Travelers 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

reinsurance and international business acquired in the merger produced minimal written premium volume

in 2006, 2005 and 2004.

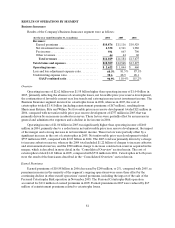

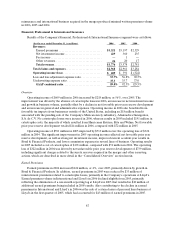

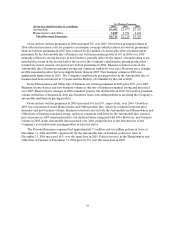

Financial, Professional & International Insurance

Results of the Company’s Financial, Professional & International Insurance segment were as follows:

(for the year ended December 31, in millions) 2006 2005 2004

Revenues:

Earned premiums ............................... $3,321 $ 3 ,197 $2,529

Net investment income. .......................... 429 360 235

Feeincome..................................... —1—

Other revenues.................................. 2620 17

Total revenues .................................. $3,776 $ 3 ,578 $2,781

Total claims and expenses .......................... $2,968 $ 2 ,961 $3,284

Operating income (loss)............................ $ 609 $ 391 $(322)

Loss and loss adjustment expenseratio ............... 53.7% 56.8 % 92.5 %

Underwriting expense ratio......................... 35.335.7 37.0

GAAP combined ratio............................ 89.0% 92.5 % 129.5 %

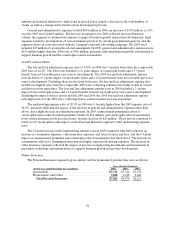

Overview

Operating income of $609 million in 2006 increased by $218 million, or 56%, over 2005. The

improvement was driven by the absence of catastrophe losses in 2006, an increase in net investment income

and growth in business volume, partially offset by a decline in net favorable prior year reserve development

and an increase in general and administrative expenses. Operating income in 2006 also benefited from

favorable tax impacts from businesses outside of the United States, including an $18 million benefit

associated with the pending sale of the Company’s Mexican surety subsidiary, Afianzadora Insurgentes,

S.A. de C.V. No catastrophe losses were incurred in 2006, whereas results in 2005 included$191 million in

catastrophe costs, the majority of which resulted from Hurricanes Katrina, Rita and Wilma. Net favorable

prior year reserve development totaled $14 million in 2006, compared with $72 million in 2005.

Operating income of $391 million in 2005 improved by $713 million over the operating loss of $322

million in 2004. The significant improvement in 2005 operating income reflected net favorable prior year

reserve development, as well as strongnet investment income, improved current accident year results in

Bond & Financial Products, and lower commission expenses in several lines of business. Operating results

in 2005 included a cost of catastrophes of $191 million, compared with $51 million in 2004. The operating

loss of $322 million in 2004 was driven by net unfavorable prior year reserve development of $739 million,

including significant charges related to the surety reserves acquired in the merger and other reserving

actions, which are described in more detail in the “Consolidated Overview” section herein.

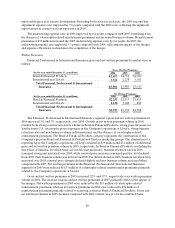

Earned Premiums

Earned premiums in 2006 increased $124 million, or 4%, over 2005, primarily driven by growth in

Bond & Financial Products. In addition, earned premiums in 2005 were reduced by $33 million of

reinstatement premiums related to catastrophe losses, primarily in the Company’s operations at Lloyd’s.

Earned premium volume in International and Lloyd’s in 2006 declined slightly from 2005, primarily

reflecting the elimination of a one-month reporting lag at Lloyd’s in 2005 that resulted in$48 million of

additional earned premiums being included in 2005 results. Also contributing to the decline in earned

premiums in International and Lloyd’s in 2006 was thesale of certain classes of personal lines business at

Lloyd’s in the first quarter of 2005, which had accounted for $43 million of earned premiums in 2005.