United Airlines 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QuickLinks -- Click here to rapidly navigate through this document

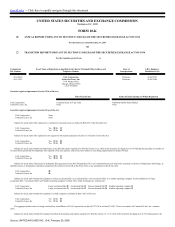

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission

File Number

Exact Name of Registrant as Specified in its Charter, Principal Office Address and

Telephone Number

State of

Incorporation

I.R.S. Employer

Identification No

001-06033

001-11355

UAL Corporation

United Air Lines, Inc.

77 W. Wacker Drive

Chicago, Illinois 60601

(312) 997-8000

Delaware

Delaware

36-2675207

36-2675206

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Name of Each Exchange on Which Registered

UAL Corporation Common Stock, $.01 par value NASDAQ Global Select Market

United Air Lines, Inc. None None

Securities registered pursuant to Section 12 (g) of the Act:

UAL Corporation None

United Air Lines, Inc. None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

UAL Corporation Yes No

United Air Lines, Inc. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

UAL Corporation Yes No

United Air Lines, Inc. Yes No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

UAL Corporation Yes No

United Air Lines, Inc. Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

UAL Corporation

United Air Lines, Inc.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large

accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

UAL Corporation Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

United Air Lines, Inc. Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

UAL Corporation Yes No

United Air Lines, Inc. Yes No

The aggregate market value of voting stock held by non-affiliates of UAL Corporation was $4,646,737,396 as of June 29, 2007. There is no market for United Air Lines, Inc. common

stock.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the

Source: UNITED AIR LINES INC, 10-K, February 29, 2008

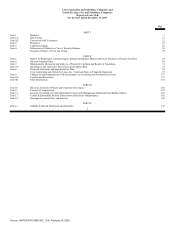

Table of contents

-

Page 1

... stock held by non-affiliates of UAL Corporation was $4,646,737,396 as of June 29, 2007. There is no market for United Air Lines, Inc. common stock. Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities... -

Page 2

... of securities under a plan confirmed by a court. UAL Corporation United Air Lines, Inc. Yes � No � Yes � No � Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of February 22, 2008. UAL Corporation United Air Lines, Inc. 118,994,379 shares of... -

Page 3

...Corporation and United Air Lines, Inc. Combined Notes to Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security... -

Page 4

..., with a total fleet of 279 aircraft operated by regional airline partners, including over 100 aircraft that offer explus, United's premium regional service, redefining the regional jet experience. Explus aircraft offer both first class and Economy Plus seating. • • • • The Company also... -

Page 5

... program and its broad global airline network. During 2007, UAL's management and its Board of Directors completed a strategic planning session to discuss the future of United. The Company has developed a five-year plan, the ambition of which is to position United as the airline of choice for premium... -

Page 6

...90 destinations primarily throughout the U.S. and Canada and operated hubs at Chicago O'Hare International Airport ("O'Hare"), Denver International Airport, Los Angeles International Airport ("LAX"), San Francisco International Airport ("SFO") and Washington Dulles International Airport ("Washington... -

Page 7

...fees, and frequent flyer costs. Unlike capacity purchase agreements, these prorate agreements require the regional carrier to retain the control and risk of scheduling, market selection, seat pricing and inventory for its flights. United Express carriers operated 279 aircraft as of December 31, 2007... -

Page 8

... and mail revenue, a 3% increase versus 2006. United Services. United Services is a global airline support business offering customers comprehensive aircraft maintenance, repair and overhaul ("MRO") services which include engine maintenance, maintenance of high-tech components, line maintenance and... -

Page 9

... Plus members can earn mileage credit for flights on United, United Express, Ted, members of the Star Alliance, and certain other airlines that participate in the program. Miles also can be earned by purchasing the goods and services of our non-airline partners, such as hotels, car rental companies... -

Page 10

... carrying passengers to points beyond designated international gateway cities due to limitations in air service agreements or restrictions imposed unilaterally by foreign governments. To compensate for these structural limitations, U.S. and foreign carriers have entered into alliances and marketing... -

Page 11

... traffic airport" and has limited the number of departure and arrival slots at the airport. Slot restrictions at O'Hare were eliminated in July 2002 and were eliminated at John F. Kennedy International Airport ("JFK") and LaGuardia Airport ("LaGuardia"), both in New York, in January 2007. From time... -

Page 12

...impose a new funding structure and make other changes to FAA operations. Past aviation reauthorization bills have affected a wide range of areas of interest to the industry, including air traffic control operations, capacity control issues, airline competition issues, aircraft and airport technology... -

Page 13

... of "open skies" (meaning all carriers have access to the destination), under which the U.S. government has negotiated a number of bilateral agreements allowing unrestricted access to foreign markets. Additionally, all of the airports that United serves in Europe and Asia maintain slot controls, and... -

Page 14

... on airport slot rights, including those at Heathrow. The open skies agreement is also expected to provide United and other carriers with access to new markets in EU countries. In September 2007, the DOT granted United antitrust immunity with bmi. The immunity goes into effect at the same time as... -

Page 15

... of United's collective bargaining groups were as follows: Employee Group Number of Employees Union(1) Contract Open for Amendment Public Contact/Ramp & Stores/Food Service Employees/Security Officers/Maintenance Instructors/Fleet Technical Instructors Flight Attendants Pilots Mechanics & Related... -

Page 16

... the future. In addition, fare increases may not totally offset the fuel price increase and may also reduce demand for air travel. From time to time, the Company enters into hedging arrangements to protect against rising fuel costs. The Company's hedging programs may not be successful in controlling... -

Page 17

...might limit the number of flights and/or increase costs of operations at certain times or throughout the day. In addition, the Company's operations may be adversely impacted due to the existing outdated air traffic control ("ATC") system utilized by the U.S. government. During peak travel periods in... -

Page 18

... to time, or because appropriate slots or facilities may not be made available. United currently operates on a number of international routes under government arrangements that limit the number of carriers, capacity, or the number of carriers allowed access to particular airports. If an open skies... -

