Travelers 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

independently-owned auto repair facilities with Company appraisers on site to complete an estimate,

handle all rental arrangements and monitor the repair process from startto finish. By managing the claim

in this way, the Company can help ensure prompt, quality results and create a differentiated, superior

claim experience for customers.

Another strategic advantage is TravCompSM, a workers’ compensation claim resolution and medical

managementprogram that assists adjusters in the prompt investigation and effective management of

workers’ compensation claims. Innovative medical and claims management technologies permit nurse,

medical and claims professionals to share appropriate vital information that supports prompt investigation,

effective return to work and claim resolution strategies. These technologies, together with effective

matching of professional skills and authority to specific claim issues, have resulted in more efficient

managementof workers’ compensation claims with lower medical, wage replacement costs and loss

adjustment expenses.

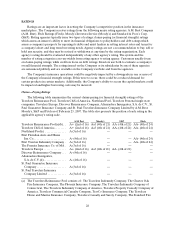

REINSURANCE

The Company reinsures a portion of the risks it underwrites in order to control its exposure to losses.

The Company cedes to reinsurers a portion of these risks and pays premiums based upon the risk and

exposure of the policies subject to such reinsurance. Ceded reinsurance involves credit risk, except with

regard to mandatory pools, and is generally subject to aggregate loss limits. Although the reinsurer is liable

to the Company to the extent of the reinsurance ceded, the Company remains liable as the direct insurer

on all risks reinsured. Reinsurance recoverables are reported after reductions for known insolvencies and

after allowances for uncollectible amounts. The Company also holds collateral, including trust agreements,

escrow funds and letters ofcredit, under certain reinsurance agreements. The Company monitors the

financial condition of reinsurers on an ongoing basis and reviews its reinsurance arrangements periodically.

Reinsurers are selectedbased on their financial condition, business practices and the price of their product

offerings. For additional information concerning reinsurance, see note 4 of notes to the Company’s

consolidated financial statements.

The Company utilizes a variety of reinsurance agreements to manage its exposure to large property

and casualty losses, including:

•facultative reinsurance, in which reinsurance is provided for all or a portion of the insurance

provided by a single policy and each policy reinsured is separately negotiated;

•treaty reinsurance, in which reinsurance is provided for a specified type or category of risks; and

•catastrophe reinsurance, in which the Company is indemnified for an amount of loss in excess of a

specified retention with respect to losses resulting from a catastrophic event.

For a description of reinsurance-related litigation, see Item 3, “Legal Proceedings.”

Catastrophe Reinsurance

Catastrophes can be caused by various natural and man-made events including hurricanes,

windstorms, earthquakes, hail, severe winter weather, explosions and fires. The incidence and severity of

catastrophes are inherently unpredictable. The extent of losses from a catastrophe is a function of both the

total amount of insured exposure in the area affected by the event and the severity of the event. Most

catastrophes are restricted to small geographic areas; however, hurricanes and earthquakes may produce

significant damage in larger areas, especially those that are heavily populated. The Company generally

seeks to reduce its exposureto catastrophesthrough individual risk selection and the purchase of

catastrophe reinsurance.

The Company utilizes reinsurance agreements with nonaffiliated reinsurers to manage its exposure to

losses resulting from one occurrence. The Company’s General Catastrophe reinsurance treaty covers the