Travelers 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.83

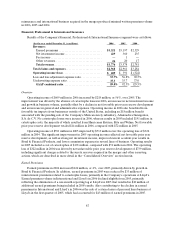

Claims and claim adjustment expenses in 2005 of $9.36billion declinedfrom the 2004 total of $9.84

billion. Included in those totals were $1.32 billion and $532 million, respectively, of catastrophe losses (net

of reinsurance). Net unfavorable prior year reserve development totaled $757 million in 2005, as described

above. Net unfavorable prior year reserve development totaled $2.03 billion in 2004, which included a $928

million charge tostrengthen asbestos reserves, a $290 million charge to strengthen environmental reserves

and the $500 million charge to increase constructionreserves acquired in the merger described in the

“Consolidated Overview” section herein. Also included in the net unfavorable prior year reserve

developmentin2004 was a $174 million addition to the reserve for uncollectible reinsurance recoverables,

$150 million recorded in TPC’s Construction operation prior to the merger, $74 million from the

commutation of agreements with a major reinsurer and other net unfavorable prior year reserve

development, primarily concentrated in the Company’s Gulf operations. Results in 2004 also reflected

increased current year loss ratios on portions of the Construction book of business. Partially offsetting the

impact of these factors was favorable prior year reserve development in several core Business Insurance

operations, which resulted from reductions in the frequency of non-catastrophe related losses attributable

to improved underwriting and pricing strategies in prior years, the results of which emerged in 2004.

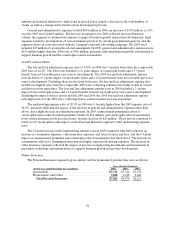

Approximately half of the$155 million 2006 pre-tax increase to asbestos reserves was due to an

increase in the projected defense costs for ten policyholders. Additionally, $15 million of the pretax reserve

adjustment was attributable to a delay in the approval and expected payment of the previously announced

settlement with PPG Industries, Inc. as part of the Pittsburgh Corning bankruptcy reorganization plan. The

remainder of the reserve adjustment was primarily due to continued litigation activity against smaller,

peripheral defendants. In 2005, the asbestos charge resulted, in part, from higher than expected defense

costs due to increased trial activity for seriously impaired plaintiffs and prolonged litigation before cases

are settled or dismissed. The 2005 charge also considered the January 2006 court decision voiding, on

procedural grounds, the previously rendered favorable arbitration decision in the ongoing ACandS

litigation. The asbestos charge recordedin 2004 primarily resulted from an increase in litigation costs and

activity surrounding peripheral defendants. The $120 million environmental reserve addition in 2006 was

primarily due to higher than expected defense and settlement costs. In 2005, the environmental reserve

charge was primarily related to declaratory judgment costs, whereas the significant 2004 charge was related

to revised estimates of costs related tosettlement initiatives. See the “Asbestos Claims and Litigation” and

“Environmental Claims and Litigation” sections herein for further discussion of these reserves.

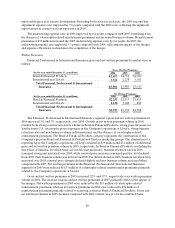

General and administrative expenses in 2006 totaled $2.10 billion, 3% higher than the comparable

total of $2.04billion in 2005. The increase in 2006primarily reflected the segment’s expenditures to

support business growth and product development, the segment’s share of costs associated with the

Company’s national advertising campaign and legal expenses related to investigations of various business

practices by certain governmental agencies. General and administrative expenses in 2005 were 4% higher

than the 2004 total of $1.95 billion, which primarily reflected the impact of the merger. The 2004 total

included merger-related charges and an increase in the allowance for uncollectible amounts duefrom

policyholders.

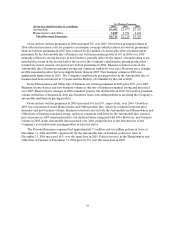

GAAP Combined Ratio

The loss and loss adjustment expense ratio in 2006 of 60.3% improved by 21.2 points compared with

the 2005 ratio of 81.5%, primarily due to the absence of catastrophe losses and net favorable prior year

reserve development in 2006 (versus net unfavorable prior year reservedevelopment in 2005). Catastrophe

losses accounted for 12.3 points of the 2005 loss and loss adjustment expense ratio. Net favorable prior

year reserve developmentin 2006 provided a 0.2 point benefit to the loss and loss adjustment expense

ratio, whereas net unfavorable prior year reserve development in 2005 accounted for 6.8 points of the loss

and loss adjustment expense ratio. The 2006 loss and loss adjustment expense ratio excluding catastrophe

losses and prior year reserve development improved over the2005 ratio on the same basis, reflecting

improvement in frequency and severity trends in several lines of business.