Travelers 2006 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2006 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

190

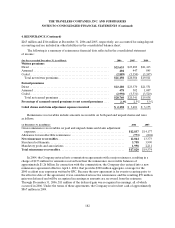

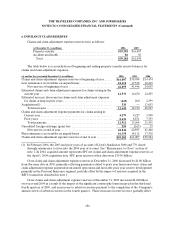

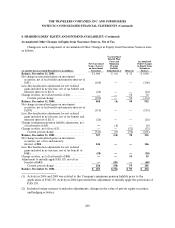

6. INSURANCE CLAIM RESERVES (Continued)

Asbestos and Environmental Reserves

At December 31, 2006 and 2005, the Company’s claims and claim adjustment expense reserves

included $4.47 billion and $4.79 billion, respectively, for asbestos and environmental-related claims, net of

reinsurance.

It isdifficult to estimate the reserves for asbestos and environmental-related claims due tothe

vagaries of court coverage decisions, plaintiffs’ expanded theories of liability, the risks inherent in complex

litigation and other uncertainties, including without limitation, thosewhich are set forth below.

Asbestos Reserves. Because each policyholderpresents different liability and coverage issues, the

Company generally reviews the exposurepresented by each policyholder at least annually on a

policyholder-by-policyholder basis. In the course of this review, the Company considers, among other

factors: available insurance coverage, including the role of any umbrella or excess insurance the Company

has issued to the policyholder; limits and deductibles; an analysis of each policyholder’s potential liability;

the jurisdictions involved; past and anticipated future claim activity and loss development on pending

claims; past settlement values of similar claims; allocated claim adjustment expense; potential role of other

insurance;the role, if any, of non-asbestos claims or potential non-asbestos claims in any resolution

process; and applicable coverage defensesor determinations, if any, including the determination as to

whether or not an asbestos claim is a products/completed operation claim subject to an aggregate limit and

the available coverage, if any, for that claim. For those policyholders for which anestimate of the gross

ultimate exposure for indemnity and related claim adjustment expense is determined, the Company

calculates, by each policy year, a ceded reinsurance projection based on any applicable facultative and

treaty reinsurance, past cededexperience and reinsurance collections. Conventional actuarial methods are

not utilized to establish asbestos reserves. The Company’s evaluations have not resulted in any data from

which a meaningful average asbestos defense or indemnity payment may be determined.

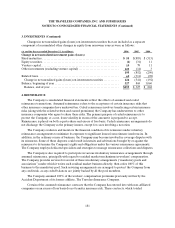

The Company also compares its historical gross and net loss and expensepaidexperience, year-by-

year, to assess any emerging trends, fluctuations, or characteristics suggested by the aggregate paid activity.

Net asbestos losses and expenses paid in 2006 were $469 million, compared with $399 million in 2005. The

$70 million net increase is primarily the result of lower reinsurance billings in 2006. Approximately 50% in

2006 and 42% in 2005 of total net paid losses relate to policyholders with whom the Company previously

entered into settlement agreements limiting the Company’s liability. At December 31, 2006, net asbestos

reserves totaled $4.05 billion, compared with $4.36 billion at December 31, 2005.

The Company recorded pre-tax asbestos reserve additions of $155 million, $830 million and $928

million in 2006, 2005 and2004, respectively, pursuant to the completion of its annual ground-up asbestos

exposure review, which included ananalysisof exposure and claim payment patterns by policyholder

category, as well as recent settlements, policyholder bankruptcies, judicial rulings and legislative actions.

Approximately half of the$155 million 2006 pretax reserve adjustment was due to an increase in the

projected defense costs for ten policyholders. Additionally, $15 million of thepretax reserve adjustment

was attributable to a delay in the approval and expected payment of the previously announced settlement

with PPG Industries, Inc. as part of the Pittsburgh Corning bankruptcy reorganization plan. The remainder

of the reserve adjustment was primarily due to continued litigation activity against smaller, peripheral

defendants. The asbestos reserve addition in 2005 resulted, in part, from higher than expecteddefense

costs due to increased trial activity for seriously impaired plaintiffs and prolonged litigation before cases

are settled or dismissed. The 2005 reserve addition also considered the January 2006 court decision