Travelers 2006 Annual Report Download - page 164

Download and view the complete annual report

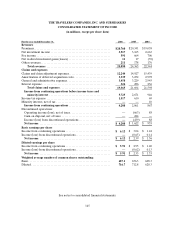

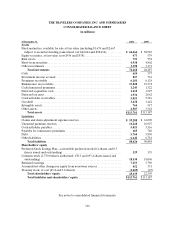

Please find page 164 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

152

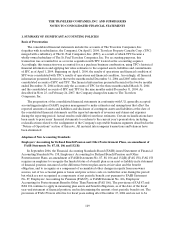

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

the United States, which resulted in an increase in income tax expense of $8 million for the year ended

December 31, 2005.

Accounting Standards Not Yet Adopted

Accounting by Insurance Enterprises for Deferred Acquisition Costs in Connection with Modifications or

Exchanges of Insurance Contracts

In September 2005, the Accounting Standards Executive Committee (AcSEC) issued Statement of

Position 05-1, Accounting by Insurance Enterprises forDeferred Acquisition Costs in Connection with

Modifications or Exchanges of Insurance Contracts (SOP 05-1). SOP 05-1provides guidance on accounting

by insuranceenterprisesfor deferred acquisition costs on internal replacements of insurance and

investment contracts other than those specifically described in Statement of Financial Accounting

Standards No. 97, Accounting and Reporting by Insurance Enterprises for Certain Long-Duration Contracts

and for Realized Gains and Losses from the Sale of Investments. SOP 05-1 defines an internal replacement as

a modification in product benefits, features, rights, or coverages that occurs by the exchange of a contract

for a new contract, or by amendment, endorsement, or rider to a contract, or by the election of a feature or

coverage within a contract.

SOP 05-1 is effective for internal replacements occurring in fiscal years beginning after December 15,

2006, withearlier adoption encouraged. The adoption of SOP 05-1 effective January 1, 2007did not have a

materialeffect on the Company’s results of operations, financial condition or liquidity.

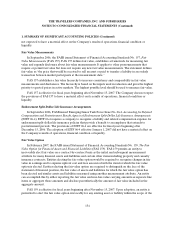

Accounting for Certain Hybrid Financial Instruments

In February 2006, theFASB issued Statement of Financial Accounting Standards No. 155, Accounting

for Certain Hybrid Financial Instruments - an amendment of FASB Statements No. 133 and 140 (FAS 155).

FAS 155 nullifies the guidance in the FASB’s Derivatives Implementation Group Issue D1 “Application of

Statement 133 to Beneficial Interests in Securitized Assets”, which had deferred the bifurcation

requirements of Statement of Financial Accounting Standards No. 133, Accounting for Derivative

Instruments andHedging Activities (FAS 133), for certain beneficial interests in securitized financial assets.

FAS 155 requires beneficial interests in securitized financial assets be analyzed to determine whether they

are freestanding derivatives or hybrid instruments that contain an embedded derivative requiring

bifurcation.

FAS 155 permits entities to fair value any hybrid financial instrument that contains an embedded

derivative that otherwise would require bifurcation. This election is ona contract-by-contract basis and is

irrevocable. Additionally, FAS 155 narrows the exception afforded to interest-only strips and principal-

only strips from derivative accounting. In addition, FAS 155 clarifies that concentrations of credit risk in

the form of subordination are not embedded derivatives and amends Statement of Financial Accounting

Standards No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities - a replacement of FASB Statement 125, to eliminate the restriction on the passive derivative

instruments a Qualifying Special Purpose Entity can hold.

In January 2007, the FASB released Statement 133 Implementation Issue No. B40, Embedded

Derivatives: Application of Paragraph 13(b) to Securitized Interests in Prepayable Financial Assets (B40). B40

provides a limited scope exception from paragraph 13(b) of FAS 133 for securitized interests that contain