Page 19

... value of its MRO and Mileage Plus businesses, which may include a possible sale of all, or part of, these operations. A number of the Company's ongoing initiatives involve significant changes to the Company's business that it may be unable to implement successfully. In addition, revenue and other... -

Page 20

... available assets as collateral to secure its various fixed obligations. At December 31, 2007, the Company has 113 unencumbered aircraft with a net book value of $2.0 billion. The Company's high level of fixed obligations, a downgrade in the Company's credit ratings or poor credit market conditions... -

Page 21

... stock issued and outstanding plus the number of shares of common stock still held in reserve for payment to unsecured creditors under the Plan of Reorganization. For additional information regarding the 5% Ownership Limitation, please refer to UAL's restated certificate available on its website... -

Page 22

..., below, for additional information regarding other risks related to our common stock. Risks Related to UAL's Common Stock UAL's common stock has a limited trading history and its market price may be volatile. Because UAL's common stock began trading on the NASDAQ National Market on February 2, 2006... -

Page 23

... securities outstanding. This restriction is applied pro rata among all holders of equity securities who fail to qualify as "citizens of the United States," based on the number of votes the underlying securities are entitled to. ITEM 1B. None. 22 UNRESOLVED STAFF COMMENTS. Source: UNITED AIR LINES... -

Page 24

... 2018, LAX in 2021 and Denver in 2025. The Company owns a 66.5-acre complex in suburban Chicago consisting of more than 1 million square feet of office space for its Operations Center, a computer operations facility and a training center. United also owns a flight training center, located in Denver... -

Page 25

...the larger cities within the United system. As part of the Company's restructuring and cost containment efforts, United closed, terminated or rejected all of its former domestic city ticket office leases. United continues to lease and operate a number of administrative, reservations, sales and other... -

Page 26

... commenced an international investigation into what government officials describe as a possible price fixing conspiracy relating to certain surcharges included in tariffs for carrying air cargo. In June 2006, United received a subpoena from the DOJ requesting information related to certain passenger... -

Page 27

... deceased victims received awards from the September 11 th Victims Compensation Fund of 2001, which was established by the federal government, and consequently are now barred from making further claims against the airlines. World Trade Center Properties, Inc., as lessee, has filed claims against the... -

Page 28

... served as Senior Vice President of Onboard Services for United. Before joining United, Ms. Allen served as the head of American Airlines' Flight Services (air transportation) from 1997 to 2003. Graham W. Atkinson. Age 56. Mr. Atkinson has been Executive Vice President-Chief Customer Officer for UAL... -

Page 29

... terms of the Plan of Reorganization and UAL has no continuing obligations for this stock. Beginning February 2, 2006, the New UAL Common Stock has traded on a NASDAQ market under the symbol UAUA. The following table sets forth the ranges of high and low sales prices per share of the New UAL Common... -

Page 30

...be considered indicative of potential future stock price performance. New UAL Common Stock repurchases in the fourth quarter of fiscal year 2007 were as follows: Total number of shares purchased as part of publicly announced plans or programs Maximum number of shares (or approximate dollar value) of... -

Page 31

... (loss) per share Cash distribution declared per common share(b) United Operating revenues Operating expenses Fuel expenses-Mainline Reorganization (income) expense Net income (loss)(a) Balance Sheet Data at period-end: UAL Total assets Long-term debt and capital lease obligations, including current... -

Page 32

... services to its customers, reduce unit costs, and increase unit revenues. Some of the Company's more significant recent developments include the following: • In 2007, UAL 's management and its Board of Directors completed a strategic planning session to discuss the future of United. The Company... -

Page 33

... Alliance will not be charged to check a second bag. United estimates that this and other changes to its baggage policy will generate more than $100 million annually in cost savings and new revenue. The Company's employees earned approximately $170 million in cash payments related to 2007 business... -

Page 34

... daily service between LAX and Frankfurt, Germany in December 2007. The Company has announced new daily service from Denver to London Heathrow commencing in March 2008. The Company received DOT approval to become the first U.S. carrier to operate daily non-stop service from SFO to Guangzhou, China... -

Page 35

... execution. Including special items, 2007 passenger revenues increased by $1.1 billion and $3.0 billion as compared to 2006 and 2005, respectively. In 2007, the change in the Mileage Plus expiration period had a significant impact on passenger revenues, as discussed below. 34 Source: UNITED AIR... -

Page 36

... non-cash fresh-start reporting impacts effective February 1, 2006 that affect the comparison of 2006 to 2005. • As part of fresh-start reporting the Company changed its accounting for Mileage Plus from the incremental cost model to the deferred revenue model. This change in accounting negatively... -

Page 37

... million greater than United's loss due to a $131 million larger bankruptcy-related impairment charge on lease certificates. Liquidity. As of December 31, 2007, UAL had total cash, including restricted cash and short-term investments, of $4.3 billion. The Company's strong cash position resulted from... -

Page 38

... 2007 and December 2007 amendments. Total debt consisting of on-balance sheet debt, the Denver municipal bonds, estimated off-balance sheet debt related to operating leases and open market debt repurchases decreased by $2.3 billion. The Company has significant noncancelable contractual cash payment... -

Page 39

... 26 carriers on December 18, 2007. The Statement of Objections sets out evidence related to the utilization of fuel and security surcharges and exchange of pricing information that the Commission views as supporting the conclusion that an illegal price-fixing cartel had been in operation in the air... -

Page 40

... to January 31, 2006 (Dollars in millions) Year Ended December 31, 2007 $ Change % Change Operating revenues: Passenger-United Airlines Passenger-Regional Affiliates Cargo Special operating items Other operating revenues UAL total United total $ 15,254 $ 3,063 770 45 1,011 14,367 $ 2,901 750... -

Page 41

... Policies, below. Mileage Plus customer accounts are deactivated after 18 months of inactivity, effective December 31, 2007. Severe winter storms in December 2007 at the Chicago and Denver hubs resulted in the cancellation of approximately 6,400 United and United Express flights at these locations... -

