Travelers 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Net Retention Policy

The following discussion reflects the Company’s retention policy as of January 1, 2007. For third party

liability, including but not limited to umbrella liability, professional liability, directors’ and officers’ liability,

and employment practices liability, Financial, Professional & International Insurance generally limits the

net retentions up to $11.5 million per policy after reinsurance. For surety protection, the Company

generally retains up to $24.5 million probable maximum loss (PML) per principal but may retain higher

amounts based on the type of obligation, credit quality and other credit risk factors. In the International

and Lloyd’s operations, per risk retentions range from $3 million to $10 million. The Company also utilizes

facultative reinsurance to provide additional limits capacity or to reduce retentions on an individual risk

basis. The Company may also retain amounts greater than those described herein based upon the

individual characteristics of the risk.

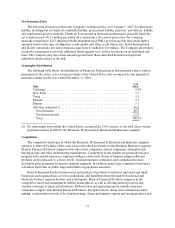

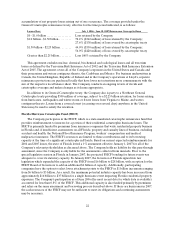

Geographic Distribution

The following table shows the distribution ofFinancial, Professional & International’s direct written

premiums for the states, or for locations outside of the United States, that accounted for the majority of

premium volume for the year ended December 31, 2006:

State

% of

Total

California........................................................... 5.8%

New York ........................................................... 5.3

Texas............................................................... 4.1

Florida.............................................................. 3.7

Illinois .............................................................. 3.1

All other domestic(1) ................................................. 44.2

Total domestic ..................................................... 66.2

Total international ................................................. 33.8

Total ............................................................. 100.0%

(1) No other single state within the United States accounted for 3.0% or more of the total direct written

premiums written in 2006 by the Financial, Professional & International Insurancesegment.

Competition

The competitive landscape in which the Financial, Professional & International Insurance segment

operates is affected by many of the same factors described previously for the Business Insurance segment.

Bond & Financial Products competes with other stock companies, mutual companies, alternative risk

sharing groups and other underwriting organizations. Competitors in this market are primarily national

property and casualty insurance companies willing to write most classes of business using traditional

products and pricing and, to a lesser extent, regional insurance companies and companies that have

developed niche programs for specific industry segments.In addition, many large commercial customers

self-insure their risks or utilize large deductibles onpurchased insurance.

Bond & Financial Products underwrites and markets its products to national, mid-sized and small

businesses and organizations, as well as individuals, anddistributes them through both national and

wholesale brokers, regional brokers, and retail agents. Bond & Financial Products competes in the

competitive surety and management liability marketplaces, as well as offering general property and

casualty coverages to financial institutions. Both national and regional property casualty insurance

companies compete with Bond & Financial Products. Its reputation for timely and consistent decision-

making, a nationwide network of local underwriting, claims and industry experts andstrong producer and