Travelers 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

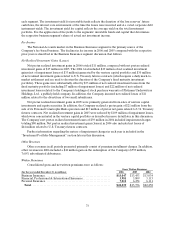

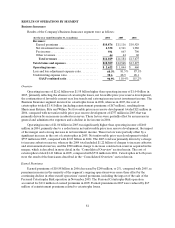

Net Written Premiums

(for the year ended December 31, in millions) 2006 2005 2004

Business Insurance................................................$ 11,046 $ 10,999 $ 10,374

Financial, Professional & International Insurance.....................3,3933,159 2,708

Personal Insurance................................................6,7116,228 5,929

Total ..........................................................$ 21,150 $ 20,386 $ 19,011

Gross and net written premiums in 2006 increased 1% and 4%, respectively, over 2005. The disparity

between gross and net written premium growth rates in 2006 was concentrated in the Business Insurance

segment andwas primarily due to a change in the structure of reinsurance coverage in the Company’s

Discover Re subsidiary that resulted in a decline in ceded premiums. Net written premium volume in 2006

was negatively impacted by a higher level of premiums cededfor the cost of property catastrophe

reinsurance, whereas net written premiums in 2005 were reduced by $121 million of catastrophe-related

reinstatement premiums.

In Business Insurance, net written premium growth in 2006 was driven by strong increases in Target

Risk Underwriting, due to significant renewal price increases for Southeastern U.S. catastrophe-prone

exposures, and in Industry-FocusedUnderwriting, due to growth in several industry sectors served by this

market. That growth was largely offset by a reduction in premium volume for operations in runoff,

primarilty dueto the sale of the Personal CatastropheRisk operation in the fourth quarter of 2005.

Business retention rates remained strong throughout the Business Insurance segment in 2006, and new

business volume increased. In Financial, Professional& International Insurance, written premium growth

in 2006 reflected strong business volume throughoutthe segment, and the absence of catastrophe-related

reinstatement premiums. Net written premium growth in the Personal Insurance segment in 2006 reflected

growth in new business volume, renewal price increases and continued strong business retention rates,

partially offset by the estimated impact of transitioning to six-month policy terms in the second half of the

year for a large portion of the Company’s multivariate pricing Automobile product, and an increase in

ceded premiums for catastrophe reinsurance.

Gross and net written premiums in 2005 both increased 7% over 2004, primarily reflecting the impact

of the merger. However, gross and net written premium volumes in 2005 were down when compared to

2004 on a proforma combined basis. The declines were concentrated in the Business Insurance segment,

reflecting the planned non-renewal of business in runoff and reduced premium volume in certain ongoing

operations due to competitive market conditions. In addition, premium volume in the Business Insurance

segment’s Construction operation was lower than in 2004 on a pro forma basis due to the now-completed

process of aligning the underwriting profile of the two predecessor companies. Net written premiums in

2005 were reduced by $121 million of catastrophe-related reinstatement premiums, whereas 2004 net

written premium volume was reduced by $76 million of reinstatement premiums primarily related to

reserving actions in the Financial, Professional & International Insurance segment. Premium volume in the

Personal Insurance segment increased over 2004, driven by continued renewal price increases andgrowth

in policies in force in the homeowners line of business. During2005, the Companyexperienced strong

business retention rates on a company-wide basis, as theCompany focused on retaining its existing book of

well-priced, profitable business. New business levels inseveral of the Company’s insurance operations also

increased over 2004. Rate increases, however, were generally lower in 2005 compared with 2004, reflecting

increased competition and more aggressive pricing in the marketplace. Rates for certain products in

selected markets declined from 2004 levels.

In the first quarter of 2005, the Company implemented changes in the timing and structure of

reinsurance purchased in the Business Insurance and Financial, Professional & International Insurance

segments. The changes in structure resulted in an increase in ceded premiums in 2005 when compared with

2004. The Company also made a modest adjustment to 2004 ceded written premiums to report at inception

all ceded written premiums for reinsurance agreements that have minimum amounts required to be ceded.

Previously, ceded written premiums for certain of these agreements were reported over the life of the