Page 42

... accounting for its frequent flyer obligation to a deferred revenue model upon its emergence from bankruptcy which negatively impacted revenues by $158 million. This resulted in increased deferred revenue due to a net increase in miles earned by Mileage Plus customers that will be redeemed in future... -

Page 43

... $ United Operating expenses: Aircraft fuel Salaries and related costs Regional affiliates Purchased services Aircraft maintenance materials and outside repairs Depreciation and amortization Landing fees and other rent Distribution expenses Aircraft rent Cost of third party sales Special operating... -

Page 44

... to an increase in non-capitalizable information technology related expenditures, generally occurring during the planning and scoping phases, for new applications in 2007. In addition, airport operations handling and security costs increased due to the new USPS contract and new international routes... -

Page 45

.... In the eleven months ended December 31, 2006, special items of $36 million included a $12 million benefit to adjust the Company's recorded obligation for the SFO and LAX municipal bonds and a $24 million benefit related to pre-confirmation pension matters. The 2007 and 2006 special items... -

Page 46

... Change % Change United Aircraft fuel Salaries and related costs Regional affiliates Purchased services Aircraft maintenance materials and outside repairs Depreciation and amortization Landing fees and other rent Distribution expenses Cost of third party sales Aircraft rent Special operating items... -

Page 47

... in credit card fees due to higher passenger revenues. UAL 's and United's other operating expenses decreased $104 million and $96 million in 2006, as compared to 2005, respectively. The adoption of fresh-start reporting, which included the revaluation of the Company's frequent flyer obligation to... -

Page 48

... the February and December 2007 amendments and prepayments of the credit facility, which lowered United's interest rate on these obligations and reduced the total obligations outstanding by approximately $1.5 billion. Repayments of scheduled maturities of debt obligations and other debt refinancings... -

Page 49

...January 31, 2006 (Predecessor Company) and eleven months ended December 31, 2006 (Successor Company). UAL and United incurred $288 million and $279 million, respectively, of increases in interest expense partly due to the higher outstanding principal balance of the credit facility for the Successor... -

Page 50

... general corporate financings. The change in cash from 2005 to 2007 is explained below. Restricted cash primarily represents cash collateral to secure workers' compensation obligations, security deposits for airport leases and reserves with institutions that process our credit card ticket sales. We... -

Page 51

...to secure workers' compensation obligations, security deposits for airport leases and reserves with institutions that process United's credit card ticket sales. Certain of the credit card processing arrangements are based on the aggregate then-outstanding bank card air traffic liability, the Company... -

Page 52

... been financed by United through operating leases which were terminated at closing. The total purchase price for these aircraft was largely financed with certain proceeds from the secured EETC financing described below. These transactions did not result in any change in the Company's fleet count of... -

Page 53

... credit facility obligations, refinance certain aircraft as discussed below and to make other debt and capital lease payments. In 2007, the Company completed financing transactions totaling approximately $964 million which included the $694 million EETC secured financing and the $270 million Denver... -

Page 54

...aircraft. United's aircraft lease payments are $7 million higher than UAL's because United leases one aircraft from a direct subsidiary of UAL. Future interest payments on variable rate debt are estimated using estimated future variable rates based on a yield curve. 53 (b) Source: UNITED AIR LINES... -

Page 55

... includes non-aircraft capital lease payments of $5 million in each of the years 2008 through 2011. United Express payments are all for aircraft. United has lease deposits of $516 million in separate accounts to meet certain of its future capital lease obligations. Amounts represent lease payments... -

Page 56

... upon the Company's exit from bankruptcy. These credit ratings are below investment grade levels. Downgrades from these rating levels could restrict the availability and/or increase the cost of future financing for the Company. Other Information Foreign Operations. The Company's Statements of... -

Page 57

... on United flights on an incremental cost basis as an accrued liability and as advertising expense, while miles sold to non-airline business partners were accounted for on a deferred revenue basis. As of the Effective Date, the deferred revenue value of all frequent flyer miles are measured using... -

Page 58

participating carriers in the Mileage Plus program, and by estimating the relative proportions of awards to be redeemed by class of service within broad geographic regions of the Company's operations, including North America, Atlantic, Pacific and Latin America. Under the new method of accounting ... -

Page 59

.... At December 31, 2007, a hypothetical 1% change in the Company's outstanding number of miles or the weighted-average ticket value has approximately a $43 million effect on the liability. Accounting for Long-Lived Assets. UAL's and United's net book value of operating property and equipment was... -

Page 60

... for certain of its Star Alliance carrier relationships, and to provide United and other carriers with access to new markets in EU countries. In September 2007, the DOT granted United and bmi antitrust immunity. The immunity goes into effect at the same time as the open skies agreement between the... -

Page 61

... for measuring future payment obligations and the expected return on plan assets. The discount rates were based on the construction of theoretical bond portfolios, adjusted according to the timing of expected cash flows for the Company's future postretirement obligations. A yield curve was developed... -

Page 62

...based upon information available to the Company on the date of this report. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. 61 Source: UNITED AIR LINES INC, 10... -

Page 63

...ability of other air carriers with whom the Company has alliances or partnerships to provide the services contemplated by the respective arrangements with such carriers; the costs and availability of aircraft insurance; the costs associated with security measures and practices; labor costs; industry... -

Page 64

... portfolio. United's policy is to manage interest rate risk through a combination of fixed and variable rate debt and by entering into swap agreements, depending upon market conditions. A portion of United's aircraft lease obligations ($497 million in equivalent U.S. dollars at December 31, 2007) is... -

Page 65

... restricted accounts for workers' compensation obligations, security deposits for airport leases and reserves with institutions that process United's credit card ticket sales. Due to the short term nature of these cash balances, the carrying values approximate the fair values. The Company's interest... -

Page 66

...PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of UAL Corporation Chicago, Illinois We have audited the accompanying statements of consolidated financial position of UAL Corporation and subsidiaries (the "Company") as of December 31, 2007 and 2006 (Successor Company balance sheets... -

Page 67

... the disclosures regarding pension and postretirement benefits. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of the Company's internal control over financial reporting as of December 31, 2007, based on the... -

