Travelers 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

(6) Represents estimated timing for fulfilling unfunded commitments for investments in real estate

partnerships, private equities andhedge funds.

(7)The amounts in “Claims and claim adjustment expenses” in the table above represent the estimated

timing of future payments for both reported and unreported claims incurred and related claim

adjustment expenses, gross of reinsurance recoverables.

The Company has entered into reinsurance agreements to protect itself from potential losses in excess

of the amount it is prepared to accept as described in Note 4 the notes to financial statements.

In order to qualify for reinsurance accounting, a reinsurance agreement must indemnify the insurer

from insurancerisk, i.e., the agreement must transfer amount and timing risk. Since the timing and

amount of cash inflows from such reinsurance agreements are directly related to the underlying

payment of claims and claim adjustment expenses bythe insurer, reinsurance receivables are

recognized ina manner consistent with the liabilities (the estimated liability for claims and claims

adjustment expense) relating to the underlying reinsured contracts. The presence of any feature that

can delay timely reimbursement of claims by a reinsurer results in the reinsurance contract being

accounted for as a deposit rather than reinsurance. (See below.) The assumptions used in estimating

the amount and timing of the reinsurance receivables are consistent with those used in estimating the

amount and timing of the related liabilities.

Reinsurance agreements that do not transfer both amountand timing risk are accounted for as

deposits and included in “Reinsurance contracts accounted for as deposits” in the table above.

The estimated future cash inflows from the Company’s reinsurance contracts that qualify for

reinsurance accounting are as follows:

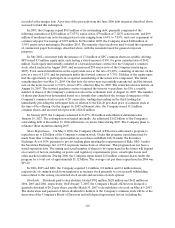

(in millions) Total

Less than 1

Year

1-3

Years

3-5

Years

After 5

Years

Reinsurance receivables ................. $ 16,618$ 4 ,592 $ 5,088 $ 2,385 $ 4 ,553

The Company manages its business andevaluates its liabilities for claims and claim adjustment

expense on a net of reinsurance basis. The estimated cash flows on a net of reinsurance basis are as

follows:

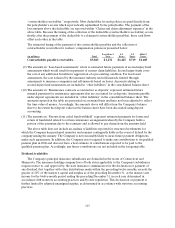

(in millions) Total

Less than 1

Year

1-3

Years

3-5

Years

After 5

Years

Claims and claim adjustment expense, net...$ 43,739 $ 12,287 $ 13,715 $ 6,367 $ 11,370

For business underwritten by non-U.S. operations, future cash flows related to reported and

unreported claims incurred and related claim adjustment expenses were translated at the spot rate on

December 31, 2006.

The amounts reported in the table above and in the table of reinsurance receivables above are

presented on a nominal basis and have not been adjusted to reflect the time value of money.

Accordingly, the amounts above willdiffer from the Company’s balance sheet to theextent that the

liability for claims and claim adjustment expenses and the related reinsurance receivables have been

discounted in the balance sheet. (See note 1 of the financial statements.)

(8)Workers’ compensation large deductible policies provide third party coverage in which the Company

typically is responsible for paying the entire loss under such policies and then seeks reimbursement

from the insured for the deductible amount. “Claims from large deductible policies” represent the

estimated future payment for claims and claim related expenses belowthe deductible amount, net of

the estimated recovery of the deductible. The liability and the related deductible receivable for unpaid

claims are presented in the consolidated balance sheet as “contractholder payables” and