Travelers 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

Company’s financial condition, earnings, capital requirements of the Company’s operating subsidiaries,

legal requirements, regulatory constraints and other factors as the Board of Directors deems relevant.

Dividends would be paid by the Company only if declared by its Board of Directors out of funds legally

available, subject to any other restrictions that may be applicable to the Company.

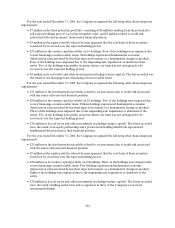

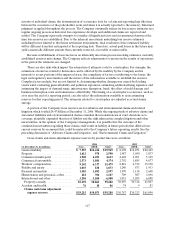

Capital Resources

Capital resources reflect the overall financial strength of the Company and its ability to borrow funds

at competitive rates and raise new capital to meet its n eeds. The following table summarizes the

components of the Company’s capital structure at December 31, 2006 and 2005.

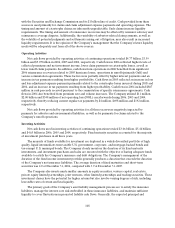

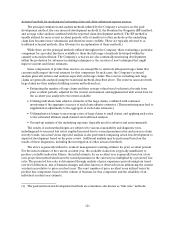

(at December 31, in millions) 2006 2005

Debt:

Short-term...................................................... $1,114

$ 310

Long-term...................................................... 4,588 5,393

Net unamortized fair value adjustments anddebt issuance costs ....... 58

147

Total debt .................................................... 5,760 5,850

Preferred shareholders’ equity....................................... 129 153

Common shareholders’ equity:

Common stock andretainedearnings, less treasury stock............. 24,554 21,799

Accumulated other changes in equity from nonowner sources......... 452 351

Total shareholders’equity ...................................... 25,135 22,303

Total capitalization.......................................... $ 3 0,895 $28,153

The increase in shareholders’ equity in 2006 reflected the Company’s strong net income for the year,

partially offset by the impact of common share repurchases and dividends to shareholders.

Line of Credit Agreement.The Company maintains an $800 million commercial paper program with

back-up liquidity consisting of a bank credit agreement. In June 2005, the Company entered into a $1.0

billion, five-year revolving credit agreement with a syndicate of financial institutions. Pursuant to covenants

in the credit agreement, the Company must maintain an excess of consolidated net worth over goodwill

and other intangible assets of not less than $10 billion at all times. The Company must also maintain a ratio

of total consolidated debt to the sum of total consolidated debt plus consolidated net worth of not greater

than 0.40 to 1.00. In addition, the credit agreement contains other customary restrictive covenants as well

as certain customary events of default, including with respect to a change in control. At December 31,

2006, the Company was in compliance with these covenants and all other covenants related to its respective

debt instruments outstanding. Pursuant to the terms of the credit agreement, the Company has an option

to increase the credit available under the facility, no more than once a year, up to a maximum facility

amount of $1.5 billion, subject to the satisfaction of a ratings requirement and certain other conditions.

There was no amount outstanding underthe credit agreement as of December 31, 2006.

Shelf Registration. In December 2005, the Company filed with the Securities and Exchange

Commission a shelf registration statement for the potential offering and sale of securities. The Company

may offer these securities from time to time at prices and on other terms to be determined at the time of

offering. During 2006, the Company issued $800 million of senior debt (as described above) under this

shelf registration statement.

Share Repurchase Capacity. At December 31,2006, the Company had$879 million of capacity

remaining under the original $2 billion share repurchase program approved by the Board of Directors in

2006. In January 2007, the Company’s board of directors authorized a $3 billion increase to the program,

which the Company currently expects to fully utilize by thefirst quarter of 2009, subject to the factors listed

in the “Share Repurchases” section above.