Page 68

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholder of United Air Lines, Inc. Chicago, Illinois We have audited the accompanying statements of consolidated financial position of United Air Lines, Inc. and subsidiaries (the "Company") as of December 31, 2007 and 2006 (Successor Company... -

Page 69

..., 2006, the Company adopted the recognition and related disclosure provisions of Statement of Financial Accounting Standards No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans-an amendment of FASB Statements No. 87, 88, 106, and 132R," which changed the method... -

Page 70

...4 Operating expenses: Aircraft fuel Salaries and related costs Regional affiliates Purchased services Aircraft maintenance materials and outside repairs Depreciation and amortization Landing fees and other rent Distribution expenses (Note 2) Aircraft rent Cost of third party sales Special operating... -

Page 71

See accompanying Combined Notes to Consolidated Financial Statements. 69 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 72

... amortization (Note 8) (2007-$324; 2006-$169) Goodwill (Note 8) Restricted cash Aircraft lease deposits Investments (Note 7) Other, net 2,871 2,280 431 340 122 722 6,766 $ 24,220 See accompanying Combined Notes to Consolidated Financial Statements. 70 Source: UNITED AIR LINES INC, 10-K, February... -

Page 73

UAL Corporation and Subsidiary Companies Statements of Consolidated Financial Position (In millions, except shares) At December 31, 2007 2006 Liabilities and Stockholders' Equity Current liabilities: Advance ticket sales Mileage Plus deferred revenue Accrued salaries, wages and benefits Accounts ... -

Page 74

... Revaluation of Mileage Plus frequent flyer deferred revenue Revaluation of other assets and liabilities Increase in aircraft rejection liability Impairment on lease certificates Increase (decrease) in other liabilities Increase in non-aircraft claims accrual Pension curtailment, settlement... -

Page 75

Cash and cash equivalents at end of period $ 1,259 $ 3,832 $ 1,631 $ 1,761 See accompanying Combined Notes to Consolidated Financial Statements. 72 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 76

...47 of tax Preferred stock dividends Share-based compensation Proceeds from exercise of stock options Treasury stock acquisitions Balance at December 31, 2006 Net income Other comprehensive income, net: Unrealized gains on financial instruments, net Pension and other postretirement plans (Note 9) Net... -

Page 77

... exercise of stock options Adoption of FIN 48 Treasury stock acquisitions Balance at December 31, 2007 $ - - - 1 $ 35 2 - 2,139 $ - - - 152 $ - - (11) (15) $ - - - 141 $ 35 2 (11) 2,418 See accompanying Combined Notes to Consolidated Financial Statements. 73 Source: UNITED AIR LINES INC, 10... -

Page 78

...) Operating expenses: Aircraft fuel Salaries and related costs Regional affiliates Purchased services Aircraft maintenance materials and outside repairs Depreciation and amortization Landing fees and other rent Distribution expenses (Note 2) Aircraft rent Cost of third party sales Special operating... -

Page 79

Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 80

...(2007-$324; 2006-$169) Goodwill (Note 8) Restricted cash Aircraft lease deposits Investments (Note 7) Note receivable from affiliates (Note 19) Other, net 2,871 2,280 431 340 122 - 710 6,754 $ 24,236 See accompanying Combined Notes to Consolidated Financial Statements. 75 Source: UNITED AIR LINES... -

Page 81

... Current liabilities: Advance ticket sales Mileage Plus deferred revenue Accounts payable Accrued salaries, wages and benefits Advanced purchase of miles (Note 18) Long-term debt maturing within one year (Note 12) Fuel purchase commitments Current obligations under capital leases (Note 16) Accrued... -

Page 82

... (Successor Company) Loss before reorganization items (Predecessor Company) Adjustments to reconcile to net cash provided (used) by operating activities- Depreciation and amortization Deferred income taxes Mileage Plus deferred revenue and advanced purchase of miles Share-based compensation Special... -

Page 83

Cash and cash equivalents at end of period $ 1,239 $ 3,779 $ 1,596 $ 1,722 See accompanying Combined Notes to Consolidated Financial Statements. 77 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 84

...tax Preferred stock dividends (Note 13) Asset contribution from parent Share-based compensation Proceeds from exercise of stock options Balance at December 31, 2006 Net income Other comprehensive income, net: Unrealized gains on financial instruments, net Pension and other postretirement plans (Note... -

Page 85

...Note 19) Share-based compensation Proceeds from exercise of stock options Balance at December 31, 2007 $ - - - - $ - - - - $ (213) 49 35 2,000 $ - - - 415 $ - - - 141 $ (213) 49 35 2,556 See accompanying Combined Notes to Consolidated Financial Statements. 78 Source: UNITED AIR LINES INC, 10... -

Page 86

...Bankruptcy Court. The new common stock was listed on the NASDAQ National Market and began trading under the symbol "UAUA" on February 2, 2006. Pursuant to the Plan of Reorganization, UAL issued 5 million shares of 2% mandatorily convertible preferred stock to the Pension Benefit Guaranty Corporation... -

Page 87

... UAL's future financial performance. See Note 12, "Debt Obligations," for further information. Significant Bankruptcy Matters Resolved in 2007. During 2007, matters related to the termination of the United Airlines Pilot Defined Benefit Pension Plan (the "Pilot Plan") were resolved in the Company... -

Page 88

...the Successor Company's financial statements in future periods as a result of court rulings, the receipt of new or revised information or the finalization of these matters. The table below includes activity related to the administrative and priority claims and other bankruptcy-related claim reserves... -

Page 89

..., and to regional affiliate revenues of $4 million. The 2007 amount relates to special operating expense credits of $30 million relating to ongoing litigation for San Francisco and Los Angeles facility lease secured interests as discussed above. For 2006, the $36 million benefit consists of a $12... -

Page 90

... other UAL securities. Accordingly, UAL and United recognized a non-cash reorganization gain of $24.6 billion and $24.4 billion, respectively. The Company revalued its Mileage Plus Frequent Flyer Program ("Mileage Plus") obligations at fair value as a result of fresh-start reporting, which resulted... -

