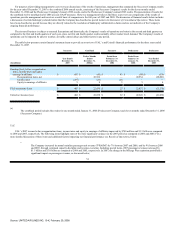

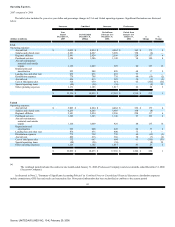

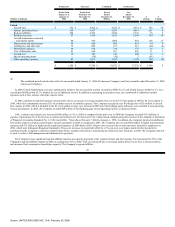

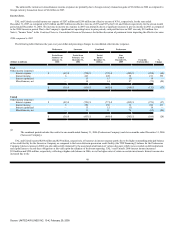

Results of Operations

As described in the "Overview" section above, presentation of the combined twelve month period of 2006 is a non-GAAP measure; however, management

believes it is useful for comparison with the full years of 2007 and 2005. United's operating revenues and operating expenses comprise nearly 100% of UAL 's

revenues and operating expenses. Therefore, the following qualitative discussion is applicable to both UAL and United, unless otherwise noted. Any significant

differences between UAL and United results are separately disclosed and explained.

UAL 's earnings from operations of $1.0 billion in 2007 improved by $590 million as compared to earnings from operations of $447 million in 2006. The

significant increase in operating earnings was due to increased revenues, cost control and special items as discussed below. UAL 's net income was $403 million

in 2007 as compared to $22.9 billion in 2006. The most significant variance is reorganization income of $22.9 billion that was recorded in the 2006 period.

Lower interest expense due to debt reductions and refinancings and a gain on the sale of an investment, as discussed below, also benefited 2007 net income as

compared to 2006.

United's improvement in earnings from operations of $573 million was consistent with UAL 's results. United's net income was $402 million in 2007 as

compared to net income of $22.7 billion in 2006, with the difference in net income primarily due to reorganization income that was recorded in the 2006 period.

See Note 1, "Voluntary Reorganization Under Chapter 11—Financial Statement Presentation" in Combined Notes to Consolidated Financial Statements for

further information on reorganization items.

38

Source: UNITED AIR LINES INC, 10-K, February 29, 2008