Travelers 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

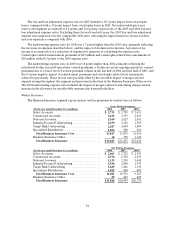

Interest Expense and Other

(for the year ended December 31, in millions) 2006 2005 2004

Net loss .............................................. $ ( 163) $ (184 ) $ (182 )

The $21 million decline in net loss for Interest Expense and Other in 2006 compared with 2005 was

primarily due to a $27 million after-tax gain realized on the redemption of the Company’s $593 million,

7.6% subordinated debentures. Results in 2006 also reflected the favorable resolution of various prior year

federal and state tax matters and the absence of expenses associated with the amortization of discount on

forward contracts related to the Company’s divestiture of Nuveen Investments that impacted the 2005 loss.

These factors were partially offset by incremental interest expense in 2006 due to the issuance in

November 2005 of $400 million, 5.50% senior notes due December 1, 2015, and theissuance in June 2006

of $400 million, 6.25% senior notes due June 20, 2016 and $400 million, 6.75% senior notes due June20,

2036. The increase in net loss for Interest Expense and Other in 2005 over 2004 was primarily due to

incremental interest expense ondebt assumed in the merger and a reduction in net investment income,

which were mostly offset by the absence of non-recurring merger-related charges and a reduction in

non-interest related other expenses in 2005.

ASBESTOS CLAIMS AND LITIGATION

The Company believes that the property and casualty insurance industry has suffered from court

decisions and other trends that have attempted to expand insurancecoverage for asbestos claims far

beyond the intent of insurers and policyholders. While the Company has experienced a decrease in

asbestos claims over the past two years, the Company continues to receive a significant number of asbestos

claims from the Company’s policyholders (which includes others seeking coverage under a policy),

including claims against the Company’s policyholders by individuals who do not appear to be impaired by

asbestos exposure. Factors underlying these claim filings include intensive advertising by lawyers seeking

asbestos claimants, the focus by plaintiffs on new and previously peripheral defendants and entities seeking

bankruptcy protection as a result of asbestos-related liabilities. In addition to contributing to the overall

number of claims, bankruptcy proceedings may increase the volatility of asbestos-related losses byinitially

delaying the reporting of claims and later by significantly accelerating and increasing loss payments by

insurers, including the Company. Bankruptcy proceedings have also caused increased settlement demands

against those policyholders who are not in bankruptcy but that remain in the tort system. Recently, in many

jurisdictions, those who allege very serious injury and who can present credible medical evidence of their

injuries are receiving priority trial settings in the courts, while those whohave not shown any credible

disease manifestation are having their hearing dates delayed or placed on an inactive docket. This trend of

prioritizing claims involving credible evidence of injuries, along with the focus on new and previously

peripheral defendants, contributes to the loss and loss expense payments experienced by the Company. In

addition, the Company’s asbestos-related loss and loss expense experience is impacted by the exhaustion or

unavailability due to insolvency of other insurancepotentially available to policyholders along with the

insolvency or bankruptcy of other defendants.

The Company continues to be involved in coveragelitigation concerning a number of policyholders,

some of whom have filed for bankruptcy, including, among others, ACandS, Inc., who in some instances

have asserted that all or a portion of their asbestos-related claims are not subject to aggregate limits on

coverage. (See “Part I—Item 3, Legal Proceedings”).In these instances, policyholders also may assert that

each individual bodily injury claim should be treated as a separate occurrence under the policy. It is

difficult to predict whether these policyholders will be successful on both issues. To the extent both issues

are resolved in policyholders’ favor and other Company defenses are not successful, the Company’s

coverage obligations under the policies at issue would be materially increased and bounded onlybythe

applicable per-occurrence limits and the number of asbestos bodily injury claims against the policyholders.