Page 91

... terminate United Air Lines, Inc. Ground Employees' Retirement Plan (the "Ground Employees Plan"), United Airlines Flight Attendant Defined Benefit Pension Plan (the "Flight Attendant Plan") and United Airlines Management, Administrative and Public Contact Defined Benefit Pension Plan ("MAPC Plan... -

Page 92

...of certain securities, incurrence of new indebtedness, repayment of old indebtedness, and other cash payments and the adoption of fresh-start reporting in the Company's Statements of Consolidated Financial Position are presented below. As discussed in Note 12, "Debt Obligations," certain instruments... -

Page 93

...683 Operating property and equipment: Owned- Flight equipment Advances on flight ...Aircraft lease deposits Restricted cash Investments Prepaid rent Pension assets Other, net 350 17 492 315 25 66 10 619 1,894 UAL total assets United total assets $ $ 19,555 $ 19,595 $ 86 Source: UNITED AIR LINES... -

Page 94

... liabilities: Long-term debt maturing within one year Advance ticket sales Mileage Plus deferred revenue Accrued salaries, wages and benefits Advanced purchase of miles Accounts payable Fuel purchase commitments Current obligations under capital leases Other $ 13 $ 1,679 709 927 686 614 280 20... -

Page 95

... Settlement of Unsecured Claims. This column reflects a discharge of $28.1 billion and $28.0 billion of liabilities subject to compromise pursuant to the terms of the Plan of Reorganization for UAL and United, respectively. Along with other 87 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 96

...for international route authorities, airport slots, trade names and other separately-identifiable intangible assets, • • Recognition of additional estimated fair value of $2.4 billion for the Mileage Plus frequent flyer obligation, Adjustments of $1.3 billion to reduce the values of operating... -

Page 97

... distribution-related costs, previously included in purchased services and commissions, to classify these costs as distribution expenses in the Statements of Consolidated Operations. Prior to 2007, "Commissions" were reported as a separate expense item and credit card transaction fees and global... -

Page 98

... use on United as operating revenues when the transportation is provided or when the ticket expires. Tickets sold by other airlines are recorded at the estimated values to be billed to the other airlines. Non-refundable tickets generally expire on the date of the 90 Source: UNITED AIR LINES INC, 10... -

Page 99

... for airport leases and reserves with institutions that process our credit card ticket sales. Financial and other institutions with which the Company conducts its business may require additional levels of security deposits or reserve holdbacks. See Note 7, "Investments," for information related to... -

Page 100

... Company also elected to change its accounting policy as of the Effective Date from an incremental cost basis to a deferred revenue model, to measure its obligation for miles to be redeemed based upon the equivalent ticket value of similar fares on United or amounts paid to Star Alliance partners... -

Page 101

... by specific operating statistics (e.g., block hours, departures) while others are fixed per month. Allocated costs represent United Express's portion of shared expenses and include charges for items such as airport operating costs, reservation-related costs, credit card discount fees and facility... -

Page 102

... publicly traded companies. Under the income approach, fair value is based on the present value of estimated future cash flows. The income approach is dependent on a number of assumptions including estimates of future capacity, passenger yield, traffic, operating costs including jet fuel prices... -

Page 103

UAL Corporation and Subsidiary Companies Combined Notes to Consolidated Financial Statements (Continued) (2) Summary of Significant Accounting Policies (Continued) (o) Ticket Taxes-Certain governmental taxes are imposed on United's ticket sales through a fee included in ticket prices. United ... -

Page 104

... employees and non-employee directors. Shares of Successor UAL Common Stock Party of Interest General unsecured creditors and employees Management equity incentive plan ("MEIP") Director equity incentive plan ("DEIP") 115,000,000 9,825,000 175,000 125,000,000 96 Source: UNITED AIR LINES INC, 10... -

Page 105

..., respectively, as the necessary conditions for issuance have been satisfied. UAL's $500 million of 6% senior notes are callable at any time at 100% of par value, and can be redeemed with either cash or UAL common stock at UAL's option. These notes 97 Source: UNITED AIR LINES INC, 10-K, February 29... -

Page 106

... notes Earnings available to common stockholders including the effect of dilutive securities Basic weighted-average shares outstanding Effect of non-vested stock options Effect of non-vested restricted shares Effect of 2% preferred securities Effect of 4.5% senior limited-subordination convertible... -

Page 107

Compensation expense associated with the UAL share-based compensation plans has been pushed down to United. See Note 2(n), "Summary of Significant Accounting Policies-Share-Based 98 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 108

...As of January 31, 2006, a total of 9 million stock options were outstanding. The Company did not issue any stock-based awards during 2005. Under the Company's Plan of Reorganization, these stock options were canceled on the Effective Date. No material share-based compensation expense was incurred as... -

Page 109

... options, stock appreciation rights, which provide the participant the right to receive the excess (if any) of the fair market value of a specified number of shares of common stock at the time of exercise over the grant price of the stock appreciation right, stock awards to be granted at no cost... -

Page 110

... have any plans to pay dividends at the time of the option grants. The volatility assumptions were based upon historical volatilities of comparable airlines whose shares are traded using daily stock price returns equivalent to the contractual term of the option. Since the new UAL common stock only... -

Page 111

... weighted-average grant date price of shares granted in 2006 was $36.78. Director Equity Incentive Plan ("DEIP"). The Nominating/Governance Committee of the UAL Board of Directors (the "Governance Committee") is authorized to grant equity-based awards to non-employee directors of the Company under... -

Page 112

... expense Medicare Part D Subsidy Valuation allowance Share-based compensation Other, net $ 243 13 10 21 (2) - 2 10 $ 15 1 9 - (12) - 5 3 $ 7,998 423 1 - (2) (8,488) - 68 $ (7,410) (416) 11 - (17) 7,830 - 2 $ 297 $ 21 $ - $ - 103 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 113

... Federal and state net operating loss carry forwards Mileage Plus deferred revenue AMT credit carry forwards Restructuring charges Other asset Less: Valuation allowance Total deferred tax assets Depreciation, capitalized interest and other Gains on sale and leasebacks Aircraft rent Intangibles Other... -

