Travelers 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.108

with the Securities and Exchange Commission and its $1 billion line of credit. Cash provided fromthese

sources is used primarily for claims and claim adjustment expense payments and operating expenses. The

timing and amount of catastrophe claims are inherently unpredictable. Such claims increase liquidity

requirements. The timing and amount of reinsurance recoveries may be affected by reinsurer solvency and

reinsurance coverage disputes. Additionally, the variability of asbestos-related claim payments, as well as

the volatility of potential judgments and settlements arising outof litigation, may also result in increased

liquidity requirements. It is the opinion of the Company’s management that the Company’s future liquidity

needs will be adequately met from all of the above sources.

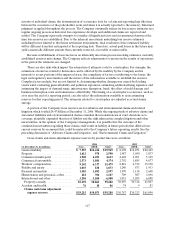

Operating Activities

Net cash flows provided by operating activities of continuing operations totaled $4.77 billion, $3.59

billion and $5.07 billion in 2006, 2005 and2004, respectively. Cash flows in 2006reflected higher levels of

collected premiums and net investment income, lower claim payments on catastrophe losses, as well as

lower runoff claim payments. In addition, cash flows from operations in 2006 benefited from significant

2006 reinsurance recoveries related to 2005 hurricane losses, operations in runoff (primarily Gulf) and

various commutation agreements. These factors were partially offset by higher interest payments and an

increase in tax payments resulting from higher profitability. Cash flows in 2005 reflected an increase in loss

and loss adjustment expense payments primarily related to the catastrophe losses incurred during 2005 and

2004, and an increase in tax payments resulting from higher profitability. Cash flows in 2004 included $867

million in cash proceeds received pursuant to the commutation of specific reinsurance agreements. Cash

flows in 2004also benefited from premium rate and volume increases. The Company utilized $11 million,

$2.00 billion and $548 million of net operating loss (NOL) carryforwards during 2006, 2005 and 2004,

respectively, thereby reducing current regular tax payments by $4 million, $698 million and $192 million,

respectively.

Net cash flows provided by operating activities for all three years were negatively impacted by

payments for asbestos andenvironmental liabilities, as well as by payments for claims related to the

Company’s runoff operations.

Investing Activities

Net cash flows used in investing activities of continuing operations totaled $3.06 billion, $5.44 billion

and $4.65 billion in 2006, 2005 and2004, respectively. Fixed maturity securities accounted for themajority

of investment purchases in all three years.

The majority of funds available for investment are deployed in a widely diversified portfolio of high

quality, liquid intermediate-term taxable U.S. government, corporate- and mortgage-backed bonds and

tax-exempt U.S. municipal bonds. The Company closely monitors the duration of its fixed maturity

investments, and investment purchases and sales are executed with the objective of having adequate funds

available to satisfy the Company’s insurance and debt obligations. The Company’s management of the

duration of the fixed income investmentportfolio generally produces a duration that exceeds the duration

of the Company’s net insurance liabilities. The average duration of fixed maturities and short-term

securities was 4.0 at December 31, 2006, compared with 3.9 at December 31, 2005.

The Company also invests much smaller amounts in equity securities, venture capital, real estate,

private equity limited partnerships, joint ventures, other limited partnerships and trading securities. These

investment classes have the potential for higher returns but also involve varying degrees of risk, including

less stable rates of return and less liquidity.

The primary goals of the Company’s asset liability management process are to satisfy the insurance

liabilities, manage the interest rate risk embedded in those insurance liabilities, and maintain sufficient

liquidity to cover fluctuations in projected liability cash flows. Generally, the expected principal and