Page 114

...tax expense as discussed in Note 2(p), "Summary of Significant Accounting Policies-New Accounting Pronouncements." In addition to the deferred tax assets listed above, the Company has an $801 million unrecorded tax benefit at December 31, 2007 attributable to the difference between the amount of the... -

Page 115

...determined that it has two reporting segments that reflect the management of its business: Mainline and United Express. See Note 2(l), "Summary of Significant Accounting Policies-Intangibles," for further information related to impairment testing. 106 Source: UNITED AIR LINES INC, 10-K, February 29... -

Page 116

... 2006, respectively: Weighted Average Life of Assets (in years) Gross Carrying Amount 2007 Accumulated Amortization Gross Carrying Amount 2006 Accumulated Amortization (Dollars in millions) Amortized intangible assets Airport slots and gates Hubs Patents Mileage Plus database Contracts Other 9 20... -

Page 117

... for certain of its Star Alliance carrier relationships, and to provide United and other carriers with access to new markets in EU countries. In September 2007, the DOT granted United and bmi antitrust immunity. The immunity goes into effect at the same time as the open skies agreement between the... -

Page 118

... accordance with SFAS 88. See Note 1, "Voluntary Reorganization Under Chapter 11" for more information. The following table sets forth the reconciliation of the beginning and ending balances of the benefit obligation and plan assets, the funded status and the amounts recognized in the Statements of... -

Page 119

...Net actuarial gain $ 43 $ 13 $ 254 $ 120 The estimated amounts that will be amortized from accumulated other comprehensive income into net periodic benefit cost in 2008 for actuarial gains are $1 million for pension plans and $17 million for 110 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 120

... into net periodic pension cost. The following information relates to all pension plans with an accumulated benefit obligation and a projected benefit obligation in excess of plan assets: December 31 (In millions) 2007 2006 Projected benefit obligation Accumulated benefit obligation Fair value of... -

Page 121

... the amounts reported for the Other Benefits plan. A 1% change in the assumed health care trend rate for the Successor Company would have the following additional effects: (In millions) 1% Increase 1% Decrease Effect on total service and interest cost for the year ended December 31, 2007 Effect on... -

Page 122

... contribution employee retirement plans, of which $28 million and $21 million, respectively, related to the IAM multi-employer plan. (10) Segment Information Segments. The Company manages its business by two reporting segments: Mainline and United Express. The Company manages its business as an... -

Page 123

..., the Company does not allocate corporate overhead expenses to its United Express segment. Certain selling and operational costs are allocated to United Express. See Note 2(j), "Summary of Significant Accounting Policies-United Express" for additional information related to United Express expenses... -

Page 124

... to be related to that reporting unit. Any excess purchase price is the amount of goodwill assigned to that reporting unit. To the extent that individual assets and liabilities could be assigned directly to specific reporting units, those assets and liabilities 115 Source: UNITED AIR LINES INC, 10... -

Page 125

... associated with its operations. The Company does not allocate corporate assets to the United Express segment. The Company's capital expenditures are reported in the Company's Consolidated Statements of Cash Flows and are related to its Mainline operations. UAL and United's operating revenue by... -

Page 126

... during 2006, in accordance with the Plan of Reorganization, the Company issued new debt, entered into the credit facility, reinstated certain secured aircraft debt and entered into other debt agreements negotiated during the bankruptcy process (including aircraft financings) in addition to repaying... -

Page 127

... (the "Guarantors"). On the closing date for the Amended Credit Facility, the obligations are secured by a security interest in the following tangible and intangible assets of United and the Guarantors: (i) the Pacific (Narita, China and Hong Kong) and Atlantic (Heathrow) routes (the "Primary Routes... -

Page 128

... documents or change lines of business. The Amended Credit Facility also requires compliance with the following financial covenants: (i) a minimum ratio of EBITDAR to the sum of cash interest expense, aircraft rent and scheduled debt payments, (ii) a minimum unrestricted cash balance of $750... -

Page 129

... semiannual interest payments on the certificates of the related pass through trust. The Class C certificates do not have the benefit of a liquidity facility. Denver Special Facilities Airport Revenue Refunding Bonds, Series 2007A. On June 28, 2007, the City and County of Denver issued approximately... -

Page 130

...interest in kind for one semi-annual interest payment in 2007. Accordingly, the notes have increased by $15 million reflecting this in kind interest payment. 2006 Debt Transactions Credit Facility. On the Effective Date, United obtained a credit facility that provided for a total commitment of up to... -

Page 131

... through the payment of cash or Successor UAL common stock, or a combination of both. Pursuant to the Plan of Reorganization, the notes were to have been issued at a conversion price of $46.86, which was calculated as 125% of the average closing common stock price for the 60 consecutive trading days... -

Page 132

... callable, at UAL's option, in cash or Successor UAL common stock, under certain conditions, beginning five years after the issuance date. In the case of any such redemption, the Company may only redeem these notes with shares of common stock if Successor UAL common stock has traded at no less than... -

Page 133

... and future UAL or United preferred stock and is redeemable at any time at the then-current liquidation value (plus accrued and unpaid dividends) at the option of the issuer. The preferred stock is mandatorily convertible 15 years from the date of issuance. Upon a fundamental change or a change in... -

Page 134

... of fuel call options with the simultaneous sale of fuel put options with identical expiration dates. In the year ended December 31, 2007 and the eleven months ended December 31, 2006, the Successor Company entered into and settled various derivative positions for its mainline operations that were... -

Page 135

...was no longer probable that a portion of the forecasted cash flows hedged by the swap would occur, in light of the Company's developing plans to retire a portion of the credit facility in advance of scheduled maturities. Any gains and losses related to interest rate swap agreements, if any, that are... -

Page 136

... issued to 26 carriers on December 18, 2007. The Statement of Objections sets out evidence related to the utilization of fuel and security surcharges and exchange of pricing information that the Commission views as supporting the conclusion that an illegal price127 Source: UNITED AIR LINES INC, 10... -

Page 137

...notes. See Note 12, "Debt Obligations" for further information. Commitments. At December 31, 2007, future commitments for the purchase of property and equipment, principally aircraft, approximated $2.9 billion, after deducting advance payments. The Company's current commitments are primarily for the... -

Page 138

...are included in the future operating lease payments disclosed in Non-aircraft lease payments in Note 16, "Lease Obligations." There remains an issue as to whether the LAX and SFO bondholders have a secured interest in certain of the Company's leasehold improvements. The Company has accrued an amount... -

Page 139

... aircraft at the end of the lease term, in some cases at fair market value and in others, at fair market value or a percentage of cost. See Note 2(j), "Summary of Significant Accounting Policies-United Express" for additional information related to United Express contracts. 130 Source: UNITED AIR... -

Page 140

... addition, of the Company's total aircraft operating leases only 10 of these aircraft leases allow the Company to purchase the aircraft at other than fair market value; these leases have fixed price buy out options specified in the lease agreements. 131 Source: UNITED AIR LINES INC, 10-K, February... -

Page 141

... by Mileage Plus members for making purchases using the Mileage Plus Visa card. The existing agreement includes an annual guaranteed payment for the purchase of frequent flyer miles. In connection with the Chase Mileage Plus agreement, the Company provided Chase a junior lien upon, and security... -

Page 142

... at that time. ALPA Non-Qualified Pension Plan. In the fourth quarter of 2006, the Company recorded a special item of $24 million as a benefit to operating income to reduce the Company's recorded obligation for this matter. This adjustment was based on the receipt of a favorable court ruling in... -

Page 143

...due to a significant restructuring program that resulted in the elimination of a significant number of positions. (22) Distribution Payable In December 2007, the UAL Corporation Board of Directors approved a special distribution of $2.15 per share to holders of UAL common stock. The distribution, of... -

Page 144

... operating expense credit of $14 million for changes in estimates for certain liabilities relating to bankruptcy administrative claims. The fourth quarter includes a gain of $41 million from the sale of ARINC. The Company's change in the expiration period for unused frequent flier miles increased... -

Page 145

... Corporation and Subsidiary Companies ...related to the Chase agreement as discussed in Note 18, "Advanced Purchase of Miles." See Note 1, "Voluntary Reorganization...shares of 2% convertible preferred stock were converted into approximately 2.2 million UAL common shares. 136 Source: UNITED AIR LINES... -

Page 146

... in the reports they file with the SEC on a timely basis. Based on that evaluation, the Chief Executive Officer and the Chief Financial Officer of UAL and United have concluded that as of December 31, 2007, disclosure controls and procedures were effective. Changes in Internal Control over Financial... -

Page 147

... to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Under the supervision and with the participation of management, including our Chief Executive Officer and... -

Page 148

...Stockholder of United Air Lines, Inc. Chicago, Illinois The management of United Air Lines, Inc. ("United") is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f). Our internal control over financial... -

Page 149

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of UAL Corporation Chicago, Illinois We have audited the internal control over financial reporting of UAL Corporation and subsidiaries (the "Company") as of December 31, 2007, based on criteria established in Internal Control... -

Page 150

ITEM 9B. None. OTHER INFORMATION. 141 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 151

... 2008 Annual Meeting of Stockholders. Certain information required by this item with respect to United is incorporated by reference from United's definitive information statement to be filed within 120 days of December 31, 2007. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES. Information required... -

Page 152

... this item are listed in the Exhibit Index which immediately precedes the exhibits filed with this Form 10-K, and is incorporated herein by this reference. Each management contract or compensatory plan or arrangement is denoted with a "†" in the Exhibit Index. 143 Source: UNITED AIR LINES INC, 10... -

Page 153

... the undersigned, thereunto duly authorized. UAL CORPORATION UNITED AIR LINES, INC. (Registrants) /s/ Glenn F. Tilton Glenn F. Tilton Chairman of the Board, President and Chief Executive Officer Date: February 28, 2008 Pursuant to the requirements of the Securities Exchange Act of 1934, this Form... -

Page 154

... David M. Wing Vice President and Controller (principal accounting officer) /s/ Graham W. Atkinson Graham W. Atkinson Director /s/ Peter D. McDonald Peter D. McDonald Director /s/ John P. Tague John P. Tague Director Date: February 28, 2008 145 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 155

Schedule II Valuation and Qualifying Accounts For the Year Ended December 31, 2007, the Eleven Month Period Ended December 31, 2006, the Month Ended January 31, 2006 and the Year Ended December 31, 2005 (In millions) Balance at Beginning of Period Additions Charged to Costs and Expenses Balance at ... -

Page 156

...) UAL Corporation Success Sharing Program-Performance Incentive Plan effective January 1, 2007 (filed as Exhibit 99.1 to UAL's Form 8-K filed March 26, 2007, Commission file number 1-6033, and incorporated herein by reference) *4.2 *4.3 *4.4 *4.5 *4.6 *†10.1 Source: UNITED AIR LINES INC... -

Page 157

... March 26, 2007, Commission file number 1-6033, and incorporated herein by reference) UAL Corporation Executive Severance Plan Amendment No. 1 dated January 1, 2008 Employment Agreement dated September 5, 2002 by and among United Air Lines, Inc., UAL Corporation and Glenn F. Tilton (filed as Exhibit... -

Page 158

... Dividend Requirements List of UAL Corporation and United Air Lines, Inc. Subsidiaries Consent of Independent Registered Public Accounting Firm for UAL Corporation Consent of Independent Registered Public Accounting Firm for United Air Lines, Inc. Certification of the Principal Executive Officer... -

Page 159

... ON ACCOUNTING AND FINANCIAL DISCLOSURE. ITEM 9A. CONTROLS AND PROCEDURES. ITEM 9B. OTHER INFORMATION. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. ITEM 11. EXECUTIVE COMPENSATION. ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED... -

Page 160

... No. 1 to the UAL Corporation Success Sharing Program-Performance Incentive Plan is executed on this 6 th day of December, 2007. Paul R. Lovejoy Name Senior Vice President, General Counsel and Secretary Title /s/ Paul R. Lovejoy Signature Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 161

QuickLinks Exhibit 10.2 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 162

...") to the UAL Corporation and United Air Lines, Inc. Executive Severance Plan dated April 1, 2007 (the "Plan"), is made as of January 1, 2008. WHEREAS pursuant to Section 11 of the Plan, the Plan may be modified or amended by the Human Resources Subcommittee of the Board of Directors (the "Committee... -

Page 163

... by the Human Resources Subcommittee of the Board of Directors of UAL Corporation, this Amendment No. 1 to the UAL CORPORATION AND UNITED AIR LINES, INC. EXECUTIVE SEVERANCE PLAN is executed on this 5 th day of December, 2007 Paul R. Lovejoy Name Senior Vice President, General Counsel and Secretary... -

Page 164

QuickLinks Exhibit 10.5 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 165

... use of cars owned or leased by United. For 2007, the Company did not own or lease any cars for the use of an individual executive, other than the Chief Executive Officer. Officers located at Headquarters, 77 W. Wacker, Chicago, IL 60601, received company paid parking. Source: UNITED AIR LINES INC... -

Page 166

QuickLinks Exhibit 10.13 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 167

...Under the UAL Corporation 2006 Director Equity Incentive Plan, non-employee directors may receive awards in the form of UAL common stock, restricted stock, stock options, stock appreciation rights and/or deferred stock units representing the right to receive UAL stock in the future. In addition, the... -

Page 168

QuickLinks Exhibit 10.15 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 169

... using 2007 and 2006 effective tax rates of approximately 43% and 49%, respectively. Earnings were inadequate to cover both fixed charges and fixed charges and preferred dividend requirements by $21.2 billion in 2005, $1.7 billion in 2004 and $2.8 billion in 2003. Source: UNITED AIR LINES INC... -

Page 170

QuickLinks Exhibit 12.1 UAL Corporation and Subsidiary Companies Computation of Ratio of Earnings to Fixed Charges and Ratio of Earnings to Fixed Charges and Preferred Stock Dividend Requirements Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 171

...dividend requirements were nonexistent for the Predecessor Company as push down accounting was not applied prior to the adoption of fresh-start reporting. Earnings were inadequate to cover fixed charges by $21.0 billion in 2005, $1.7 billion in 2004 and $2.8 billion in 2003. (c) Source: UNITED AIR... -

Page 172

QuickLinks Exhibit 12.2 United Air Lines, Inc. and Subsidiary Companies Computation of Ratio of Earnings to Fixed Charges and Ratio of Earnings to Fixed Charges and Preferred Stock Dividend Requirements Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 173

...de C.V. Mileage Plus, Inc. UAL Loyalty Services, LLC United Aviation Fuels Corporation United Cogen, Inc. United Vacations, Inc. Air Wis Services, Inc. (Wholly-owned subsidiary): Air Wisconsin, Inc. Air Wis Services, Inc. (999 shares) and United Air Lines, Inc. (1 share) Domicile Management Services... -

Page 174

QuickLinks Exhibit 21 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 175

...explanatory paragraphs relating to the Company's emergence from bankruptcy, changes in accounting for share based payments, and the method of accounting for and the disclosures regarding pensions and postretirement benefits), and the effectiveness of UAL Corporation's internal control over financial... -

Page 176

QuickLinks Exhibit 23.1 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 177

...statement schedule of United Air Lines, Inc. (which report expresses an unqualified opinion and includes explanatory paragraphs relating to the Company's emergence from bankruptcy, changes in accounting for share based payments, and the method of accounting for and the disclosures regarding pensions... -

Page 178

QuickLinks Exhibit 23.2 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 179

....1 Certification of the Principal Executive Officer Pursuant to 15 U.S.C. 78m(a) or 78o(d) (Section 302 of the Sarbanes-Oxley Act of 2002) I, Glenn F. Tilton, certify that: (1) (2) I have reviewed this annual report on Form 10-K for the period ended December 31, 2007 of UAL Corporation (the "Company... -

Page 180

QuickLinks Exhibit 31.1 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 181

... material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. (b) /s/ Frederic F. Brace Frederic F. Brace Executive Vice President and Chief Financial Officer Date: February 28, 2008 Source: UNITED AIR LINES INC, 10... -

Page 182

QuickLinks Exhibit 31.2 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 183

... 31.3 Certification of the Principal Executive Officer Pursuant to 15 U.S.C. 78m(a) or 78o(d) (Section 302 of the Sarbanes-Oxley Act of 2002) I, Glenn F. Tilton, certify that: (1) (2) I have reviewed this annual report on Form 10-K for the period ended December 31, 2007 of United Air Lines, Inc... -

Page 184

QuickLinks Exhibit 31.3 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 185

... material, that involves management or other employees who have a significant role in the Company's internal control over financial reporting. (b) /s/ Frederic F. Brace Frederic F. Brace Executive Vice President and Chief Financial Officer Date: February 28, 2008 Source: UNITED AIR LINES INC, 10... -

Page 186

QuickLinks Exhibit 31.4 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 187

... financial condition and results of operations of UAL Corporation. Date: February 28, 2008 /s/ Glenn F. Tilton Glenn F. Tilton Chairman, President and Chief Executive Officer /s/ Frederic F. Brace Frederic F. Brace Executive Vice President and Chief Financial Officer Source: UNITED AIR LINES INC... -

Page 188

QuickLinks Exhibit 32.1 Source: UNITED AIR LINES INC, 10-K, February 29, 2008 -

Page 189

...; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of United Air Lines, Inc. Date: February 28, 2008 /s/ Glenn F. Tilton Glenn F. Tilton Chairman, President and Chief Executive Officer /s/ Frederic F. Brace... -

Page 190

QuickLinks Exhibit 32.2 _____ Created by 10KWizard www.10KWizard.com Source: UNITED AIR LINES INC, 10-K, February 29, 2008